Robert A. Simons Ph.D. - Maxine Goodman Levin College of Urban

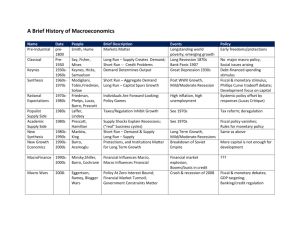

advertisement

Robert A. Simons Ph.D. Professor Levin College of Urban Affairs Cleveland State University r.simons@csuohio.edu With help from Arthur Schmidt 2013-2014 Housing Forecast Presented to Cleveland Homebuilders Association (HBA) November 8, 2012 CLEVELAND METRO IN THE STATE, NATION AND WORLD • We are nested in the world economy • We have 11 fortune 500 companies in NE Ohio • Our manufacturing is down • Our medical is up • Our housing prices are cheap • Our bubbles, if we have them, are small • Our local government is fractionalized and our local tax burden is high • • We tend to lead nation into recession and lag them out We now have shale-gas fracking as an engine, just emerging US: LOOKING BACK TO 1999 AND BEYOND Longer view: since @1970; recessions in 1974 (oil shock) 1979-1981 (more oil and stagflation ) 1982 (double dip); 1986-1989 (real estate only – tax code driven); 1991 (economic exhaustion) and 2001 (9-11) Expansion from 2002 until 2007-2008 recession (Financial rules and liquidity driven, FNMA, FMC, AIG) 7 recessions in 42 years=Average of a recession every 6 years Since 1999=average cycle: 2 recessions in 12 years Housing construction leads us out of a recession: NOT! US Employment Mix: since 1999: MFG.-32%; CONST.12%; SERV (except education) +4%; LEISURE +12%; GOV’T +9%, HEALTH CARE +30% INTERNATIONAL THINGS TO WATCH • ASIA / CHINA GROWTH • EUROPE MELTDOWN • MIDDLE EAST TURMOIL • US SUSTAINED RECOVERY / FISCAL CLIFF WSJ OCTOBER 2012 Greek Debt is > 8% over German rate EUROPE - MONETARY UNION? • EU IS AT A CRITICAL POINT • NATIONAL FISCAL AND BANKING SECTORS NEED TO BE MERGED • GERMANY WOULD PAY THE BAILOUT BILL FOR WEAKER SISTERS (Portugal, Ireland, Spain, Italy) • EURO UNLIKELY TO COLLAPSE (FEAR), BUT STRONG ENFORCEMENT NEEDED • FUTURE OF UNION STILL NOT CLEAR, BUT RECESSION IS • • • • • • • • • MIDDLE EAST IRAN AND NUCLEAR SANCTIONS SYRIA CIVIL WAR CONTINUES PALESTINIAN INTERNAL DISCORD EGYPT ARAB LEADER –PROGRESS? ISRAELI-PALESTINIAN PEACE EFFORT LEBANON –TINDERBOX TURKEY AND THE KURDS, ARMENIANS IRAQ, AFGHANISTAN WINDING DOWN EFFECT ON INTERNATIONAL RELATIONS AND ENERGY PRICES US ISSUES • 4 MORE YEARS OF DEMOCRATIC PRESIDENT, AT LEAST 2 MORE YEARS OF SPLIT CONGRESS • MONETARY AND FISCAL POLICY • ECONOMIC GROWTH • CONSTRUCTION FEDERAL FUNDS TARGET RATE Fed target rates remain at all time lows For how long? ANOTHER FEW YEARS INTEREST RATES ARE SO LOW, ELDERLY PEOPLE CAN’T EASILY LIVE OFF THEIR INCOME THE ECONOMIST 11/3/12 2.2% GROWTH IS THE NEW NORMAL BUT THE STOCK MARKET DROPPED 2+% !! Demand side • Borrowers are CLAWING THEIR WAY BACK from underwater • Still have artificial backlog of foreclosed property Percent of Homeowners Underwater, U.S. 35.00% 30.00% 28.60% 26.80% 2012 – CLOSER TO 2325% 25.00% 23.20% 22.30% 20.00% Percent Underwater 15.00% 10.00% 5.00% Source: Zillow 0.00% 2009 Q1 2010 Q3 2011 Q2 2011 Q3 House prices are firming YEAR ON YEAR % CHANGE And construction is starting to pick up a bit In OhioFRACKING (shale gas recovery) • Fracking will affect NE Ohio • 2 shale layers, Marcellus and Utica • Ohio unemployment rate 7%, <US • Shale will be a substantial Driver of growth But…. • Banks are slow to pick up • Fannie and Freddie are still in limbo • And strengthening house sales will slow rental growth Simons 2013-2014 forecast US GDP positive, relatively low @2.2% AND STEADY. No double dip • Consumer confidence mixed at best, stocks recovered @DJIA= 13,000. Firms doing better. • Little risk taking. STILL Lots of cash on sidelines. Short term rates <1%. More savings healthy in long run. Reasonable consumption also. Older folks need to work • Bouncing along the bottom, Jobless recovery, BUT UNEMPLOYMENT RATE <8%. • Presidential election year 2012 ---- 4 more years of OBAMA. Fiscal cliff gridlock? • Housing prices and re-sales stabilized at lower levels, inching up. Continued residential foreclosures will hold prices down and compete with existing inventory. Residential construction down >70%, but glimmers of hope Commercial refinancing issues have not been resolved. Retail sector problematic, but improving slightly. Loan originations, servicing, new commercial construction lending will be flat, at very low levels down >90%. Hang on Some housing niches still active. LIHTC, new location thrill/upper end. MF/rental unit starts inching up, New micro-homes? New construction: SOME ACTIVITY, STILL WON’T BE ROBUST FOR next few years Robert A. Simons Ph.D. Professor Levin College of Urban Affairs Cleveland State University r.simons@csuohio.edu