discount rate

advertisement

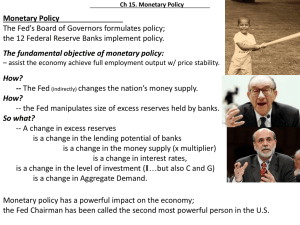

Chapter 18 The Tools Of Federal Reserve Policy ©Thomson/South-Western 2006 1 The Federal Reserve Goals and Tools Goals influence greater output lower the unemployment rate prices level stability tools of monetary policy or instruments of monetary policy open market operations discount window policy reserve requirement policy intermediate target variables short-term interest rates monetary aggregates (M1, M2, M3) 2 The Reserve Requirement Instrument Can be considered a “tax” on banks because it cause bank to hold a larger portion of their assets in non-interest-earning form (reserves). Banks must maintain Reserve requirements or required reserve ratios that the Fed set. Before 1980, reserve requirements only existed for member banks and ratio for member banks were set higher than non-members’. Now the ratio apply to all banks. 3 Discount Window Policy A facility through which the Federal Reserve lend reserves directly to depository institutions. Funds borrowed are called discount loans Funds are charged at a discount rate Funds are short-term loan Transaction is accomplished by a bookkeeping entry, bank reserves increase with the amount of the loan. 4 Discount Window Policy Three classes of credit available: Primary credit- granted to banks in good condition who are permitted to borrow as much as they want discount rate > fed funds rate Secondary credit provided to troubled banks that are experiencing liquidity problems ½ percentage point higher rate Seasonal credit provided to banks subject to seasonal fluctuations in loan demand—like agricultural activity Main function of the discount rate today is to set upper limit on potential movement in the federal fund rate. 5 Open Market Operations: Fundamental Considerations Open market operations Buying and selling of securities in the open market The Fed is empowered to buy or sell U.S. Treasury securities federal agency securities banker's acceptances other securities Domain of Federal Reserve's open market operations could be carried out in any asset. To avoid favoritism, politics, and unintentional signals, the Fed only buys U.S. government and agency securities and banker's acceptances. No matter what items it buys, Fed simply pays with a check written on itself. The Fed’s balance sheet impact will always be the same, regardless of the type of asset the Fed purchases or sells. 6 Discovery Of Open Market Operations And The Banking Act Of 1935 Accidental Discovery Prior to 1920,the discount window was the only Fed policy tool, The Fed's revenues were only the interest received on the Fed's discounts loans. An early 1920s recession led to a drop in revenue, so individual Fed bought U.S. government securities. When Fed purchased securities to compensate for reducing interest income, interest rates in the market fell, and credit conditions eased. 7 Impact of Open Market Ops The Fed conducts open market operation with the desire to impact: Short term interest rate Bank reserves (R) Monetary base (B) Money aggregates (the M’s) The policy is conduct by selling and buy securitiessssss 8 Impact of Open Market Ops (Selling) If the Fed sells $225 million in U.S. Treasury bills to a government securities dealer reserves and the monetary base contract dollar-for-dollar, money supplies directly decrease by dollar-for-dollar 9 Impact of Open Market Ops (Buying) When the Fed buys $400 million in Treasury bonds and bills from banks, reserves and the monetary base expand dollar-for-dollar, But the money supply is not directly or immediately affected. This happens when banks initiate the multiple deposit-expansion process by making loans and buying securities. 10 Impact of Open Market OpsSummary Sell and Buy to Banks reserves and the monetary base contract/expand dollarfor-dollar, BUT the money supply is not directly or immediately affected. This happens when banks initiate the multiple deposit contraction/expansion process. Sell and Buy to Dealers reserves and the monetary base contract/expand dollarfor-dollar, AND the money supply is immediately contract/expand dollar-for-dollar. The effect to money supply will be even greater when banks initiate the multiple deposit contraction/expansion process. 11 Open Market Operations and the Federal Funds Rate The effects of the Fed's open market operations transmit very quickly throughout the nation through the federal funds market. The supply of reserves is determined by Federal Reserve policy. When the Fed purchases securities, bank reserves are boosted dollar-for-dollar. => lower federal fund rate When the Fed sells securities, bank reserves decline dollar-for-dollar. => higher federal fund rate 12 Figure 18-1 Purchase of Securities Federal Funds Rate S1 S2 4.0 3.5 Demand Reserves 13 The Effectiveness Of Open Market Operations Impacts of Open Market Operations via two primary channels: Impact on Bank Reserves, the Monetary Base, and the Monetary Aggregates: The Fed can use relatively accurate control over bank reserves and the monetary base by manipulating its security portfolio. Impact on Security Prices and Interest Rates (Yields): When the Fed buys government securities in the open market, it bids up security prices and therefore reduces their yields. Marketable securities are substitutable, so a decline in government security yields extends to yields on other assets. 14 Advantages of Open Market Operations Precision: firm and accurate control over aggregate bank reserves and the monetary base, while a high degree of accuracy cannot be achieved through changes in the discount rate or reserve requirements. Flexibility: in the market each day, buying and selling large quantities of securities very easy for the Fed to alter course Source of Initiative: The Fed is able to dominate aggregate bank reserves and the monetary base. 15 Early Disadvantages of Open Market Operations Signaling: Changes in the discount rate and reserve requirements are superior to open market operations in signaling policy changes to the public. Regional Bias: Prior to well-developed financial markets, a regional bias operated in open market operations, because the effects were concentrated in select urban areas where security dealers were located; open market operations did not disperse across the nation. 16 Technical Aspects Of Open Market Operations Defensive Operations versus Dynamic Operations Defensive open market operations open market operations made for the purpose of "defending" bank reserves and the monetary base against the influence of outside forces Dynamic open market operations open market operations made to deliberately change the course of economic activity now, from protector to initiator 17 Outright Transactions versus Repurchase Agreements Outright transactions The Fed uses outright purchases to bring about long-run or permanent growth in reserves and the monetary aggregates. Repurchase agreements (and reverse repurchase agreements) The Fed uses repurchase agreements (repos) and reverse repurchase agreements to neutralize the impact on reserves and the monetary base of transitory changes. Recall a repurchase agreement is a money market instrument wherein one party sells securities with an explicit agreement to buy them back at a specified future date and price. 18 Table 18-1 19