Transforming Rental Assistance (TRA)

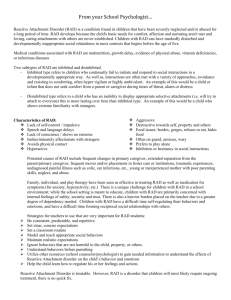

advertisement

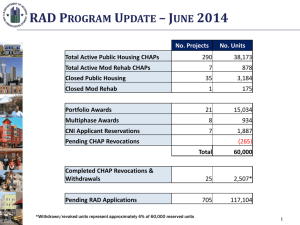

RAD Program Update December 31, 2013 First Component of RAD 2 APPLICATION VOLUME 3 APPS, CHAPS & CLOSINGS PENDING APPLICATIONS CURRENT CHAP AWARDEES CLOSED No. Units PHAs No. Units PHAs No. Units PHAs First Component - PHA 674 84,127 282 322 54,506 158 14 1,287 10 First Component – Mod Rehab 9 974 - 4 559 - 0 0 - Multiphase Awards - 2,576 19 - - - - - - Portfolio Awards - 32,019 64 - - - - - - 683 119,696 282 326 55,065 158 14 1,287 10 TOTAL: GRAND TOTAL (PROJECTS) 1,023 GRAND TOTAL (UNITS) 176,048 GRAND TOTAL (UNIQUE PHAs) 382 Note: This data reflects applications received as of 12/31/13 and CHAPs awarded through 1/6/14. CHAP Awardees includes CNI applicants as well as Portfolio and Multiphase awards made as of 1/6/14. 4 PERCENTAGE OF PUBLIC HOUSING APPLICATIONS BY CENSUS REGION COMPARED TO CURRENT PUBIC HOUSING PROJECTS RAD: 11% PH: 8% RAD:16% PH: 29% RAD: 17% PH: 13% RAD: 56% PH: 49% Note: This data reflects the regional breakdown of RAD applications (“projects”) received compared to the number of existing PH projects in each region. 5 PERCENTAGE OF CURRENT PH UNITS BY HUD REGION THAT HAVE APPLIED FOR RAD 7% 15% 3% 6% 7% 18% 16% 21% 22% 21% Note: This data reflects the percentage of PH units in each HUD region that have applied for RAD; note that units are considered public housing until the RAD closing is complete. 6 RAD PARTICIPANT PROFILE Top 10 Applicants by PHA 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Chicago, IL – El Paso, TX – Nashville, TN Birmingham, AL Baltimore, MD – San Francisco, CA – Charlotte, NC Mobile, AL – Tampa, FL – Greensboro, NC – 10,935 units 6,100 units 5,384 units 5,015 units 4,583 units 4,575 units 3,424 units 3,410 units 3,065 units 2,195 units 7 PROJECT LOCATIONS 8 SIZE OF PHA Note: This data reflects the percentage of unique PHAs that have applied for RAD, by size. 9 PROJECT TYPE 10 SECTION 8 CONVERSION CHOICES BY PROJECT 11 TYPE OF PERMANENT PROJECT FINANCING Type of 1st Mortgage Financing (without Tax Credits) 12 TYPE OF PERMANENT PROJECT FINANCING Type of 1st Mortgage Financing (with Tax Credits) 13 TYPE OF LIHTCS BY PROJECT 14 ADDRESSING RANGE OF CHALLENGES Indicated PHA Objectives • Modernize aging family & elderly properties • Sub rehab of deteriorated properties • Thin densities/mix-incomes via PBVs & transfer authority • Demolish/replace severely distressed/obsolete properties • Portfolio streamlining 15 Second Component of RAD 16 2ND COMPONENT UPDATE Current Status Closed* Not ClosedFunded** Projects Units Projects Units Projects Units Projects Units Projects Units 2 300 5 649 37 4,351 4 280 2 71 0 0 1 25 4 324 2 10 1 51 GRAND TOTAL Projects GRAND TOTAL Units 50 5,651 8 410 Program-Type Mod Rehab RAP SUP SUP - Retro RAP - Retro Not ClosedNot Yet Not Approved Funded*** 1 0 205 0 0 0 0 0 15 0 1,930 0 0 1 0 22 0 0 0 0 16 2,135 1 22 TOTAL 3 505 6 674 56 6,605 7 312 3 122 75 8,218 *Closed = Executed PBV HAP Contract **Not Closed-Funded = TPV funding has been issued as voucher budget authority to the PHA for the PBV contract, owner and PHA are going through final steps before executing HAP ***Not Closed-Not Funded: These projects are approved but won't move forward until TPV funding becomes available 17 RAD 2ND COMPONENT—RS & RAP GEOGRAPHY Highly Concentrated in a Few States WA VA 2% PA 3% 1% Other CA 7% 3% CT 1% IL 6% MA 15% NY 29% MD 4% MI 12% NJ 15% MN 2% 18 2ND COMPONENT OF RAD UPDATE • Remaining Rent Supp and RAP Stock by FY Expiration Total RAP Units: 11,088 Total RS Units: 5,053 19