WALGREEN CO.

advertisement

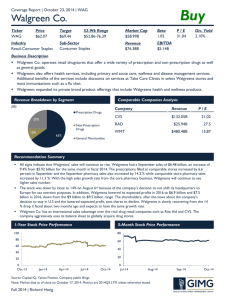

WALGREEN CO. Matt Byford Brandon Honey Shivam Khanna Joe Vaccaro October 28, 2008 Agenda ► Company Overview ► Macroeconomic Overview ► Industry Overview ► Recent Developments ► Forecasting/Expectations ► Valuation of Walgreens ► Recommendation Company Overview ► Founded in 1901 by Charles Walgreen 1st store was in Chicago ► 226,000 employees as of 8/31/2007 ► Goal is to have 7,000 stores open by 2009 Company Overview ► Walgreen company operates retail drug store chains that are engaged in the retail sale of prescription drugs, non-prescription drugs, and general merchandise. ► In 2008, it opened 561 net new stores for a total of 6443 Walgreens in 49 states, District of Columbia, and in Puerto Rico. ► It is the fastest growing retailer in the US, and is the 2nd largest drugstore chain behind CVS. ► Ranked 44th on the Fortune 500 list of the largest US-based companies. ► On the list of Fortune’s magazine’s Most Admired Companies in America for the last 14 consecutive years. Company Overview ► A.G. McNally Chairman of the Board since 2008 Chief Executive Officer since 2008 Board member sine 1999 ► Gregory Wasson President and Chief Operating Officer since 2007 ► Jeff Rein retired in October 2008 Chairman and Chief Executive officer since 2003 ► William Rudolphsen Senior Vice President and Chief Financial Officer since 2004, new role as Chief Risk Officer ► Has been with Walgreens since 1977 Macroeconomic Overview Decline in Consumer Confidence Consumer Confidence Index (CCI) 120 100 80 60 40 20 CCI hit all time low in June 2008 (51) Se p. 20 08 Ju n08 M ar -0 8 20 07 De c. Se p. 20 07 Ju n07 M ar -0 7 20 06 De c. Se pt . 20 06 0 Macroeconomic Overview ► ► Oil continues to be volatile, but lower prices will have positive impact on economy Cost to do business will be lower Strategy ► Organic store growth ► Relocate, ► remodel Densely-populated areas like Southern California and Northeast Invest heavily in high-tech store and distribution systems which drive service up and costs down ► Acquisitions where there are synergies ► Healthcare offerings beyond that of a traditional pharmacy ► Offer an online drugstore web site totally integrated with retail stores Take Care Healthcare Systems Increase market share in front-end of stores ► Must continue to find ways to leverage the benefits of scale without losing the ability to react quickly to changes in customer needs ► Strategy ► Growth Walgreens is currently increasing their net stores operated by approximately 1 store every 16 hours The company, which currently operates 6,443 stores, plans to operate at least 7,000 stores by 2009 ►See room for organic growth to 13,000 stores Innovations ► Introduced freestanding stores in early 1990s with drive thru pharmacies ►Today, more than 80% of Walgreen Co.’s stores have drive thru pharmacies ► Nation-wide 1 hour photo service ►Available ► Touch ► 50% at more than 98% of stores tone prescription refills of people live within 2 miles of a Walgreens Drug Store Industry ► Highly Competitive Industry Competition with other drugstore chains, independent drugstores, mail order prescription providers, internet pharmacies Other competitors include various grocery stores, mass merchants, and dollar stores ► Main competitors: CVS Corp. (CVS) Rite Aid Corp. (RAD) Wal-Mart (WMT) ► Pharmaceutical more than grocery department ► Now offers a $4 generic prescription plan Drugstore.com RCMP Position ► Own 500 shares in Walgreens ► Purchased at $25/share on 10/06/1999 ► Sold 500 shares at $49.94/share on 9/14/2006 ► Cost Basis is $12,500 ► Stock is now trading at $21.40/share ► Valued at $10,700 ► Represents ► Unrealized 2.4% of portfolio market value Loss of $1,800 or 14.4% Shareholder Base ► 67% of shares owned by institutional investors ► 125,000 shares sold by insiders in last 6 months Correlation Business Specialty pharmacy Prescription drugs Home infusion