Transforming Rental Assistance (TRA)

advertisement

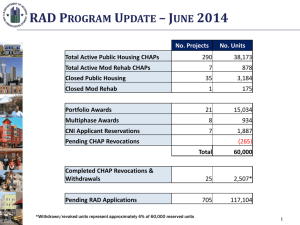

RAD: A New Source of Rental Subsidy September 29, 2013 RAD AUTHORITY Authorized in Consolidated Further Continuing Appropriations Act of 2012 (Public Law 112-55) • Initial program rules outlined in PIH Notice 2012-18 (3/8/12) • Final program rules outlined in PIH Notice 2012-32 (7/26/12) • Revision 1 in PIH Notice 2012-32 REV 1 (7/2/13) Allows public housing and certain at-risk multifamily legacy programs to convert to long-term Section 8 rental assistance • 1st Component, Competitive: Public Housing & Mod Rehab • 2nd Component, Non-competitive: Mod Rehab, Rent Supp, & RAP 2 WHY RAD? Public Housing • Capital repair needs in excess of $25.6B across portfolio, or $23,365/unit • Section 9 funding platform unreliable (pro-rations, cuts), inhibits access to private debt and equity capital (declaration of trust) • Losing 10,000-15,000 hard units/year 3 Billions 2000-12 FUNDING CURVES—SECTION 9 $6 $5 $4 PIH Capital Fund $3 PIH Operating Fund $2 Graph does not include $4billion in 2009 to Cap Fund through ARRA $1 $0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 4 Billions 2000-12 FUNDING CURVES—SECTION 8 $18 $16 $14 $12 $10 PBRA OCAF ~4% per year PBRA TBRA $8 $6 Graph does not include $2billion in 2009 to PBRA through ARRA $4 $2 $0 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 5 RAD PH RENTS—CONVERTING CURRENT FUNDING $900 Sample Public Housing Conversion Per Unit Monthly $800 $700 $600 Operating Fund $330 Housing Assistance Payment $474 $500 $400 Capital Fund $144 $792 $300 $200 $100 Tenant Payment $318 Tenant Payment $318 Pre-Conversion Section 9 ACC Post-Conversion Section 8 HAP At closing, funding is converted to a Section 8 contract rent $6 1ST COMPONENT—OVERVIEW • Public Housing & Mod Rehab • Can compete to convert assistance to: – Project-Based Rental Assistance (PBRA) or – Project-Based Vouchers (PBV) • Cap of 60,000 units (applications must be received by 9/30/2015) • Convert at current funding only • Choice-Mobility, with limited exemptions • Applications are first-come, first-served until cap reached 7 1ST COMPONENT—STATUS 1st Component—As of July 1 • • • • • • 132 CHAP awards—14,781 units 51% converting to PBRA; 49% converting to PBV Over 60% of projects planning to use LIHTCs ~ 45% of deals using FHA insurance [223(f) & 221(d)(4)] Over 60 partnering lenders and investors Leverage ~$815M in debt & equity investments (conservative) 1st Component—Since July 1 • Additional 100+ applications—or +18,000 units 8 RAD 1ST COMPONENT INITIAL AWARDS—GEOGRAPHY Northeast Midwest South West PHAs and Mod Rehab Units Awarded 949 1,279 Total 9,997 2,556 14,781 949 Units 1,279 Units 2,556 Units 9,997 Units 9 PH INITIAL AWARDS—KEY CHARACTERISTICS Capital Needs • 22% New Construction • 78% Rehab ― 24% proposed Greater than $50K in Rehab ― 23% proposed $30K – 50K in Rehab ― 21% proposed $10K – 30K in Rehab ― 32% proposed Less than $10K in Rehab 10 PH INITIAL AWARDS—KEY CHARACTERISTICS PHA Objectives • Modernize aging family & elderly properties • Sub rehab of deteriorated properties • Thin densities/mix-incomes via PBVs & transfer authority • Demolish/replace severely distressed/obsolete properties • Portfolio streamlining 11 KEY CHANGES IN THE RAD NOTICE • Locking in 2012 contract rents for all applications received by 12/31/13 • Allowing a PHA to “bundle” rents to facilitate financing • Allowing MTW agencies rent fungibility 12 KEY CHANGES IN THE RAD NOTICE • Mixed Finance projects Removing unit cap for Mixed Finance projects Allowing financially distressed HOPE VI projects to apply • Exempting awarded projects from the Public Housing Assessment System (PHAS) 13 KEY CHANGES IN THE RAD NOTICE • Eliminating unit caps on: Mod Rehab projects # of units a PHA