Heineken Intenational

advertisement

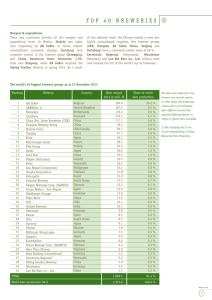

Heineken International Kody Harper Channing Renner Trevor Willis History • Established in 1864 – Gerard Adriaan Heineken – Amsterdam • In the late 1800’s, became Europe’s top beer producer • Publically traded in 1939 – HINKF • Revenue in 2008 of €14,701 million Euros Current & Future Profile • Current Profile – Substantial revenues in 2009 – New online program for 12 students • Future Profile – Economic downturn – Vague progress in certain countries SWOT Analysis • Strengths – Large Work Network • Over 70 countries and 125 breweries – Alliance with UEFA • Union of European Football Associations – Over 140 million viewers worldwide per game – Brand Awareness – Strong and rounded brand portfolio • Over 200 beers within Heineken’s portfolio • Top brands: Heikenken and Amstel SWOT Analysis • Weaknesses – Profit Margins • Decreased profit margins • Increased start up costs – Increased debt • 2007-08 $11 billion increased debt • Debt acquiring acquisitions SWOT Analysis • Opportunities – Failing and smaller breweries • Start up costs • Brewery and Maltery – Global Beer industry • Beer is good!! • 1.7% increase in market from 2008 to projected 2013 SWOT Analysis • Threats – Europeans…Drink more beer!!! • Slow growth rate, not coming close to estimates • Leading market for Heineken • Girly drinks – Financial status • Law violations hindering finances Global Market Expansion • 2nd – 4th in the world beer market • Largest brewer in Europe – 125 breweries worldwide – 70 countries • 5 geographical regions: – – – – – Central and Eastern Europe Western Europe Asia Pacific The Americas Africa and the Middle East Heineken International Website Global Market Expansion • Central and Eastern Europe – Terrific market share in Austria, Bulgaria, Greece, and Slovakia – Sold 53,300 liters worldwide in 2008 • Western Europe – Majority of profit – Large market share throughout multiple countries – New brewery in Spain Heineken's Geographical Revenue, 2008 Asia Pacific 2% The Americas 11% Africa and Middle East 11% Central and Eastern Europe 25% Western Europe 51% Global Market Expansion • Asia Pacific – Main breweries in Malaysia, Thailand, Vietnam, China, Singapore, Mongolia – 26.4 million gallons in Ho Chi Minh City in one year – Chinese Expansion • 3rd brewery in China Global Market Expansion • The Americas – Specialization in exports • Light beer only in America – Multiple breweries • Latin America, Caribbean – FEMSA Agreement Global Market Expansion • Africa and Middle East – Fastest growing segment • 35.3 percent from 2007-08 – Egypt brewery purchase Competition • Anheuser-Busch InBev • SABMiller • Carlsberg Group • The Boston Beer Company Competition • Anheuser-Busch InBev – Largest competitor to Heineken International – Anheuser Co. dates back to 1366 – 1987 Inbev was formed – In 2008, companies merged to form AnheuserBush Inbev – Key Products • Beer & Soft drinks Competition • SABMiller – Second largest brewery – SAB originated in late 1900’s – In 2002 company merged with Miller – Key products are Beer and Soft drinks – Six of top 50 Beers Competition • Carlsberg Group – Fourth Largest Brewing company – Founded in 1868 in Malawi – Weak presence in US – Producing mineral water with Coca Cola Competition • The Boston Beer Company – US based independently owned company – Created in 1984 by Jim Koch – Won more awards than any international brewing company – Many large companies have wanted to buy, but will not sell Company Revenues (In Millions), 2008 25 $23.6 $21.0 20 $18.7 15 $11.8 10 $4.8 5 0 Anheuser-Busch Inbev Heineken International The Boston Beer Company Carlsberg Group SABMiller Global Beer Market Share, 2008 Anheuser-Busch InBev 26% Other 55% SABMiller 12% Heineken 7% Industry Analysis • Global beer market – Grew by 2% in 2008 – Slow growth – Standard lager maintains high market share Global Beer Market Segmentation, 2008 Specialty beer 10% Ales, Stouts & Bitters 4% Low/No Alcohol 2% Premium Lager 29% Standard Lager 55% Industry Analysis • Segmentation by geographical region – Europe – 50% – Americas – 29% – Asia-Pacific – 21% Recommendations • Short-term – New marketing strategy • Sales increase, finances increase • New forms of marketing – Reduce acquisitions with debt • Acquiring negative assets • Stick to what they have – Diversity • Increased product line= larger market share • More appealing brand Recommendations • Long-Term – Increased shelf space • The more customers see the more they will buy – Portfolio increase: Financing smaller companies • Boston Brewing Company • Great brands with small finances – Ethical and Law standards • Public image • Health awareness Conclusion • Top 5 beer company in the world • Largest brewer in Europe • Strong brand portfolio • Substantial revenues in 2009