Mergers and Acquisitions (M&As): Running Afoul of Antitrust Laws

advertisement

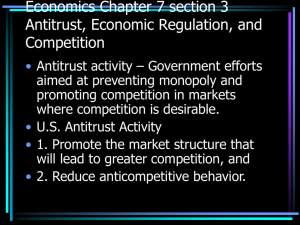

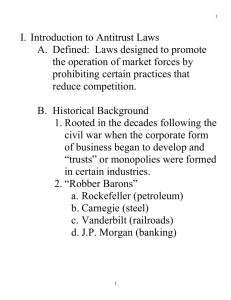

Mergers and Acquisitions (M&As): Running Afoul of Antitrust Laws Jennifer Sawayda Program Specialist Anderson School of Management University of New Mexico Albuquerque, NM What Do We Need to Know about Antitrust? • Sherman Antitrust Act of 1890 – Prohibits formation of trusts – John Rockefeller’s Standard Oil – 1911 • Clayton Act of 1914 – Expands Sherman Antitrust Act – Forbids price discrimination, M&As that significantly reduce competition, sales on the condition of exclusive dealing, and serving on board of two rival companies. Important Law for M&As • Hart–Scott–Rodino Antitrust Improvements Act – The Department of Justice and the Securities and Exchange Commission must receive notice of M&As valued over $70.9 million (adjusted accordingly) – The companies involved must receive approval before the transaction is closed – The agencies will review the proposed transaction to see whether it will significantly hinder competition – If you don’t comply, it could cost your company $16,000 in fines per day of non-compliance The Waiting Period • 30 day initial waiting period – Afterward, the agencies might file a “Second Request” wanting more information – Agencies might allow transaction to proceed earlier if no competitive issues are detected Horizontal Mergers • The biggest issues occur with horizontal mergers, in which two competing companies combine. Antitrust concerns arise if the merger significantly reduces competition by decreasing the number of entities in the market. – Examples: Whole Foods’ acquisition of Wild Oats, AT&T’s attempted acquisition of T-Mobile, proposed acquisition between American Airlines and U.S. Airways. • Government challenges of M&As appear to be rising in recent years What Do the Agencies Look At? • • • • • • Market share Geographic market Substitute products in the market Motivation of the companies involved Ease of market entry Perceived impact on innovation Beware of What You Say! • The agencies inspect documents of the firms involved. If documents contain references to reducing competition, creating barriers to entry, or other antitrust language, agencies more likely to see the M&A as an attempt to reduce competition • Instead, discuss procompetitive benefits of the M&A Whole Foods and Wild Oats • Whole Foods announced its acquisition of major rival Wild Oats • FTC challenged the merger, believing it would reduce competition in the natural and organic supermarket industry and give Whole Foods too much power over customers • John Mackey’s postings criticizing rival Wild Oats under pseudonym became an issue • In 2009 Whole Foods agrees to sell Wild Oats trademark and several stores Southwest Airlines and Air Tran • Southwest Airlines acquires AirTran for $1.4 billion in 2010 • FTC approves the deal – Little overlap between two carriers – Southwest’s high customer service could benefit customers once carried over to AirTran – New routes for Southwest customers AT&T and T-Mobile • In 2011 AT&T announced its intention to purchase T-Mobile USA for $39 billion • Justice Department announced it would file a lawsuit to block the bid – The merger would make AT&T the largest wireless carrier in U.S. – Justice Department believed this could have an adverse impact on consumers and competitors • AT&T dropped the bid; write-off of $4 billion American Airlines and U.S. Airways • In 2012 American Airlines announced intention to acquire U.S. Airways • The Justice Department filed a lawsuit – The merger would make the firm the world’s largest airline – Claimed that merger would result in less competition and higher prices – Cites internal documentation to support its assertions • American Airlines claims the DOJ is holding them to different standards than it had used with other airline mergers Antitrust in Other Countries • Antitrust issues are alive and well in other countries – New York Stock Exchange Euronext and Deutsche Borse merger blocked by European Commission – European Union seeking to block merger of U.P.S. with TNT Express – Chinese antitrust authorities rejected Coca-Cola’s bid to acquire juice maker Huiyuan Conclusion—Avoiding Problems • Conduct risk assessments early on and consider possible objections to M&A • Be careful what is put in internal documentation • Educate customers about the benefits the merger would afford them