Finance Formula Sheet: Bond Pricing, Perpetuities, Returns

advertisement

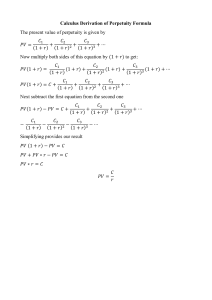

UNSW Business School COMM1180 Value Creation Term 3 2023 Week 8 Value for Investors Formula Sheet Simple bond pricing formula The fair value of a bond with exactly n 6-month periods remaining to maturity, face value 𝐹, and a coupon rate c% (i.e., a coupon amount of 𝐶 = 𝑐%/2 × 𝐹) and a per period discount rate of 𝑟 is 𝑃0 = 𝐶 1 − (1 + 𝑟)−𝑛 𝐹 + (1 + 𝑟)𝑛 𝑟 Constant ordinary perpetuity (e.g. perpetual preference shares): 𝑃𝑉0 = 𝐶 𝑟 Growing perpetuities Assume that payments grow at constant rate g from one period to the next (typically 𝑔 < 𝑟), e.g., 𝐶2 = (1 + 𝑔)𝐶1 ⋯ 𝐶𝑛 = (1 + 𝑔)𝑛−1 𝐶1 . Growing perpetuity If 𝐶1 is the first payment at the end of the first period, then: 𝑃𝑉0 = 𝐶1 𝑟−𝑔 Growing Perpetuity due If 𝐶0 is the first payment at the beginning of the first period, then: 𝑃𝑉0 = 𝐶0 (1 + 𝑟) 𝑟−𝑔 Return decomposition Given current price 𝑃0 , future price 𝑃1 , end of period dividend 𝐷1 , the expected return on equity 𝑟𝑒 can be decomposed into 2 parts, the forward dividend yield and expected capital gains: 𝑟𝑒 = 𝐷1 𝑃1 − 𝑃0 + 𝑃0 𝑃0 An alternative representation where g is the earnings (dividend) growth rate is: 𝑟𝑒 = 𝐷1 +𝑔 𝑃0 Re-invest to grow The growth rate of earnings in year t 𝑔𝑡 = Retention Rate%,𝑡−1 × Return on new investments%,𝑡 = 𝑅𝑅𝑡−1 × 𝑅𝑂𝐼𝑡 2