Section 2 Reconciling the Bank Account (con`t.)

advertisement

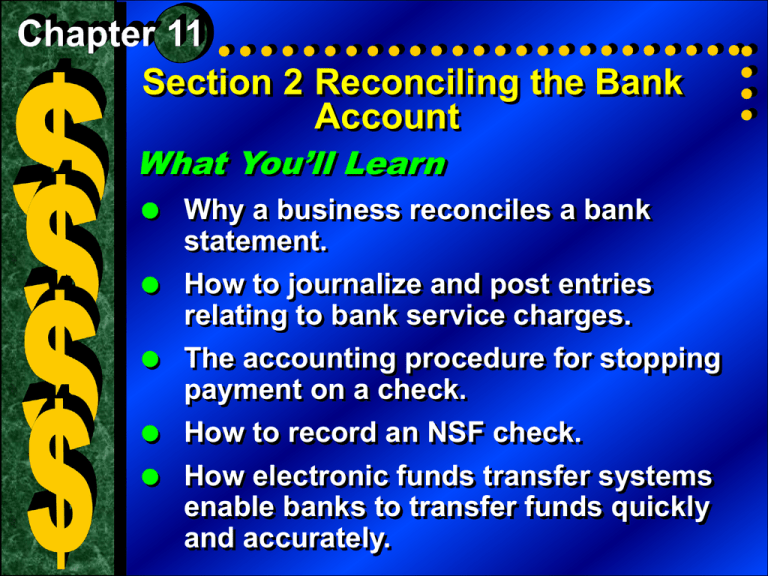

Section 2 Reconciling the Bank Account What You’ll Learn Why a business reconciles a bank statement. How to journalize and post entries relating to bank service charges. The accounting procedure for stopping payment on a check. How to record an NSF check. How electronic funds transfer systems enable banks to transfer funds quickly and accurately. Section 2 Reconciling the Bank Account (con’t.) Why It’s Important Reconciling the bank account ensures that a business owner is aware of all transactions that affect cash. Key Terms bank statement canceled checks reconciling the bank statement outstanding checks outstanding deposits bank service charge stop payment order NSF check electronic funds transfer system (EFTS) Section 2 Reconciling the Bank Account (con’t.) Proving Cash General Ledger Cash in Bank account = Checkbook Balance Section 2 Reconciling the Bank Account (con’t.) The Bank Statement A bank statement is an itemized record of all the transactions in a depositor’s account over a given period, usually a month. When a bank sends a statement to a depositor, it may return the checks paid by the bank and deducted from the depositor’s account. These returned checks are called cancelled checks. Section 2 Reconciling the Bank Account (con’t.) The Bank Statement (con’t.) Ending balance Beginning balance Checks paid by bank (cancelled checks) Other deductions Deposits into the account Section 2 Reconciling the Bank Account (con’t.) The Bank Statement (cont.) The process of determining any differenced between the bank statement and the checkbook is called reconciling the bank statement. Outstanding checks are checks that have been written but have not yet been presented to the bank for payment. Outstanding deposits are deposits that have been made and recorded in the checkbook but do not appear on the bank statement. A bank service charge is a fee the bank charges for maintaining bank records and processing bank statement items for the depositor. Section 2 Reconciling the Bank Account (con’t.) Reconciling a Bank Statement Documents the differences between the bank balance and the checkbook balance. 2 3 4 5 6 7 Section 2 Reconciling the Bank Account (con’t.) Recording Bank Service Charges A bank service charge is an expense that is recorded in the accounting records. Closing Entry (con’t.) On November 1 Roadrunner received the bank statement. A bank service charge of $8 appeared on the statement. JOURNAL ENTRY Section 2 Reconciling the Bank Account (con’t.) Special Banking Procedures Stop payment order is a demand by the drawer that the bank not honor a certain check. An NSF check is a check returned to the depositor by the bank because there are not sufficient funds in the drawer’s checking account to cover the check. Banks use electronic funds transfer system (EFTS) to transfer funds among accounts quickly and accurately without the exchange of checks. An example is on p272, Figure 11-15. Section 1 Banking Procedures (con’t.) Demonstration Problems Problems 11-3 to 11-5. 3,172.50 -24.50 1 3148.00 2 3 4 5 6 7 1242.-2700.-3942.-794.-3148.-- 731 742 745 245.-88.-461.-- 794.-- 21 20-Aug 8 Miscellaneous Expense Cash in Bank July Bank Statement 12.75 12.75 24 20-Aug 21 Accounts Receivable-Fran Alexander Cash in Bank NSF Check 98.45 98.45 Section 2 Reconciling the Bank Account (con’t.) Assignment Check Your Understanding •Thinking Critically 1&2 1 is worth 5 points 2 is worth 4 points •Problem 11-2