Steps to complete the checkbook reconciliation. Have your

advertisement

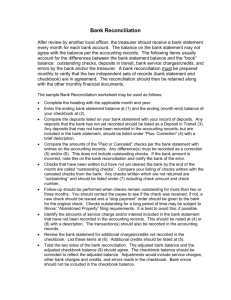

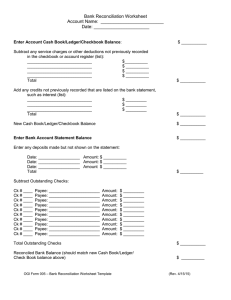

Steps to complete the checkbook reconciliation. 1. Have your checkbook register and the bank statement. 2. Compare the two accounts for written checks, deposits, withdrawals and automatic transactions. 3. Place a check in the checkbook register in the “√” column (between the subtraction column and the additions column) if the item and amount correspond to each statement correctly. Be sure to verify the check number and amount. Do this for every item on the checkbook and bank statement. If an item is on the checkbook register, but not the bank statement, do NOT put a check in the column. If an item is on the bank statement, but not on the checkbook register, you may have forgotten to enter the transaction. Check to see if the bank’s entry is valid (call the bank for more information if necessary) 4. Use the attached worksheet labeled “Blank Reconciliation Work Sheet”. 5. Fill in the upper right line with the ending balance from the bank statement. 6. On the line below this, add any deposits that are on the checkbook register but not on the bank statement. If there are no unaccounted deposits place a “0” on the line to show you haven’t forgotten to add an amount. 7. Add these two amounts on the third line. 8. List all the checks listed on the checkbook register that are not on the bank statement in the “Outstanding Checks” section. Be sure to include the check number and the amount. 9. Place the sum of all the outstanding checks on the bottom box. 10. Place this number on the line under “Sub-Total”. 11. Subtract the Outstanding Check total from the Sub-Total. 12. This number on the bottom line is your “Adjusted Ending Balance” and should be the same as your ending checkbook register amount. If the two numbers are not the same, one of the following could be the reason. a. You did a math error on the worksheet b. You entered the ending balance from the checkbook on the spot where you should have put the ending balance from the bank statement. c. You may have missed a “√” for a check or place a “√” where you should not have. d. Not all entries were made in the checkbook register. e. There was a mathematical error on the checkbook balance somewhere.