File

advertisement

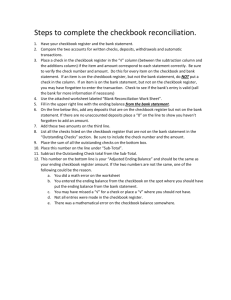

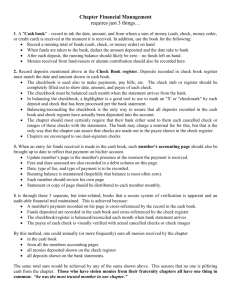

Chapter 7 Budgeting 101 Principles of Investing Before We Begin Please have your notebook and your Chapter 7 Packet on your desk Ch 7 Essential Questions 1. How is money active? 2. What are the reasons why people do not budget? 3. What are some common problems associated with budget failures? 4. What are the benefits of a budget? 5. What is a zero-based budget and how does one complete it? Lesson 1 1. How is money active? Explain why money is “active” Define cash flow plan and state when a cash flow plan should be developed State and explain 5 ways money can be utilized 2. What are the reasons why people do not budget? State and explain 4 reasons why people do not budget DO NOW Write down 3-5 different ways you use your money. Write down what you think are the 3 most important categories in a budget. Listen to Dave Dave Ramsey Part 1 Video How Money is Active Money is always moving Money can be utilized in many ways including the following: earn it, spend it, save it, invest it, and give it Listen to Dave Dave Ramsey Part 2 Video Reasons Why People Do Not Budget A budget has a negative connotation because it has been used to control them. You fear what you may find so you don’t create a budget. It has been used to abuse them Most people have never had one that really worked so they don’t want to try another budget. Lesson 1 1. How is money active? State and explain 3 ways to use a check Identify and explain 4 advantages of using checks Identify and explain 4 disadvantages of using checks Identify and define the parts of a check Practice writing 3 checks Identify and define the parts of a checkbook register Practice recording 3 checks into a checkbook register 2. What are the reasons why people do not budget? DO NOW List 3 ways you use a check List 3 advantages of using checks List 3 disadvantages of using checks Ways to Use a Check 1. Make a payment 2. Cash it 3. Write it out as cash This can be done in one of two ways Advantages of Using Checks 1. Safety or Security 2. Convenience 3. Records of your Transactions 4. Proof Disadvantages of Using Checks 1. Security Concerns 2. Time 3. Recordkeeping 4. Not being able to use them all the time or everywhere Activity 1 How to Write a Check Definition- an order to a bank to pay a specified sum to the person or business named on the check Only 51% of teens know how to write a check I explained the parts of a check. Then I modeled and demonstrated how to write a check by using the one below Activity 1 - How to Write a Check All of you are now going to practice writing checks by writing 3 checks on your own or with the person sitting next to you Check Number 1 Check amount: $70.00 Date: January 10, 2015 Who the check is being paid to: AT&T Check Number 2 Check amount: $90.00 Date: January 21, 2015 Who the check is being paid to: Comcast Check Number 3 Check amount: $125.00 Date: February 11, 2015 Who the check is being paid to: ShopRite Students volunteer to demonstrate how they wrote their 3 checks Activity 1- How to Write a Check After you write a check you then have to record the check information into your checkbook register This is very important! All of you are now going to practice recording the checks into a checkbook register On your own or with the person sitting next to you, record the 3 checks you just wrote into the checkbook register Students volunteer to demonstrate how they recorded the 3 checks they wrote in the checkbook register Lesson 1 1. How is money active? State and explain 4 reasons why it is important to budget one’s checkbook Explain the process of fixing an error/s in one’s bank statement Describe how to balance or reconcile (think scale!) one’s account after receiving one’s bank statement Practice recording 14 transactions into a checkbook register and then balancing or reconciling a checkbook 2. What are the reasons why people do not budget? DO NOW List 3 reasons why it is important to balance your checkbook What should you do if you find an error in your bank statement? (A record, usually sent to the account holder once per month, summarizing all transactions in an account) Reasons to Balance your Checkbook 1. To keep track of your money 2. To catch mistakes 3. To avoid overdrafts 4. To help with budgeting Your Bank Statement 1. When you receive your bank statement, compare your check register to the bank statement to make sure that neither you nor your bank made a mistake This is called balancing or reconciling your account If you find an error on your statement you must notify your bank within 60 days from the date of the statement Activity 2- Balancing your Checkbook Definition- a book of blank checks with a register for recording checks written Only 34% of teens know how to balance a checkbook and reconcile an account register to a bank statement Activity 2- Balancing your Checkbook All of you are now going to practice filling out the check register and balancing or reconciling your checkbook Students volunteer to demonstrate how they balanced their checkbook by recording all of their transactions and deposits into their checkbook register and calculating the correct adjustments to their balances. Lesson 2 3. What are some common problems associated with budget failures? State and examine 4 common problems associated with budget failures 4. What are the benefits of a budget? State and examine 6 benefits of a budget DO NOW List 3 reasons why you think people fail at maintaining or following a budget List 3 benefits of having a budget Listen to Dave Dave Ramsey Part 3 Video Common Problems Associated with Budget Failures The budget doesn’t work because things are left out 2. The budget is too complicated 3. You don’t actually create a budget 4. You write a budget, but don’t live on it 1. Benefits of a Budget 1. Removes the management by crisis from your finances 2. Managed money goes further than money that is not managed 3. Managed money removes many of the money fights from your marriage 4. Budgets remove guilt, shame, and fear from relationships 5. A written plan can remove many overdrafts and stress from your life plan can show you where you’re over spending in certain areas of your life 6. A written Discussion Questions 1. Of the 5 ways one can utilize money, which 2 ways are the most important and why? Please explain 2. Which advantage of using checks is the most important for consumers and why? Please explain 3. Do the advantages of using checks outweigh the disadvantages? wrote their thoughts down and then shared their Please explain Students thoughts with the class- interactive instruction 4. Due to the tech-savvy world we live in today, should paper checks and checkbooks be a thing of the past? Please explain 5. 6. Which advantage of a budget is the most important for families? Only 32% of Americans, or nearly 1 in 3 Americans, put together a budget each month. Why is this so and how can we convince more Americans to create a monthly budget? Please explain Lesson 3 4. What are the benefits of a budget? 5. What is a zero-based budget and how does one complete it? Define a zero-based budget and practice completing 2 zero-based budgets DO NOW List 3 reasons why students should learn how to budget. What age do expect your parents to stop supporting you financially? How much do you think you spend a month? According to Dave… 86% of teens agree with the following statement: I expect and would like my parents to stop supporting me financially before age 25 On average, teens spend $19 per week Activity 3 Student Budget Definition- cash flow plan; assigns every dollar to a specific category/expense at the beginning of each month. Only 41% of teens know how to budget their money Activity- Student Budget All of you are now going to read through the first scenario (Marcus) and create a zero-based budget for Marcus Budgets will vary! Monthly Total This column shows you how much you are spending on necessities each month. If you do not know the amount, write down your best estimate. Account Write in how this area is paid—by check, automatic bank draft, cash, etc. Students volunteer to demonstrate how they created a budget for Marcus Activity- Student Budget All of you are now going to create your own personal budget based on your income and expenses Budgets will vary! BUT must include Giving and Saving as funded categories You all need to get in the habit of putting something away in these categories, even if it isn’t the full 1015%. Teenagers tend to spend a lot of money on clothes and entertainment, so make sure those categories are appropriately funded Finally, Remember, the point is to spend every dollar on paper before the month begins! Students volunteer to demonstrate how they created a budget for themselves