582-596

advertisement

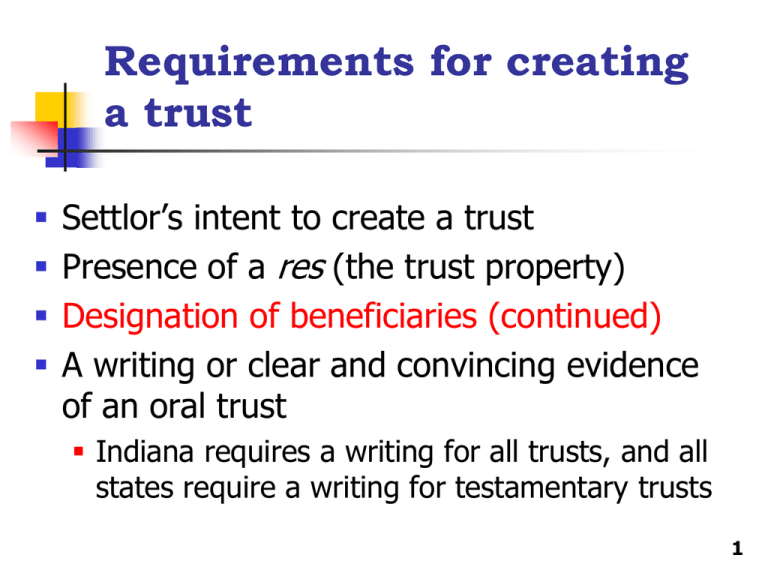

Requirements for creating a trust Settlor’s intent to create a trust Presence of a res (the trust property) Designation of beneficiaries (continued) A writing or clear and convincing evidence of an oral trust Indiana requires a writing for all trusts, and all states require a writing for testamentary trusts 1 The requirement of trust beneficiaries A trust must have one or more ascertainable beneficiaries—if we can’t identify the beneficiaries, the trust will fail—there must be someone to whom the trust owes fiduciary duties and who can call the trustee to account Charitable trusts need not have ascertainable beneficiaries Trusts for one’s descendants may have currently unascertainable beneficiaries when the trusts are created 2 In re Searight’s Estate, In re Searight’s Estate 95 N.E.2d 779 (Ohio App. 1950), p. 582 George Searight “$1000 to be used…to pay Florence…for the keep and care of my dog as long as it shall live.” Executor/Trustee “I give and bequeath my dog, Trixie…” Florence Hand 3 Can a dog be a beneficiary of a trust? We know from Russell (page 359), that you can’t leave property in a will to a dog Would it have been a problem if George had created a trust for the benefit of dogs in general? No, he could have created a charitable trust for dogs (page 583, top) The problem here is that George designated a particular dog, so we have a private trust, and we don’t have a beneficiary who can enforce the terms of the trust 4 Can a dog be a beneficiary of a trust? The court permitted the bequest, treating it, like other courts, as an “honorary trust” (page 583) Such trusts are valid as long as the “trustee” is willing to carry out the terms of the bequest (hence the term honorary). (The court also said that it could be called a gift with a power (page 583).) Note that while Trixie was not in a position to enforce the trust, the residuary beneficiaries of the will have some ability to do so since they can seek reversion of the trust if the trustee neglects the responsibilities of the trust. 5 Trusts for noncharitable purposes, p. 586 Honorary Trust Transferee is not obligated to carry out settlor’s purpose If transferee declines, she holds the property on resulting trust and property reverts to settlor or settlor’s successors Used in Searight’s Estate Statutory Purpose Trust Statutory trust for pet animal or other noncharitable purpose Authorized by UTC §§408409 and UPC §2-907 Typically authorize court to reduce excessive trust property and provide for enforcement by settlor or court appointee Ind. Code § 30-4-2-18 6 Requirements for creating a trust Settlor’s intent to create a trust Presence of a res (the trust property) Designation of beneficiaries A writing or clear and convincing evidence of an oral trust Indiana requires a writing for all trusts, and all states require a writing for testamentary trusts 7 Requirement for a writing Generally, a writing is not required, except for testamentary trusts or trusts of land Clear and convincing evidence required to validate oral trust But in Indiana, “a trust in either real or personal property is enforceable only if there is written evidence of its terms bearing the signature of the settlor or the settlor's authorized agent.” Ind. Code §30-4-2-1(a) 8 Estate of Fournier Estate of Fournier (Slide 1) 902 A.2d 852 (Me. 2006), p. 589 Faustina Fogarty Juanita Flanigan Rose ?? ?? Curtis King George Fournier $400,000 in trust for Fogarty Josephat Madore Yvette Madore 9 Estate of Fournier, Estate of Fournier (Slide 2) 902 A.2d 852 (Me. 2006) (2) Fournier asks Madores to hold $400,000 in secret, to be delivered upon his death to Fogarty because she “needed it more” than his other sister. Note discovered with instructions Fournier dies testate. that $400,000 be divided among Fogarty, Flanigan and King. Court Residue in equal holds oral trust was for benefit of shares to Fogarty, all three residuary takers. Flanigan, and King. 2002 1998 or 1999 Fournier tells Flanigan of arrangement with Madores. 2005 Fournier gives Fogarty a gift of $100,000. Madores give $400,000 to Fogarty. Court finds oral trust of money for her benefit. 10 Fournier Note that the probate court weighed the conflicting testimony and found no trust, while the supreme court resolved the inconsistency in favor of a trust Why did the supreme court override the probate court? Maybe because Flanigan had an incentive to misremember/mislead while the Madores did not In the end, the trust’s beneficiaries turned out to the same as the will’s beneficiaries. Why did Fournier bother with the trust? Trying to evade taxes? 11 Olliffe v. Wells Olliffe v. Wells 130 Mass. 221 (1881), p. 593 Semisecret Trust Desire to create trust appears on the face of the will Terms are undisclosed Extrinsic evidence not needed to prevent unjust enrichment Devise is unenforceable Secret Trust Devise is absolute on the face of the will Extrinsic evidence necessary to prevent unjust enrichment Court will impose a constructive trust on promisor But Restatement would treat semisecret trusts like secret trusts 12