Pharmacy Benefit Manager

advertisement

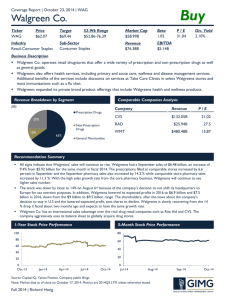

Analysts: Su Chen Gina Huang Xuhao Yang Jonathan Barki Date: November 10th, 2011 1 Portfolio Position RCMP currently holds 500 shares of WAG, bought on 6th Oct 1999 at the price of $25 For the previous trade day , WAG closed at $ 31.72 @11/9/2011 Holding value is 16% of total portfolio value 2 Product Class 3 Walgreen Drug Retail Market Share 4 Margin Analysis 5 Dupont Analysis 6 Slow Store Growth 7 Treasury Stock Plan 8 Past 5 Year Stock Performance 9 Source: Yahoo Finance Stock Performance Comparison 10 Source: WSJ Industry Structure •Mature Regulation Level •Medium Revenue Volatility •Low Barriers to Entry •Medium Capital Intensity Concentration Level Life Cycle Stage •Medium Industry Globalization •Low •Medium Competition Level •High 11 Source: IBIS World Per capita disposable income Per capita disposable income determines an individual's ability to purchase goods or services Positive job growth and lower savings will lead to an annual growth rate of 1.6% over the outlook period, but the growth will be hindered by higher tax rates needed to balance the fiscal deficit. Source: IBISWorld 12 Number of adults over 65 years old Older people are more likely to require medical attention or assistance Baby boomers have started reaching the age of 65, resulting in growth of over 3% a year The expansion of this group will be aided by further medical innovations, superior nutrition and improved safety 13 Source: US Census Bureau Number of people with private health insurance The number of people with private health insurance has declined during the five years to 2011, in response to the poor economic environment. The number of people with private health insurance is forecast to increase considerably during the five years to 2016, particularly in 2014, when a health insurance exchange will be initiated. Ultimately, 32 million previously uninsured individuals are forecast to gain coverage by 2019. 14 Source: US Census Bureau Federal funding for Medicare and Medicaid Medicaid is geared towards people with low incomes and Medicare covers almost everyone 65 or older The Congressional Budget Office projects that Federal funding for Medicare and Medicaid will rise at 6.70% per year to surpass a trillion dollars by 2016. This growth Funding for Medicare rises at a high but largely stable rate. This is because changes are driven by demographic shifts which occur predictably and slowly over time. Meanwhile, Medicaid expenditures fluctuate in accordance with the business cycle making it more volatile. 15 Source: Office of Management and Budget Generic drugs VS brand name drugs When the patent of a brand name medication expires, a generic version of the drug can be produced and sold. Generic drugs are as safe and effective as the brand name equivalent, with exactly the same ingredients, but are much cheaper In general, generic drugs generate lower total sales dollars per prescription, but higher gross profit margins , compared with patent-protected brand name drugs. Generic drugs are more profitable for wholesalers because of the enhanced bargaining position with generic manufacturers 16 Big Three Wholesalers, Revenues and Gross Profits, Brand vs. Generic Drugs Generic drugs represent about 9% of revenues but 56% of gross profits Source: Pembroke Consulting estimates 17 Walgreens to benefit from expiring patents Patents to expire in 2011 Patents to expire in 2012 23% of Walgreens’ prescription drugs sales Patent Expiring Company 2010 U.S. sales Lipitor Pfizer $5,329M Zyprexa Eli Lily $2,496M Levaquin Johnson& Johnson $1,312M Concerta Johnson& Johnson $929M Protonix Pfizer $690M Source: IBIS World 42% of Walgreens’ prescription drugs sales 18 Patent Expiring Company 2010 U.S. sales Plavix Sanofi $6,154M Seroquel Astrazeneca $3,747M Singulair Merck $3,224M Actos Takeda $3,351M Enbrel Amgen $3,304 Biggest drugstore chain VS Top three PBMs Walgreens failed to agree on new contract terms with Express Script, one of the three largest Pharmacy Benefit Managers(PBM) The break-up with Express Script will cost Walgreens about $5 billion in annual sales, or about seven percent of its business. 19 Pharmacy Benefit Manager(PBM) Pharmacy Benefit Manager (PBM) is a third party administrator of prescription drug programs, primarily responsible for processing and paying prescription drug claims. PBMs like Express Scripts and Medco are patients' first point of contact with the pharmaceutical supply chain. These PBMs are using their massive scale to wield stronger bargaining power over retailers, and are encouraging consumers to switch to their own low-cost mail-order facilities instead of retail drugstores As a result, retail drugstores like Walgreens are facing unprecedented reimbursement and competitive pressure. 20 Consolidation in the healthcare industry Many organizations in the healthcare industry, including pharmacy benefit managers, have consolidated in recent years to create larger healthcare enterprises with greater market power, which has resulted in greater pricing pressures to WAG Two of the three largest pharmacy benefit managers, Medco Health Solutions, Inc. and Express Scripts, Inc., announced an agreement to merge in July 2011, completion of which is subject to regulatory and other conditions. If this consolidation trend continues, it may lead to further pressure on the prices for our products and services and adversely affect our business. 21 Closest Competitors CVS: The Pharmacy Services segment provides pharmacy benefit management (PBM) services, mail order services specialty pharmacy services, plan design and administration and claims processing. The Retail Pharmacy segment sells prescription drugs and general merchandise. General merchandise include over-the-counter drugs, beauty products, cosmetics, film and photo finishing services, greeting cards, and convenience foods. Rite Aid: Rite Aid sells prescription drugs and front end products. Front end products include over-the-counter medications, health and beauty aids, personal care items, cosmetics, household items, beverages, convenience foods, greeting cards, seasonal merchandise, photo processing, and other everyday products. Concerns LIFO Inventory Reporting Effects Costs of Goods Sold Net Income and EBIT Operating Property Leases as oppose to Capital Property Leases Overstates Operating Expenditure Impacts Net Income and EBIT Understates Debt Impacts Enterprise Value Must be taken into consideration with Multiples Cutting ties with Express Scripts $5.3 billion sales lost, 7% overall sales Effect earnings by 50 cents Final Price $34.31 10% 10% 80% Multiple 1 $35.53 DCF $33.24 24 Multiple 2 $41.66 Our Recommendation Stock price as of (11/9/2011): $31.72 HOLD 25