Spring 05 Ch. 10

advertisement

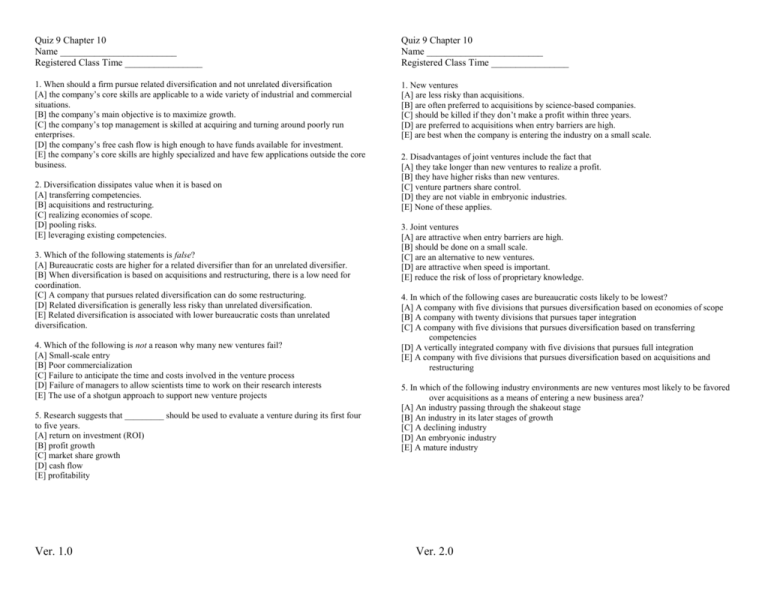

Quiz 9 Chapter 10 Name ________________________ Registered Class Time ________________ Quiz 9 Chapter 10 Name ________________________ Registered Class Time ________________ 1. When should a firm pursue related diversification and not unrelated diversification [A] the company’s core skills are applicable to a wide variety of industrial and commercial situations. [B] the company’s main objective is to maximize growth. [C] the company’s top management is skilled at acquiring and turning around poorly run enterprises. [D] the company’s free cash flow is high enough to have funds available for investment. [E] the company’s core skills are highly specialized and have few applications outside the core business. 1. New ventures [A] are less risky than acquisitions. [B] are often preferred to acquisitions by science-based companies. [C] should be killed if they don’t make a profit within three years. [D] are preferred to acquisitions when entry barriers are high. [E] are best when the company is entering the industry on a small scale. 2. Diversification dissipates value when it is based on [A] transferring competencies. [B] acquisitions and restructuring. [C] realizing economies of scope. [D] pooling risks. [E] leveraging existing competencies. 3. Which of the following statements is false? [A] Bureaucratic costs are higher for a related diversifier than for an unrelated diversifier. [B] When diversification is based on acquisitions and restructuring, there is a low need for coordination. [C] A company that pursues related diversification can do some restructuring. [D] Related diversification is generally less risky than unrelated diversification. [E] Related diversification is associated with lower bureaucratic costs than unrelated diversification. 4. Which of the following is not a reason why many new ventures fail? [A] Small-scale entry [B] Poor commercialization [C] Failure to anticipate the time and costs involved in the venture process [D] Failure of managers to allow scientists time to work on their research interests [E] The use of a shotgun approach to support new venture projects 5. Research suggests that _________ should be used to evaluate a venture during its first four to five years. [A] return on investment (ROI) [B] profit growth [C] market share growth [D] cash flow [E] profitability Ver. 1.0 2. Disadvantages of joint ventures include the fact that [A] they take longer than new ventures to realize a profit. [B] they have higher risks than new ventures. [C] venture partners share control. [D] they are not viable in embryonic industries. [E] None of these applies. 3. Joint ventures [A] are attractive when entry barriers are high. [B] should be done on a small scale. [C] are an alternative to new ventures. [D] are attractive when speed is important. [E] reduce the risk of loss of proprietary knowledge. 4. In which of the following cases are bureaucratic costs likely to be lowest? [A] A company with five divisions that pursues diversification based on economies of scope [B] A company with twenty divisions that pursues taper integration [C] A company with five divisions that pursues diversification based on transferring competencies [D] A vertically integrated company with five divisions that pursues full integration [E] A company with five divisions that pursues diversification based on acquisitions and restructuring 5. In which of the following industry environments are new ventures most likely to be favored over acquisitions as a means of entering a new business area? [A] An industry passing through the shakeout stage [B] An industry in its later stages of growth [C] A declining industry [D] An embryonic industry [E] A mature industry Ver. 2.0 KEY KEY 1 2 3 4 5 A Page 344-345 D Page 345 E Page 344 D Page 348 C Page 349 Ver. 1.0 1 2 3 4 5 B Page 346 C Page 358 C Page 357 E Page 344 D Page 346 Ver. 2.0