Supply Chain Oil Vulnerability: Mitigation and

advertisement

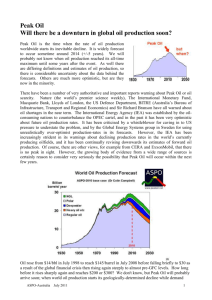

Sustainable Supply Chains Supply Chain Oil Vulnerability: Mitigation and adaptation Bruce Robinson Convenor ASPO-Australia Supply Chain Oil Vulnerability: Mitigation and adaptation Bruce Robinson Convenor Australian Association for the Study of Peak Oil The evidence and the “No Worries” mythology www.ASPO-Australia.org.au An Australia-wide network of professionals working to reduce oil vulnerability Working groups Oil & Gas industry Urban and transport planning Finance Sector Health Sector Social Services Sector Regional and city Defence and Security Conservation and Environment Remote & indigenous communities Active transport (bicycle & walking) Agriculture, Fisheries and Food Biofuels Construction Industry Public transport sector Economics Tourism Children and Peak Oil Young Professionals working group 3 Outline 1. Serious global oil shortages are quite likely in the near term. The evidence is mounting, but so is the “no-worries” hype. 2. Supply chain and logistics planning should include serious consideration of "Peak Oil" scenarios 3. Oil vulnerability assessment of key suppliers, clients and contractors would be a valuable precaution ● What is Peak Oil ? the time when global oil production stops rising and starts its final decline ● When is the most probable forecast date ? ? 2015 +/- 5 years ● “Peak Exports” will arrive sooner, as exporting countries use more of their own oil internally, leaving less for export ● What psychology or mythology is stopping decision-makers considering these risks ?? 4 Psychological aspects of Peak Oil “Beyond The State of Denial” Peak Oil seminar, Perth, 2001 The Theory of Black Swan Events is a metaphor The event is a surprise (to the observer) and has a major impact. After the fact, the event is rationalized by hindsight. Revised edition, 2008 Why do leaders consistently ignore looming signs of crises even when they know the consequences could be devastating? Most events that catch us by surprise are both predictable and preventable, but we consistently miss (or ignore) the warning signs Peak Oil is probably a "Predictable Surprise" which is being ignored 6 Optimism bias Strategic misrepresentation Sydney Morning Herald, 10th July 2008 8 Doomsday warning on fuel stock Cameron Stewart February 28, 2013 AUSTRALIA would grind to a halt within three weeks with almost no deliveries of food or medicine if its overseas oil and fuel supplies were cut off. An NRMA-commissioned report on the nation's liquid fuel security released today says the government has allowed the country to become too dependent on foreign supply of liquid fuels. It says there are no coherent contingency plans to deal with the devastating impact of any cut to overseas supply because of war, economic turmoil or natural disasters, instead adopting a "she'll be right" approach. The report, written by retired RAAF Air Vice-Marshal John Blackburn, finds that 85 per cent of transport fuel comes from overseas crude oil or imported fuel. . 9 Air Vice-Marshal John Blackburn AO retired from the Royal Australian Air Force in 2008 as the Deputy Chief of the Air Force following a career as an F/A-18 fighter pilot, test pilot and strategic planner. 10 11 Dr. Sadad I. Al Husseini, ex Saudi Aramco Oil and Money Conference, London, October 2007 ...predicts a 10 year plateau a structural ceiling determined by geology Price $/barrel Production M b/day 100 90 80 70 The economic mantra is that as prices rise, production will increase. Clearly not true from these data. 12 Murray and King, January 2012 481 433-435 13 14 Oil prices to double by 2022, IMF paper warns (West Australian May 2012) May 2012 October 2012 IMF study: Peak oil could do serious damage to the global economy Washington Post October 27, 2012 "The modelling is forecasting what can be termed ‘the 2017 drop-off’. The outlook under a base case scenario is for a long decline in oil production to begin in 2017 16 BITRE 117 David Gargett 17 Tuesday 13 July 2010 18 'Peak Oil' and the German Government Military Study Warns of a Potentially Drastic Oil Crisis 1st September 2010 US military warns oil output may dip causing massive shortages by 2015 April 11th 2010 www.csiro.au/resources/FuelForThoughtReport.html 20 US oil peak 1970 mb/d USOil Oil Production Production US 2012 19101910-2011 – 2012 (EIA) (million barrels/day) million barrels / day 10 8 Now 48% self-sufficient ?? 6 4 2 0 1910 1930 1950 US EIA Field Production of Crude Oil MCRFPUS1 1970 1990 2010 21 1,600 US Shale Oil Bonanza or Hype or both ?? 