can convert • Creating new awards for: Portfolio conversions Multi-phase conversion Joint RAD/CNI applicants 14 Aggregated Number of Unit Awards Issued RAD PH AWARDS TREND CHART 160,000 140,000 120,000 Awards-to-Date 100,000 80,000 60,000 Awards Expected Based on Application Trends Awards Expected Based on Current Outreach 40,000 Anticipated Future Awards 20,000 0 15 DEVELOPMENT OPPORTUNITIES • For profit and non-profit Developer Opportunities • First new HAP contracts in over 20 years • Responding to PHA RFP’s for development services • • • • • • Larger PHAs: mixed income developments, etc. Mid-sized PHAs: 250 to 2500 units: Development opportunities not previously available. Resource: HUD website: PHA profiles; PHA mortage amounts based on RAD; RAD Inventory Assessment Tool Conversion of existing mixed finance developments Combining other HUD programs, (Choice Neighborhoods, etc.) with RAD Development of off-site “transfer of assistance” units 16 FINANCING: FHA LIHTC PILOT PROGRAM Streamlined-Enhanced FHA 223(f) & LIHTCs • Rehab expenditures of up to $40,000/unit • Tax credit or Bond Cap allocation in hand • Processed in Multifamily Hubs • Using MAP lenders approved for the Pilot • Goal of 3-4 month turnaround on applications 17 FINANCING: FHA MULTIFAMILY MORTGAGE INSURANCE Section 223(f) • Refinance or acquisition • Minor/moderate repairs ($6,500/unit*high cost factor) • Permanent debt with repair escrow - up to 35 years Section 221(d)(4) • Substantial rehab: 2 major building systems • Construction/permanent debt all in one - initial/final closing • 40-year financing Mortgagee Letter for RAD Transactions issued 10/12 • Eligibility, underwriting criteria, processing & materials 18 FINANCING: LIHTC • TE Bonds and 4% credits • Short bond structure • Higher rents • Lower borrowing rates • HFA support in QAPs for 4% deals: gap funds; scattered sites; pools; preservation set-asides; etc. • 9% credits • New construction • Points for HAP contracts for off-sites 19 RAD WEB PAGE RAD Notice, application materials, and additional resources can be found at www.hud.gov/rad Email questions to radresource.net Sign up at radcapitalmarketplace.com 20 CURRENT RAD LENDERS & INVESTORS Alliant Capital Boston Capital California Community Reinvestment Corporation Centerline Capital Group Community Affordable Housing Equity Corporation Community House Partners Development Corporation Direct Tax Credits, Inc. Enterprise Community Investment Georgia Department of Community Affairs Great Lakes Capital Fund Hudson Housing Capital Hunt Capital Parnters National Equity Fund Newport Partners LLC Ohio Capital Corporation Ohio Capital Housing Corporation PNC Real Estate Prestige Affordable Housing Equity Partners Raymond James Tax Credit Funds Inc. RBC Capital Markets Bellwether Enterprise Real Estate Capital LLC Arbor Commercial Mortgage Capital Fund Services Inc. Beekman Securities Crain Mortgage Group LLC Centerline Mortgage Capital Fifth Third Bank Chase Bank First Citizens Bank NA Columbus Bank and Trust Forest City Capital Corporation Continental Mortgage Corporation Great Lakes Capital Fund Federal Home Loan Bank of Chicago Highland Commercial Mortgage Hunt Capital Partners Lake Forest Bank & Trust Company McCan Communities Lancaster Pollard New Mexico Bank & Trust Love Funding NW Financial Group LLC M&T Rabobank N.A. PNC Real Estate Red Stone Equity Partners Prudential Huntoon Paige Associates LLC SunTrust Bank RBC Capital Markets Housing Finance Group TD Bank US Bank Red Mortgage Capital Red Stone Equity Partners Rockport Mortgage Richmon Group St. James Capital LLC Union Bank US Bank Community Development Corporation Walker Dunlop 21

![RAD PPT Michigan Presentation 5.9.13.ppt[...]](http://s2.studylib.net/store/data/005346357_1-710f69a00abbbbdd4222e30f9215f0c5-300x300.png)