Why RAD? - Mississippi Home Corporation

advertisement

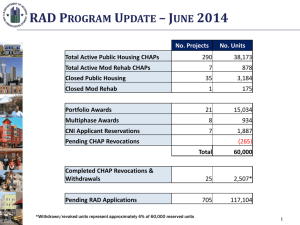

WHY RAD? Mississippi Home Conference Biloxi, MS February 20, 2013 Gregory A. Byrne Senior Program Manager HUD Gregory.A.Byrne@hud.gov RAD AUTHORITY • Authorized as part of the Consolidated Further Continuing Appropriations Act of 2012 (Public Law 112-55) • Allows public housing and certain at-risk Multifamily legacy programs to convert to long-term Section 8 rental assistance • Two components – Competitive – cap of 60,000 units (public housing and Mod Rehab) – Non-competitive – no cap but subject to availability of tenant protection vouchers (Mod Rehab, Rent Supplement and Rental Assistance (RAP) programs) 2 RAD CONVERSION AUTHORITY Public Housing Mod Rehab No Cap , but subject to availability of TPVs Cap of 60,000 Units PBRA RS & RAP PBV PBV 3 THIS IS RAD $900 Sample Public Housing Conversion Per Unit Monthly $800 $700 $600 Operating Fund $330 Housing Assistance Payment $474 $500 $400 Capital Fund $144 $792 At closing, funding is converted to a Section 8 contract rent $300 $200 $100 Tenant Payment $318 Tenant Payment $318 Pre-Conversion Post-Conversion $ACC Section 8 4 EXAMPLE Milwood I Mixed-Finance Project (McComb, MS) First phase of a redevelopment of an existing public housing project, involving demolition and new construction 10 project-based vouchers (with tax credits) 16 public housing units (with tax credits) 26 total units 13 duplexes PBV contract rents average $621 Public housing contract rents average $325 2/2/2012 5 DEVELOPMENT BUDGET – ORIGINAL Sources Capital Fund Financing Program (CFFP) Loan Tax Credit Equity FHLB AHP Funds Deferred Developer Fee Total $595,000 $3,925,486 $182,000 $90,658 $4,793,144 Uses Construction Costs Soft Costs Soft/CFFP Loan Total 2/2/2012 $3,045,000 $1,653,144 $95,000 $4,793,144 6 PRO-FORMA – ORIGINAL Annual PUM Revenues Section 8 Rents $74,496 $239 Public Housing Rents $62,367 $200 $1,800 $6 $(6,843) ($22) $131,820 $423 $101,191 $324 $7800 $25 Total $108,991 $349 NOI $22,829 $73 ($0) ($0) $22,829 $73 Other Vacancy loss Effective Gross Income Expenses Operating Expense Replacement Reserves Debt Service Cash Flow 2/2/2012 7 WHAT IF? • The public housing units were assigned the RAD rents of approximately $500 PUM • First mortgage terms were as follows: • • • • 2/2/2012 Amortization period = 30 years Rate = 3.5% Mortgage Insurance Premium = 0.45% Debt coverage ratio = 1.20 8 PRO-FORMA – REVISED Annual PUM Revenues Section 8 Rents $74,496 $239 Public Housing Rents $96,000 $308 $1,800 $6 ($8,525) ($27) $163,771 $526 $101,191 $324 $7800 $25 Total $108,991 $349 NOI $54,780 $176 ($45,650) ($146) $9,130 $29 Other Vacancy loss Effective Gross Income Expenses Operating Expense Replacement Reserves Debt Service Cash Flow 2/2/2012 9 MAGIC With the RAD rents, the project is able to generate in excess of $800,000 in first mortgage proceeds, which would have eliminated the need for the PHA to contribute CFFP funds. 2/2/2012 10 RAD WEB PAGE RAD Notice, application materials, and additional resources can be found at www.hud.gov/rad Email questions to radresource.net 11

![RAD Inventory Assessment Tool for PHAs.d[...]](http://s3.studylib.net/store/data/009534164_1-662cb19c4d031e223487dfa771763564-300x300.png)