1,400 Sevenfold increase in rigs US Oil Rig Count 1,200 Baker Hughes 1995-June 2013 1,000 800 600 400 200 0 28/10/95 1995 24/7/98 19/4/01 2001 14/1/04 10/10/06 6/7/09 2007 1/4/12 2013 Only 37% increase in production 250,000 200,000 150,000 100,000 50,000 US US monthly monthly oil oil production production EIA EIA 1995-March 1995-March 2013 2013 0 Oct-1995 Apr-2001 Oct-2006 Apr-2012 22 Australian Shale Oil Bonanza or Hype ?? $3.00 Linc Energy Share price to 21st June 2013 $2.50 $2.00 Announcement 23rd January 2013 Arckaringa Basin Coober Pedy $1.50 $1.00 Shale Oil “as big as Saudi Arabia” (103-233 billion barrels) $0.50 $0.00 May0 2012 50 August 100 150 November 200 February 250 June 2013 23 Big fields are found first, and as they decline, they are replaced by smaller and smaller fields soon the additional small fields can not match the decline of the large fields, so the overall production begins its final decline 24 World Discovery Peaked in 1964 Billion barrels of oil per year After Longwell, 2002 60 50 Discovery revisions backdated 3-year moving average Campbell 2012 40 30 20 10 0 1930 1950 1970 1990 2010 2030 25 IEA November 2008 The world is heading for a catastrophic energy crunch that could cripple a global economic recovery because most of the major oil fields in the world have passed their peak production, a leading energy economist has warned. (IEA’s Fatih Birol) The IEA estimates that the average production-weighted observed decline rate worldwide is currently 6.7% pa for fields that have passed their production peak”. 26 2008 Even if oil demand were to remain flat to 2030, 45 m barrels/day of gross capacity -roughly four times the capacity of Saudi Arabia - would be needed just to offset the decline from existing fields 27 A simple observation -- or why peak will be earlier than most people expect Chris Skrebowski Petroleum Review London ‘Global production falls when loss of output from countries in decline exceeds gains in output from those that are expanding.’ Expansion Decline 28 Australia uses 59,000 megalitres of oil each year a 390m cube Sydney Harbour Bridge is 134 m high 70% of Australia’s oil usage is in transport If Australia’s 20 M tpa wheat crop → ethanol ~ 10% 29 Million barrels/ day 2012 BP Statistical Review, 2013 Australia uses 1.0 China 10.2 US 18.6 World 86.2 US 1 cubic km oil / year Australia l China 1 km l United States 30 China – Motor Vehicle Production China kb/day Oil consumption and production 12,000 Consumption 10,000 8,000 Imports 6,000 4,000 Production 2,000 0 1965 1975 1985 From BP Statistical Review 2013 1995 2005 2015 UK kb/day Oil consumption and production 3,000 2,500 2,000 Consumption 1,500 Imports Production 1,000 500 0 1965 1975 1985 From BP Statistical Review 2013 1995 2005 2015 Indonesia kb/day Oil consumption and production 1,800 Consumption 1,600 1,400 Imports 1,200 1,000 Production 800 600 Indonesia left OPEC in 2009 400 200 0 1965 1975 1985 1995 2005 2015 From BP Statistical Review 2013 34 Saudi Arabia kb/d Oil Consumption and Production 14,000 Production 12,000 10,000 8,000 Exports 6,000 Consumption 4,000 2,000 0 1965 1975 1985 1995 2005 2015 From BP Statistical Review 2013 35 USA kb/d Oil consumption and production 20,000 Consumption 15,000 Imports 10,000 Production 5,000 0 1965 1975 1985 1995 2005 2015 From BP Statistical Review 2013 36 Australia Oil consumption and production kb/d Consumption 1,000 800 Imports 600 Production 400 200 0 1965 1975 1985 1995 2005 2015 From BP Statistical Review 2013 37 World Oil Production Forecast ASPO-2013 (Dr Colin Campbell) Gas plant NGL Billion Barrels / year Polar Deepwater (>500m) 30 Heavy and frac. Regular conventional 20 10 2012 0 1950 1970 1990 2010 2030 2050 38 "Anyone who believes exponential growth can go on forever in a finite world is either a madman or an economist." IEA US-EIA Kenneth E. Boulding, economist 1910-1993 "The only function of economic forecasting is to make astrology look respectable" John Kenneth Galbraith 39 www.ASPO-Australia.org.au The nation, individual businesses and individuals face serious oil vulnerability risks, both short-term and long-term The supply chain and logistics sector is of course highly vulnerable. Failure to plan now may prove incredibly costly: a“predictable surprise” An oil vulnerability assessment and risk management plan is an essential first step Hint: Check your superannuation is not being invested into urban toll-roads, tunnels and airports. ASPO-Australia can assist, if needed www.ASPO-Australia.org.au Bruce.Robinson@ASPO-Australia.org.au 0427 398 708 08-9384-7409 Try to separate the hype and mythology from the actual evidence of oil vulnerability risks 40