LHC Mini Meeting 2014

LHC District Meeting

Denim Springs HA

August 19. 2014

Holly Knight, Vice President of Development, BGC

202-699-1998 holly@thebennettgrp.net

Goal of RAD

In order to preserve the public housing stock convert its assistance to the project-based Section 8 platform, which will:

1.

Stabilize funding

2.

3.

4.

Create access to private capital

Streamline HUD programs

Enhance housing options for residents

In order to convert the entire public housing stock,

HUD continues to ask Congress for authority and for funds.

Challenge and tools

CHALLENGE:

• The Public Housing program has remained underfunded for more than 30 years, leading to ~$26 billion capital backlog

• The nation’s Public Housing stock is struggling, and has significant capital repair needs

NEW TOOL:

• Conversion to the project-based Section 8 programs provides an opportunity to invest billions into the public housing stock

• The Rental Assistance Demonstration (RAD) allows PHAs to undertake this conversion for some units

• HUD has achieved its goal of standing up this new tool, attracting many PHAs to participate

• Only 60,000 units are currently able to convert; lifting cap will make the RAD tool available to all PHAs who want to use it.

Lift the RAD Cap Coalition: website with resources

Early RAD conversations

•

•

•

•

•

•

•

“RAD will only work for public housing projects with low needs”

“RAD is for PHAs in strong markets.”

“RAD is for small PHAs”

“Everyone will convert to PBRA”

“Everyone will convert to PBV”

“RAD only works with 9% Low Income Housing Tax Credits and there’s not enough to go around”

“RAD will only work with FHA mortgage insurance – 99% of these transactions will go FHA”

• “RAD won’t work”

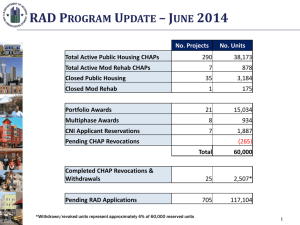

P ERCENTAGE OF C URRENT PH U NITS BY HUD R EGION THAT HAVE

A PPLIED FOR RAD

7% 3% 15% 6%

7%

18%

16%

21%

22%

21%

Note: This data reflects the percentage of PH units in each HUD region that have applied for RAD; note that units are considered public housing until the RAD closing is complete.

5

Whole Portfolio Conversions

• 76% of the PHAs with CHAP awards have proposed to convert their entire stock,

•

•

• including

52 small PHA (<250 units)

29 medium PHA (250-1,250 units)

26 large PHAs (>1,250 units)

RAD Helping PHAs Address Challenges

Indicated PHA Objectives

• Complete repairs – range of moderate repairs, substantial rehab and New Construction

• ~ 20% of projects planning Demolition and New Construction (on site or off site)

• Average repair hard costs of ~ $45,000 per unit ($25,000 per unit excluding new construction)

• Place mixed-finance properties on solid financial footing for long term (~ 15% of projects)

• Thin densities/mix-incomes via transfer of assistance

• Streamline programs

Reviewing Applications on the Waitlist

• Secretary Donovan letter 2/20 confirms HUD will review the

~ 685 applications above the 60,000 unit cap

•

•

Instruction from Secretary:

Review applications and prepare conditional approvals.

• Next two weeks conditional CHAPs to be issued

• When cap is lifted, HUD will issue CHAPs to all approved applications and process in order of the waiting list.

• HUD will use the RAD Notice for these projects but will use

FY14 funding levels to calculate the rents.

RAD Update

HUD has asked for RAD cap to be lifted in 2015 budget

RAD Application by

RAD Application update

Application Overall Sources of Funding

RAD Application tax credits

Operating Subsidy Funding

OFND Annual Amount

$6 000 000 000

$5 031 106 183

$5 000 000 000

$4 900 000 000 $4 921 341 060

$4 594 294 060 $4 611 918 201

$4 149 983 999

$4 000 000 000

$3 000 000 000

$2 000 000 000

$1 000 000 000

$-

89.20

%

2014

82%

2013

94.968% 100%

2012 2011

OFND Annual Amount (U.S.) Proration

103%

2010

88.42%

2009

Capital Fund Capital Funding Trends

2,5E+09

$2 341 258 000 $2 365 835 000

2E+09

$1 910 035 000

$1 790 000 000 $1 800 000 000

$1 696 372 000

1,5E+09

1E+09

500000000

0

2009 2010 2011 2012 2013 2014

1 2 3 4 5 6

PH Development Resources

Note: Not listed PHA PBV at FMR, PHA Cost Center Funds, Admin Fees

What is the future?

