PowerPoint Slides

advertisement

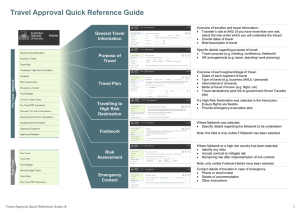

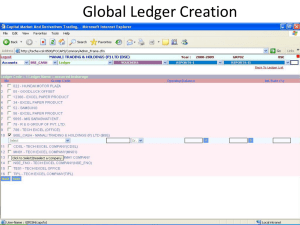

Julie Thompson, ITS September 29, 2011 Agenda We will be talking about Integrity, Month End, and Year End queries collectively We’ll review what the queries are showing you Tips for finding variances Effect variances can have 5 Primary Types of Integrity Checks 1. Summary vs. Detail 2. Integrity within Commitment Control (APPROP vs ORG vs DETAIL) 3. Integrity between Commitment Control and General Ledgers (DETAIL_EX vs ACTUALS) 4. Checks for things that should not exist 5. Checks for things that should exist Primary Players Tables Summary LEDGER_KK LEDGER Ledger Groups APPROP, ORG, DETAIL, PROJ_GRT, PRMST_EXP, PRMST_REV, REVEST ACTUALS, CAPITAL, GAAP, ENCUMB Detail KK_ACTIVITY_LOG JRNL_LN Type 1: Summary vs. Detail LEDGER_KK LEDGER KK_ACTIVITY_LOG JRNL_LN Integrity 05: BOR_CHK_KKLEDG_ACTV Compares detail activity in KK_ACTIVITY_LOG to summary amount in LEDGER_KK Type 1: Summary vs. Detail LEDGER_KK LEDGER KK_ACTIVITY_LOG JRNL_LN Integrity 08: BOR_CHK_LEDG_JRNL Compares detail activity in JRNL_LN to summary amount in LEDGER Type 1: Summary vs. Detail LEDGER_KK LEDGER KK_ACTIVITY_LOG JRNL_LN KK_BUDGET _LN Integrity 06: BOR_CHK_KKLEDG_BUD Compares detail activity in KK_BUDGET_LN with summary amount in LEDGER_KK Summary vs Detail data example: Integrity Check 05: BOR_CHK_KKLEDG_ACTV LEDGER_KK KK_ACTIVITY_LOG Summary vs Detail data example: Integrity Check 08: BOR_CHK_LEDG_JRNL LEDGER JRNL_LN Type 1: Summary vs. Detail These queries should never have a variance A DBI is usually, but not always required to correct Update LEDGER_KK or LEDGER to reflect correct activity, or Clean bad data out of KK_ACTIVITY_LOG or JRNL_LN, or Can sometimes resolve functionally by clearing Budget Check Exception Type 2: Integrity within Commitment Control LEDGER_KK APPROP ORG DETAIL PRMST_EXP PRMST_REV PROJ_GRT REVEST Integrity 01: BOR_CHK_PROJ_ENC_LEG - Encumbrances between PRMST, PROJ_GRT, and DETAIL Integrity 04: BOR_CHK_UNREST_LEDGER - Encumbrances and Expense between APPROP, ORG, and DETAIL Integrity 10: BOR_CHK_REVAPPROP_BUD - Budgets between REVEST and APPROP Integrity within Commitment Control data examples: Integrity Check 01: BOR_CHK_PROJ_ENC_LEG LEDGER_KK Type 2: Integrity within Commitment Control These queries should never have variances since all ledgers should be updated at the same time upon a valid budget check Corrective Action is usually a journal entry directly to Commitment Control If the variance is for a Project ledger, we will usually opt to rebuild the project ledgers because many schools still have residual variances from 8.9 upgrade So, how do you find these variances? For variances in the Summary vs Detail and Integrity within Commitment Control queries find the accounting period where the variance exists Then use a detail query to identify the specific transaction(s) Finding variances … Integrity Check 05: BOR_CHK_KKLEDG_ACTV Finding variances … Finding variances … Integrity Check 05: BOR_CHK_KKLEDG_ACTV Finding variances … Once you know the accounting period, you can use the BOR_KK_ACTIVITY query to identify the transaction You may want to tweak it a bit. I recommend adding a Business Unit prompt (improves performance), and changing the LEDGER_GROUP = ‘DETAIL’ criteria to LEDGER = prompt Finding variances … So now what? Once you’ve found the transaction, check for any budget errors. If they exist, clear them. Even if the transaction does not show as having a Budget Error, re-budget checking can sometimes clear the issue (may need to trick the system to reset the budget flags) If the variance persists, submit a ticket to ITS Type 3: Integrity between Commitment Control and GL Ledgers LEDGER_KK LEDGER Integrity 02: BOR_CHK_PROJ_EXP_LEG - Expense between PRMST, PROJ_GRT, DETAIL, and ACTUALS Integrity 03: BOR_CHK_PROJ_REV_LEG - Revenue between PRMST, DETAIL, and ACTUALS Integrity 07: BOR_CHK_DETL_ACTLS - Expense between DETAIL and ACTUALS Type 3: Integrity between Commitment Control and GL Ledgers LEDGER_KK LEDGER Integrity 09: BOR_CHK_REV_LEDGER - Revenue between REVEST, DETAIL, and ACTUALS Integrity 11: BOR_CHK_DTL_ENC - “Encumbrance” between DETAIL and ENCUMB - Corrective