Ch15

advertisement

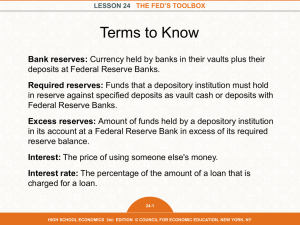

Tools of Monetary Policy Chapter 15 1 2 Tools of Monetary Policy Open market operations Changes in borrowed reserves Affect the quantity of reserves and the monetary base Affect the monetary base Changes in reserve requirements Affect the money multiplier 3 Tools of the Fed and Fed Funds Open market purchase Increases reserves Supply up Federal funds rate down Discount rate increase Reduces discount loans Reduces reserves Supply down Federal funds rate up 4 Tools of the Fed and Fed Funds Reserve requirement increase Banks scurry to find reserves Demand for reserves rises Federal funds rate up 5 Federal Funds Market Federal funds rate—the interest rate on overnight loans of reserves from one bank to another Primary indicator of the stance of monetary policy Since the beginning of February 1994, after every FOMC meeting, the Fed announced the target federal funds rate as monetary policy. 6 Demand in the Market for Reserves What happens to the quantity of reserves (RR+ER) demanded by banks, holding everything else constant, as the federal funds rate, iff, changes? Excess reserves are insurance against deposit outflows The cost of holding ER is the interest rate that could have been earned minus the interest rate that is paid on these reserves, ier 7 Banks’ Demand for Reserves 1. R = RR + ER 2. iff opportunity cost of ER, ER 3. Demand curve slopes down 4. Downward sloping demand curve becomes flat (infinitely elastic) at ier 5.Since the fall of 2008 Fed has paid interest on reserves at a level that is below the federal funds rate target. 8 Banks’ Demand for Reserves Federal Funds rate iff=ier Reserves 9 Fed’s Supply of Reserves Two components: non-borrowed and borrowed reserves Cost of borrowing from the Fed is the discount rate Borrowing from the Fed is a substitute for borrowing from other banks If iff < id, then banks will not borrow from the Fed and borrowed reserves are zero The supply curve will be vertical As iff rises above id, banks will borrow more and more at id, and re-lend at iff The supply curve is horizontal (perfectly elastic) at id 10 Fed’s Supply of Reserves iff=id NBR Reserves 11 Market for Reserves Why does the federal funds rate converge to i*? 12 13 Discount Loans and Discount Rate The discount rate charged for primary credit (the primary credit rate) is set above the usual level of short-term market interest rates. (Because primary credit is the Federal Reserve's main discount window program, the Federal Reserve at times uses the term "discount rate" to mean the primary credit rate.) The discount rate on secondary credit is above the rate on primary credit. The discount rate for seasonal credit is an average of selected market rates. 14 15 Open Market Operation Open market purchase => iff down unless it is already equal to ier. 16 Advantages of Open Market Operations 1. 2. 3. 4. The Fed is in complete control of the tool. Discount rate tool needs cooperation of the banks. OMO is flexible and precise; it can be small or large. OMO can be reversed easily. OMO is fast. There is no time lag between the evaluation and the impact. 17 Open Market Operations Dynamic OMO: To change the level of reserves and the monetary base. Defensive OMO: To offset the movements in other factors. Every day New York Fed evaluates the federal funds market and buys or sells securities to hit the desired federal funds rate. 18 Open Market Operations Temporary OMO Repo: Fed purchases securities with the understanding that the seller will buy them back within two weeks. Reverse repo (Matched sale-purchase): Fed sells securities with the understanding that it will buy back them back. Permanent OMO Conducted after the temporary OMO. 19 Change in the Discount Rate Discount rate down => iff may go down 20 Discount Policy Primary credit allowed to healthy banks without limit. Secondary credit extended to banks in trouble at 50 basis points above the primary rate. Seasonal credit given to small banks in tourist and agricultural areas. 21 Discount Policy The Fed’s discount policy is designed to ward off financial crises. The Fed is the lender of last resort. Provides unlimited funds to banks in trouble. It creates a buffer against bank panics and financial meltdown. Franklin National received 5% of total reserves in 1974. Continental Illinois in 1984 received three times the amount FN got. The possible meltdown that could have occurred in Black Monday (10/19/87) was avoided through Fed’s lender of last resort function. During the financial meltdown of 2008, reserves increased from 100b to 1400b. 22 Moral Hazard of Discount Policy If banks believe that the Fed will bail them out in times of trouble, they will take unnecessary chances and will engage in risky behavior. The Fed allowed many small banks to fail. Too-big-to-fail policy is seen to be unfair. 23 Change in Required Reserves An increase in the reserve ratio forces banks to hold more reserves at each and every federal funds rate. Reserve ratio up => iff up 24 Reserve Requirements Depository Institutions Deregulation and Monetary Control Act of 1980 sets the reserve requirement the same for all depository institutions 3% of the first $48.3 million of checkable deposits; 10% of checkable deposits over $48.3 million The Fed can vary the 10% requirement between 8% to 14% 25 Reserve Requirements This is a very powerful tool. If deposits are around $800 billion, a 1% change in the reserve requirement can have a $8 billion impact on the reserves of the banking system. It is a blunt tool. It can create severe liquidity problems for banks if the Fed raised the reserve requirement. 26 Can Reserve Requirements Be Abolished? Each bank will have to keep reserves to fulfill deposit outflows. The money supply process will work the same way except that ER/D and rd will be combined. Many central banks have either reduced or eliminated the reserve requirement. 27 How the Fed Limits Fluctuations 28 Monetary Policy Tools of the European Central Bank Open market operations Main refinancing operations Weekly reverse transactions Longer-term refinancing operations Lending to banks Marginal lending facility/marginal lending rate (100 basis points above target) Deposit facility (100 basis points below target) 29 Monetary Policy Tools of the European Central Bank Reserve Requirements 2% of the total amount of checking deposits and other short-term deposits Pays interest on those deposits so cost of complying is low 30 Jiazuo Xie Approach Federal Funds Rate is determined in the market where only banks appear as supplier and demander of Excess Reserves. Federal Reserve by increasing or decreasing reserves can forecast the change in ER A constant ER/R ratio allows the Fed to predict the change. 31 Jiazuo Xie Approach Banks which are short of RR, demand reserves from other banks. Their demand responds to the cost of reserves: iff. The higher the iff, the lower the demand If iff exceeds id, they will borrow from the Fed instead of Federal Funds market Because the Fed pays ier at iff=ier cost of borrowing is zero; infinite demand. 32 http://www.federalreserve.gov/monetarypolicy/reqresbalances.htm 33 Demand for Federal Funds id ier ER 34 Jiazuo Xie Approach The supply of ER comes from banks that already have enough RR. If iff=ier, banks rather keep the ER If iff>ier, banks will supply the Federal Funds market, the higher the difference, the higher the supply There is, however, a limited supply of ER determined by the Fed 35 Supply of Federal Funds iff ier ER 36 Fed Increases Nonborrowed Reserves iff ier ER NBR1 NBR2 NBR3 NBR4 37 Fed Changes Reserve Requirement id id ier ier ER ER Reserve Requirement Increased Reserve Requirement Decreased 38 Discount Rate Changed id id’ Discount Rate Decreased Discount Rate Increased 39