Corporate Level and International Strategy

advertisement

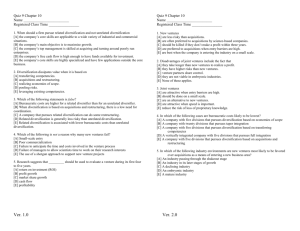

Corporate-Level and International Strategy Introduction Corporate level issues Corporate parent The corporate parent refers to the levels of management above that of the business units and therefore without direct interaction with buyers and competitors PRODUCT/MARKET DIVERSITY Diversification is a strategy that takes the organisation into both new markets and products or services Reasons for diversification Efficiency gains from resources (by- products) Gains from corporate managerial capabilities Increase market power Response to environmental change Risk diversification Powerful stockholder's pressure Related diversification Related diversification can be defined as strategy development beyond current products and markets, but within the capabilities or value network of the organisation Related diversification is often seen as superior to unrelated diversification Time and cost saving The difficulty for business-unit managers in sharing resources with other business units Vertical integration Backward integration Forward integration Horizontal integration Unrelated diversification Unrelated diversification is the development of products or services beyond the current capabilities or value network. Unrelated diversification is described as a ‘conglomerate strategy’ Exploiting dominant logic (focusing major business) Effective in underdeveloped markets Diversification and performance International diversity and international strategy Reasons for international diversity Globalization of markets Following customers while internationalizing Bypass home market limitations Exploit differences between countries and geographical regions * Difference in culture * Administrative difference * Geographical specific differences * Specific economic factor (labor) Economic benefits * Reap economies of scale * Stabilization of earning across markets To broaden the size of the market to exploit strategic capabilities Internationalization of value adding activities To enhance their knowledge base Market selection and entry Macro economic condition Political environment Infrastructure Transport and communication Availability of local resources Tariff and non-tariff barrier Similarity of cultural norms Extent of political and legal risks Entry modes Exporting, contractual arrangements, joint ventures, foreign direct investment Market entry Modes, Advantages and Disadvantages Market entry Modes, Advantages and Disadvantages Market entry Modes, Advantages and Disadvantages Market entry Modes, Advantages and Disadvantages International value framework Global sourcing: Purchasing services and components from the most appropriate suppliers around the world regardless of their location Locational advantages Cost advantage Existence of unique capabilities as competitive advantage International strategies Global-local dilemma (standardization) Concentration of assets and capabilities in limited location (mostly home) Generic strategies Multi-domestic strategy Value adding in individual national market to unique local requirements Global strategy Standardized products Value Creation and The Corporate Parent Value-adding and value-destroying activities of corporate parents The value-adding activities Focus Clarity to external stakeholders: Clarity to business units: Providing expertise and services Knowledge creation and sharing processes Value-destroying activities Corporate parents can add cost with systems and hierarchies that delay decisions, create a ‘bureaucratic fog’ and hinder market responsiveness. Executives are not truly answerable for the performance of their businesses. Diversity and size of some corporations make it very difficult to see what they are about. VALUE CREATION AND THE CORPORATE PARENT The value-adding activities 1. Envisioning Focus: Clarity to external stakeholders: Clarity to business units: 2. Intervening monitoring the performance improve business-unit level performance coaching and training Value-destroying activities Bureaucratic fog’ hinder market responsiveness Executives are not truly answerable for the performance of their businesses. Diversity and size of some corporations make it very difficult to see what they are about MANAGING THE CORPORATE PORTFOLIO The growth share (or BCG) matrix A star is a business unit which has a high market share in a growing market A question mark (or problem child) is a business unit in a growing market, but without a high market share A cash cow is a business unit with a high market share in a mature market Dogs are business units with a low share in static or declining markets