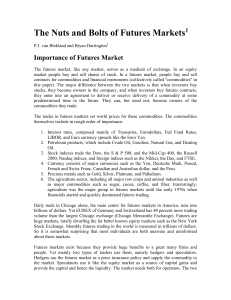

Basic Futures Definitions

advertisement

ECON 337: Agricultural Marketing Lee Schulz Assistant Professor lschulz@iastate.edu 515-294-3356 Chad Hart Associate Professor chart@iastate.edu 515-294-9911 Futures Markets Organized and centralized market Today’s price for products to be delivered in the future A mechanism of trading promises of future commodity deliveries among traders Futures and Options Market tools to help manage (share) price risks Mechanisms to establish commodity trades among participants at a future time Available from commodity exchanges / futures markets Agricultural Futures Markets Has some unique features due to the nature of agricultural businesses Supply comes online a few times during the year So at harvest, supply spikes, then diminishes until the next harvest Production decisions are based price forecasts Planting decisions can be made a full year (or more) before the crop price is realized Users provide year-round demand Livestock feeding, biofuel production, food demand Futures Market Exchanges Competitive markets Open out-cry and electronic trading Centralized pricing Buyers and sellers are both in the market Relevant information is conveyed through the bids and offers for the trades Bid = the price at which a trader would buy the commodity Offer = the price at which a trader would sell the commodity CME Group http://www.cmegroup.com/ Products Agricultural commodities Corn, soy, cattle, hogs, etc. Energy Currency Metals Weather Others Futures Contracts A legally binding contract to make or take delivery of the commodity Trading the promise to do something in the future You can “offset” your promise Standardized contract Form (weight, grade, specifications) Time (delivery date) Place (delivery location) Soybean Futures Form 5,000 bushels No. 2 Yellow Soybeans (at price), No. 1 Yellow soybeans (at 6 cents over price), and No. 3 Yellow Soybeans (at 6 cents under price) Time Contract months: Sept, Nov, Jan, Mar, May, July, and August Source: CME Group Soybean Futures Partial listing of delivery points Source: CME Group Rulebook Delivery Points Corn Soybeans Wheat Source: Irwin, Garcia, Good, and Kunda, 2009 Marketing and Outlook Research Report 2009-02 Futures Contracts No physical exchange takes place when the contract is traded (no actual commodity moves) Payment is based on the price established when the contract was initially traded (prices can and will change before delivery is taken) Deliveries can be made when the contract expires or the offsetting futures position must be taken to settle up Deliveries occur on less than 5 percent of the traded contracts Market Positions You can either buy or sell initially to open a position in the futures market “Make” a promise to make or take delivery Do the opposite to close the position at a later date “Offset” the promise (and no commodity changes hands) Trader may also hold the position until expiration and make or take physical delivery of the commodity Trading Futures Contracts All trades through a licensed broker Brokerage house has a “seat” at the exchange and is allowed to trade Represented “on the floor” to exercise trade Local broker to initiate transaction and manage account with client Full service and discount brokers CME Group http://www.cmegroup.com/ Open, High, Low, Last Price Settlement Price Volume Open Interest Daily Limits Terms and Definitions Basis The difference between the spot or cash price and the futures price of the same or a related commodity. Bear Someone that thinks the price will decline Bull Someone that thinks the price will increase Cash vs. Futures Prices Iowa Corn in 2013 The gap between the lines is the basis. 2013 Basis for Iowa Corn Terms and Definitions Clearing House The division of the futures exchange through which all trades made must be confirmed, matched and settled each day until offset or delivered. Commission For futures contracts, the one-time fee charged by a broker to cover the trades you make to open and close each position. Terms and Definitions Long position A position in which the trader has bought a futures contract that does not offset a previously established short position. Short position A position in which the trader has sold a futures contract that does not offset a previously established long position. Going Short Sold Dec. 2014 Corn @ $4.55 What type of trader (bull or bear) would go short? What events would send prices in a favorable direction? Going Long What type of trader (bull or bear) would go long? Bought Nov. 2014 Soybeans @ $11.20 What events would send prices in a favorable direction? Class web site: http://www.econ.iastate.edu/~chart/Classes/econ337/ Spring2014/ Have a great weekend!