Walgreen Co.

advertisement

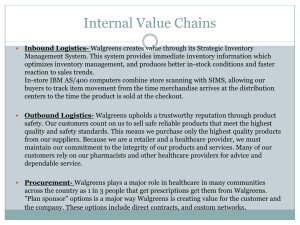

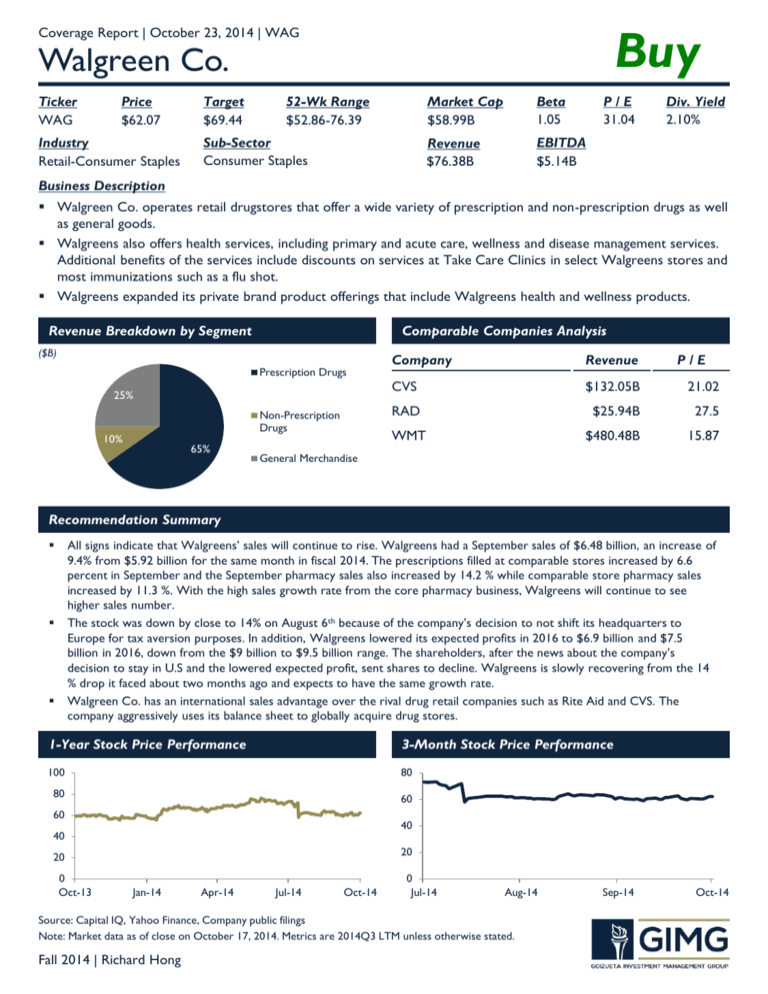

Buy Coverage Report | October 23, 2014 | WAG Walgreen Co. Ticker WAG Price $62.07 Industry Retail-Consumer Staples Target $69.44 52-Wk Range $52.86-76.39 Sub-Sector Consumer Staples Market Cap $58.99B Beta 1.05 P/E 31.04 Revenue $76.38B EBITDA $5.14B Div. Yield 2.10% Business Description Walgreen Co. operates retail drugstores that offer a wide variety of prescription and non-prescription drugs as well as general goods. Walgreens also offers health services, including primary and acute care, wellness and disease management services. Additional benefits of the services include discounts on services at Take Care Clinics in select Walgreens stores and most immunizations such as a flu shot. Walgreens expanded its private brand product offerings that include Walgreens health and wellness products. Revenue Breakdown by Segment Comparable Companies Analysis ($B) Prescription Drugs 25% Non-Prescription Drugs 10% 65% Company Revenue P/E CVS $132.05B 21.02 RAD $25.94B 27.5 WMT $480.48B 15.87 General Merchandise Recommendation Summary All signs indicate that Walgreens’ sales will continue to rise. Walgreens had a September sales of $6.48 billion, an increase of 9.4% from $5.92 billion for the same month in fiscal 2014. The prescriptions filled at comparable stores increased by 6.6 percent in September and the September pharmacy sales also increased by 14.2 % while comparable store pharmacy sales increased by 11.3 %. With the high sales growth rate from the core pharmacy business, Walgreens will continue to see higher sales number. The stock was down by close to 14% on August 6th because of the company’s decision to not shift its headquarters to Europe for tax aversion purposes. In addition, Walgreens lowered its expected profits in 2016 to $6.9 billion and $7.5 billion in 2016, down from the $9 billion to $9.5 billion range. The shareholders, after the news about the company’s decision to stay in U.S and the lowered expected profit, sent shares to decline. Walgreens is slowly recovering from the 14 % drop it faced about two months ago and expects to have the same growth rate. Walgreen Co. has an international sales advantage over the rival drug retail companies such as Rite Aid and CVS. The company aggressively uses its balance sheet to globally acquire drug stores. 1-Year Stock Price Performance 3-Month Stock Price Performance 100 80 80 60 60 40 40 20 20 0 Oct-13 Jan-14 Apr-14 Jul-14 Oct-14 0 Jul-14 Aug-14 Source: Capital IQ, Yahoo Finance, Company public filings Note: Market data as of close on October 17, 2014. Metrics are 2014Q3 LTM unless otherwise stated. Fall 2014 | Richard Hong Sep-14 Oct-14