Therapy provider Drugstores Nonprescription Drugs General merchandise Take care Health clinics Product class 2008 2007 2006 2005 Prescription 66% 65% 64% 64% Non-prescription 10% 10% 11% 11% General Merchandise 24% 25% 25% 25% ► Prescription sales continue to become a larger portion of the company’s business. Aging population Introduction of lower priced generics (Medicare D) R&D of innovative drugs Walgreen Outlook ► Advantages: Good reputation / quality Convenience of locations: High market share Economies of scale Aging population ► Risk factors: Peaking generic drug cycle: Store saturation/cannibalization Competition from CVS/Caremark, Wal-Mart Diverging from original growth strategy Porters Five Forces: Retail Drug Industry ► Rivalry: High Competitive Industry Direct mail pharmacy benefit managers Grocery stores & big box retailers ► Threat of Substitutes: Low Few alternative choices for products sold at Walgreens/Drug Retailers ► Bargaining Power of Buyers: Moderate Insurance companies Walgreens receives premium prices for front end convenience items ► Bargaining Power of Suppliers: Moderate Watch government regulations / upcoming election ► Barriers to Entry: Moderate High initial capital expenditures & supplier relationship required Comparables WAG CVS Market Cap: 21.18B 35.05B 379.52M 195.40B 2.56B Qtrly Rev Growth: 8.80% 2.10% -1.10% 10.40% 13.40% Revenue: 59.03B 84.90B 26.44B 397.38B 6.20B 28.19% 20.39% 27.31% 24.47% 27.31% 4.28B 6.65B 708.66M 29.79B 505.83M 5.83% 6.43% 0.53% 5.83% 4.87% Net Income: 2.16B 3.06B -1.44B 13.39B N/A EPS: 2.166 2.036 -1.78 3.361 0.74 P/E: 9.88 11.99 N/A 14.78 13.64 PEG: 0.76 0.79 N/A 1.3 0.86 P/S: 0.38 0.47 0.02 0.51 0.41 Gross Margin: EBITDA: Oper Margins: RAD WMT Industry Source: Yahoo Finance 1 Yr. Stock Performance Source: Yahoo Finance 5 Yr. Stock Performance Source: Yahoo Finance Longs Bid Withdrawal ► Competitive action vs. Failed action Caused CVS to overvalue Longs CVS must pay $71.50 per share Most likely has to access debt ►Challenging debt market ►CVS must pay a penalty if it cannot access financing Longs Bid Withdrawal ► Longs is exposed to the poor condition of the CA market ► Longs would have few synergies with WAG ► WAG did not want to risk its credit rating Senior unsecured debt was downgraded anyway from AAA to AA ►EBIT coverage ratio fell because of increase in LT debt ►Uncertainty of strategic direction ►CEO Jeff Rein retired Expectations ► Prescription sales will grow ► Specialty Pharmacy sales will become a greater part of the business ► 7000th store will open FY 2009 ► Organic store growth will begin slowing in 2011 Increases flexibility Slower sales growth ► Promotional activity will be moderated ► People will return to their doctors as the economy recovers Generic Drugs Expectations ► Greater use of generic drugs as baby boomers retire and receive a fixed income ► A significant amount of brand name drugs are expected to come off of patent between 2009-2011 Currently, WAG is in a valley ►There were few brand name drugs coming off of patent in 2008 Expect a peak within the next 3 years Expectations ►A new CEO is expected to lead Walgreens Upside potential ► Possible political effects with more affordable health care coming from different plans Valuation – DCF Analysis ► Cost of equity = 7.6% ► Cost of debt = 5.36% ► Wacc = 7.35% ► Long term growth = 3% ► Stock Price = 23.55 Comparable’s data ► Strong profitability margins; expected decline over 5 years ► Strong Return on Equity, Return on Asset numbers; expected decline ► Implied growth through PEG ratio lower than industry average ► P/E ratio is lower than market and industry average EVA Analysis ► Strong Return on Average Invested Capital, expected decline going forward Recommendation ► Hold the stock at this price. People have over-reacted and this has pushed the stock price down. Company is well positioned as compared to it’s peers ► New CEO could put the company back on track.