by Petros Krasaris, Senior Manager, International Tax

advertisement

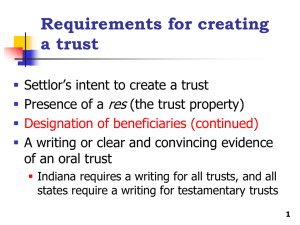

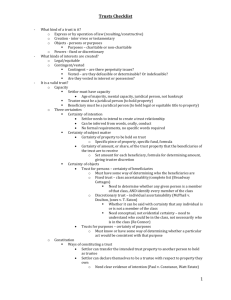

Cyprus International Trusts A tool for international tax planning 29 September 2014 Areas to be covered 1. Trusts: a) Cypriot tax considerations b) Setting up a trust: tax considerations c) Tax considerations during trust’s life span d) Use of Cyprus International Trust 2. Introduction of CFC rules in Russia 3. End of tax secrecy? Page 2 Trusts: Cypriot tax considerations ► Trusts: transparent entities (“pass through”) for Cyprus tax purposes meaning that taxation is at the level of beneficiaries. ► Beneficiaries: subject to tax in Cyprus (as applicable) as if they directly hold the assets / directly earn the income. Separation of legal & beneficial owner. ► Distributions by a trust are disregarded for Cyprus income tax purposes (no withholding tax). ► Trustee: responsible for payment of taxes arising on property and income of trust and for any other statutory obligations of the trust (such as filing of returns). ► Different tax treatment? Irrevocable Vs Revocable? Fixed interest Vs Discretionary? No formal guidance (tax circular) given hence no special rules exist. Page 3 Setting up a trust: tax considerations ► Why? Tax deferral? Tax optimization? ► In-depth tax analysis: Tax considerations relevant for: the Settlor; the property being transferred (e.g. real estate transfer taxes); the beneficiaries; ongoing taxation of property / income of the trust. ► Will the trust arrangement be acceptable in the jurisdiction of the settlor? ► Personal tax considerations for the settlor /beneficiaries should be carefully considered. ► Country-by-country analysis is required to assess if the trust is eligible to apply double tax treaties. Possible to use an underlying holding company to overcome this. Page 4 Tax considerations during trust’s life span LIFE SPAN OF A TRUST Establishment During the life Termination • Acceptability of trust in the jurisdiction of the settlor • Transfer of assets • …. • Taxation of beneficiaries (arising basis Vs distribution basis) • Fixed interest Vs discretionary trust • Foreign withholding taxes • …… • Taxation of beneficiaries • Flow-back to settlor (revocable) • ….. Page 5 Use of Cyprus International Trust Business assets CYP HoldCo CYP Trust Personal assets Portfolio companies / assets Foreign OpCo Alternative investments (real estate, mutual funds) Page 6 Fixed income securities (money market, bonds, deposits) Introduction of CFC rules in Russia ► Beginning of September, Russian MinFin released a revised version of proposed changes to tax laws. ► CFC rules: Foreign trusts and foundations are excluded only if they are unable to distribute profits to participants or beneficiaries. ► “Control” over a trust (or a foundation) is defined as the ability to influence the decisions adopted by the person who manages the assets of the trust (or foundation) with respect to the distribution of profit rather than the level of his/her participation interest. ► Is there is scope for tax planning for CFC purposes? Page 7 End of tax secrecy? ► OECD Global Standard: “look through approach” to payments made to trusts. ► EU Savings Directive: closing the loopholes, such as use if trusts. ► Registry of trusts (as of 2013) maintained in Cyprus. Page 8