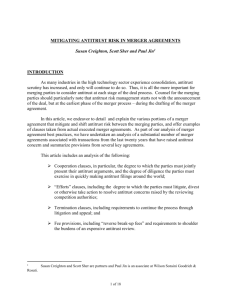

1. If a merger is held to be unlawful, the acquiring

advertisement

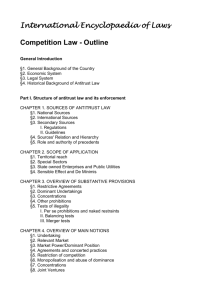

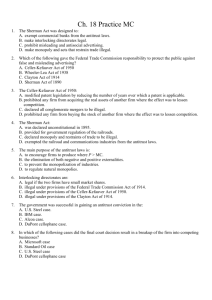

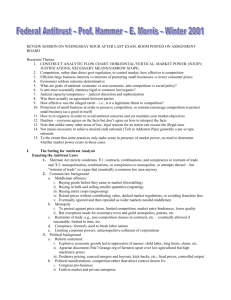

1 I. Introduction to Antitrust Laws A. Defined: Laws designed to promote the operation of market forces by prohibiting certain practices that reduce competition. B. Historical Background 1. Rooted in the decades following the civil war when the corporate form of business began to develop and “trusts” or monopolies were formed in certain industries. 2. “Robber Barons” a. Rockefeller (petroleum) b. Carnegie (steel) c. Vanderbilt (railroads) d. J.P. Morgan (banking) 1 2 II. Major Pieces of Legislation A. Sherman Antitrust Act 1890 1. Section 1: Prohibits combinations and conspiracies in restraint of trade. 2. Section 2: Attacks Monopolization and attempts to monopolize. B. Clayton Act 1914 1. Made the intent of the Sherman Act more specific. 2. In particular, it prohibited certain Acts when they substantially lessened competition or tended to create a monopoly. a. Section 2: Outlaws price discrimination Price discrimination: Charging purchasers in different markets different prices that are unrelated to cost differences. 2 3 b. Section 3 Forbids tying contracts Tying contracts: producer requires buyer to purchase other products from the seller besides the desired product. c. Section 7 Prohibits interlocking stockholding Interlocking stockholding: One firm acquiring the stock of a competing firm. d. Section 8 Prohibits interlocking directorates Interlocking directorates: The director of one firm is a board member of a competing firm. 3 4 C. Federal Trade Commission Act 1914 1. Created the FTC to investigate unfair competitive practices and issue cease and desist orders when unfair methods of competition are discovered. D. Wheeler-Lea Act 1938 a. Expanded FTC powers to include “unfair and deceptive practices,” such as false advertising and deceptive packaging aimed at consumers. b. FTC was established as an independent antitrust agency. E. Celler-Kefauver Act 1950 1. Amended Section 7 of the Clayton Act by prohibiting one firm from acquiring the assets of another firm when the effect would be to lessen competition. 4 5 III. Areas of Focus in Antitrust Activity A. Merger Activity (Figure 18.1) 1. Types of Mergers a. Horizontal Merger: Merger between two firms producing similar products in the same market. 1. Antitrust Division of the Justice Department uses Section 7 of the Clayton Act to challenge horizontal mergers that add 100 or more points to the Herfindahl Index or where the post-merger Herfindahl Index is greater than 1,800. b. Vertical Merger: The merging of firms at different stages in the productive process. 1. Usually escapes antitrust activity. 5 6 c. Conglomerate Merger: Merger of a firm in one industry with another firm in an unrelated industry. 1. Usually escapes antitrust activity. B. Monopolization 1. Issues of Interpretation a. Structuralists Believe that a firm with a very high market share will behave like a monopolist. Therefore, structure alone can make a firm a legitimate target for antitrust activity. b. Behavioralists Believe that the relationship between structure, behavior and performance is unclear. Therefore, behavior not 6 7 structure should be the criterion for antitrust prosecution. C. Collusive Activities such as price fixing, dividing up market Share and rigging government contracts. 1. per se violation IV. Important Antitrust Cases A. Standard Oil Case 1911 1. Court ordered Standard Oil broken up because of anticompetitive actions. 2. Structure vs. behavior issue unresolved. B. U.S. Steel Case 1920 1. U.S. Steel had 50% of the steel mkt. 2. Court ruled that U.S. steel had monopoly power, but was not guilty of antitrust violations because it did not use that power unreasonably. 3. Established “Rule of Reason” 7 8 C. ALCOA Case 1937-1945 1. ALCOA controlled 90% of the aluminum ingot mkt. 2. The court ruled that ALCOA got its monopoly position reasonably by prior standards. However, the court ruled that ALCOA was in violation of Antitrust Laws because of structure alone. D. Dupont Cellophane Case 1956 1. The issue here was defining the relevant market. Was it cellophane or all flexible packaging materials (wax paper and tin foil)? 2. Court used broad definition. 8 9 E. Microsoft Case 1998-2002 1. Microsoft was charged with violating section 2 of the Sherman Antitrust Act by taking a series of actions that were designed to maintain its “Windows” monopoly (controlled 95% of the operating system market). Microsoft was also charged of being in violation of Section 1 of Sherman because of bad conduct. 2. Microsoft was found guilty of being in violation of Anti-trust because it behaved badly. a. Specifically Microsoft illegally tied its Internet Explorer browser to windows and provided Internet Explorer at no charge. b. Microsoft agreed to change its behavior toward its competitors as described in the "last word." 9 10 V. Penalties for being in violation of antitrust: A. Imprisonment & Fines Maximum Prison Sentence: 10 years Companies can be fined a maximum of $100,000,000 and individuals $1,000,000. B. Structural Remedies 1. If a merger is held to be unlawful, the acquiring company will be made to divest itself of the acquired company. 2. Company may be broken up, but this is rare. C. Treble Damages Anyone that is injured by antitrust violations can sue for treble damages. D. Consent Decree 10