Action to re-run ENCUMB ledger build - ENCUMB ledger is not closed and can be rebuilt at any time Integrity between KK and GL Ledger data example: Integrity 03: BOR_CHK_PROJ_REV_LEG LEDGER_KK LEDGER_KK LEDGER Integrity between KK and GL Ledger data example: Integrity 07: BOR_CHK_DETL_ACTLS LEDGER_KK LEDGER Type 3: Integrity between Commitment Control and GL Ledgers Variances between Commitment Control and ACTUALS very common Timing Issue - Any transaction that has been budget checked and not posted will be a variance If running throughout year, monitor for lingering variances Will probably only be clear at Fiscal Year End If “true” variance, then journals to Commitment Control are usually needed Finding variances… 3 primary sources of variances: Vouchers budget checked, but not yet posted (BOR_AP_UNPOSTED_VCHR) Expense Reports budget checked, but not yet posted (BOR_EX_UNPOSTED_ACCRUALS) Expense Reports posting for different amount than budget checked Finding variances… “Known Issue” with Expense Reports not re-budget checking when mileage is changed Workaround: uncheck/recheck “approve expense” box If you are an Expense user, add BOR_KK_EX_ER_RECON to your month end list of queries to run This query will return any Expense Reports budget checked for a different amount than posted for Relatively easy DBI to fix if caught before Expense Reports are closed Type 4: Checks for Things that Should Not Exist Month End 01: BOR_CHK_JE_PENDING - Returns transactions not journal generated or journals with errors Month End 02: BOR_CHK_UNPOST_SUBSYSTEM - Returns any subsystem journal that has been unposted (ability to unpost subsystem journals has been removed) - Will cause FDM errors Type 4: Checks for Things that Should Not Exist Month End 03: BOR_CHK_CASH_ENCUMB - Returns cash encumbrances (ITS can run utility to delete them) - Coming from Encumbrance journals on which the ‘DEFAULT’ transaction code is used. Can be either Payroll Encumbrance process of manual Encumbrance journals - Will cause your BOR_BTA_ENCUMB_PAYABLE query to be out - Will cause FDM editor errors for period 0 Type 4: Checks for Things that Should Not Exist Month End 04: BOR_CHK_REST_WOUT_PROJ - Fund 20000 transactions without a Project Month End 05: BOR_CHK_ERROR_ENCUMB - Encumbrances in Revenue or Balance Sheet accounts Month End 06: BOR_CHK_NEG_ENCUMB - Negative Encumbrances Type 4: Checks for Things that Should Not Exist Year End 01: BOR_CHK_12000_BALANCES - Balances in Fund 12000 (inactive fund) Year End 02: BOR_CHK_FDM_CAPITAL_CF - Returns CAPITAL transactions where CFs are missing and Fund Code not equal to 52000 Year End 04: BOR_CHK_PERSERV_ENCUM - Returns Personal Services Encumbrances (only “shouldn’t exist” if YE and Zero Personal Services process has been run) Integrity 12: BOR_CHK_BUD_REF_FISCAL_YEAR - Returns transactions with Budget Ref greater than FY entered Type 5: Checks for Things that Should Exist Year End 03: BOR_CHK_PERIOD0_POPULATED - Ensure that ACTUALS, CAPITAL, GAAP, DETAIL_EN, and ENCUMB have beginning balances Year End 05: BOR_NET_ASSET_ACCOUNT - Returns beginning balances for Net Asset accounts Why do we care? Variances undermine the intent of Commitment Control If you have Encumbrances or Expenses recorded in KK_ACTIVITY_LOG, but not LEDGER, transactions may pass budget checking that shouldn’t If you have Encumbrances or Expenses recorded in DETAIL, but not APPROP, transactions may pass budget checking that shouldn’t, since we control at APPROP Why do we care? Can cause overspending or underspending Year End Reporting of Expenses does come from ACTUALS, but if you’re spending based on KK, then your numbers may not be what you expected Causes inaccurate reporting to your departments Why do we care? Encumbrance errors can affect your ENCUMB ledger which affects the BTA_ENCUMB_PAYABLE query and the Budgetary Compliance Report Encumbrance errors will affect your Surplus/Deficit reporting Bad data can cause FDM editor errors Wrap-Up Run Summary vs Detail, Integrity within Commitment Control, and Checks for things that shouldn’t exist throughout the year, don’t wait until Year End Begin the hunt for variances by adding accounting period to queries You may still need ITS to find or correct the variance Questions