• Losing affordable housing

• $26 Billion capital investment need

• Unpredictable and insufficient funds

• Limited investments in public housing

• Aging housing stock: average PH is 43 years old

• Marketability and curb appeal

• Rules and regulations increasing

• Under performing PHAs and consolidation

• Funding trends decreasing

• HUDs program consolidation goals

Sample Public Housing Conversion

Per Unit Monthly (PUM) – Same funding

$900

$800

$700

$600

Operating Fund

$200

Operating Fund

$330

2013 Funding

$164

$500

2013 Funding

$400

$95

$300

$200

Tenant Payment

$150

T enant Payment

$318

$100

$-

Pre-Conversion

Housing Assistance

Payment

Assistance

Payment

$474

Tenant Payment

T

$150

$318

Post-Conversion

PH Options

Why RAD

Builds on a more stable funding platform

Lock in funding

Better than Capital Fund Finance, Leveraged Op Sub, or EPC

Leverage private capital to address physical needs and preserve your units

Leverage 4% LIHTC get 30% project equity

Leverage 9% LIHTC get 60+% project equity

Leverage developer fees, seller take back finance, ground lease

Apply for grants HOME, Federal Home Loan Bank

Provides a great deal of regulatory and reporting relief

Saves in reporting to HUD, policies, and oversight more with board and PHA

Why RAD

Procurement with developer partner is simplified

Expenses

Gives real estate opportunities

Can move HAP contract as needed

Can move out of flood zones/hazard zones/undesirable areas

Can use non federal funds to purchase properties or land

Benefits of partnering for expiring LIHTC, Home projects,

HUD Multifamily developments

Best and highest use of assets

Feasibility, Marketability, and Sustainability

RAD flexibility

Transfer assistance from unworkable units prior to conversion

Market accommodations in meeting 1-for-1 preservation

(e.g., convert efficiencies to 1 bdrms; long-term vacant units)

Combine RAD & agency PBVs or SAC TPVs>PBVs

Flexibility to reduce densities, replace housing off-site, produce mixed income communities

Allows PHA to undertake renovations immediately or after conversion, as warranted

Demolition/New Construction allowed

Ability to “bundle” project applications for flexibility with initial contract rents

Backlog of Capital Needs

Capital repair needs of $23,365 per unit

Needs at your PHA

Roof - $8,000

3 Bedroom 504 Compliance $25-35,000

ADA Site compliance $10-15,000

HVAC replacement -$4,000

Water Heater - $350

Site Soil Erosion- $20,000

Appliances –Range $450 / Fridge $550

Show the PHA the Money

• The RAD options:

• Modest rehab with no debt

• Modest rehab with debt only

• Moderate rehab with debt and 4% LIHTCs

• Major rehab or replacement with debt and 9% LIHTCs

• These are funding sources that are not conveniently available to small PHAs

• A conversion of all LIPH units eliminates the HUD requirements for:

• Procurement

• Annual and Five‐ Year Plans

• PHAS

• REAC (if…PBV)

• You Get to Keep the Money – no offsets, developer fees, seller take back financing, cash flow options

What can RAD do now?

15-20 year, renewable contracts with use agreement

Predictable initial contract rent setting; annual operating cost adjustments for inflation (OCAF)

Established replacement and operating reserves; standard industry underwriting requirements

RAD HAP funding begins at construction closing

No limitations on use of project cash flow

PHA ownership/control similar to LIHTC practices

Long-term affordability ensured

RAD Similar and Different to mixed finance

• Similarities:

Real Estate Transaction same

Rent/Income

Reporting to 3 rd parties

Physical needs assessment is a driver

• Differences:

PHAs want to self manage

RAD PCNA tool

Complicated HUD regulations

Lower Income to project

Expenses higher may need to be adjusted

Type of 3 rd party reporting HUD versus Investor

• Benefits of PHA Partner

Invested in community

Familiar with social services

Knows the community partners

Has managed PH inventory on shoestring budget

Familiar with compliance

RAD Transaction Concerns

• Timing

• Tax credit compliance versus HUD compliance

• Rent calculation and income qualification

• Boards and their role changes

• Limited knowledge of mixed finance

• Management

• Ownership changes impact pilot and taxes

• Investors and HFA unfamiliar with PHAs

• RAD rents are low

• HUD conversion requirements

• PBV/PBRA

• PHA Plan

• Site and neighborhood

• Elderly designation

• Environmental

• Relocation (URA)

• Affirmatively Furthering Fair Housing

Change