“RAD” Program - Housing Alliance of Pennsylvania

advertisement

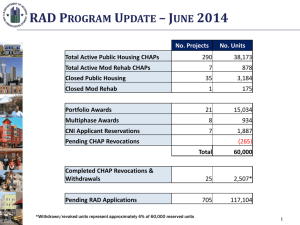

Rental Assistance Demonstration “RAD” Program Homes Within Reach November18, 2014 Martin Walsh Reno & Cavanaugh, PLLC 1 RAD Overview • Goal: Preserve vulnerable federally-assisted projects by converting existing subsidies to long-term Section 8 to leverage debt/equity • Premise: Converting Public Housing Units to RAD (HAP) contract (PBRA or PBV)– allowing PHA to finance property without Mixed Finance Process • Authority: (1) FY 2012 HUD Appropriations Act (2) Notice PIH 2012-32, REV-1 (July 2, 2013) • 1st Component: Public Housing & Mod Rehab: • 60,000 Unit Cap • No cost conversions (but 2012 rents for some) • 2nd Component: Mod Rehab, Rent Supp & RAP: • Non-Competitive • No Unit Cap, but subject to availability of Tenant Protection Vouchers (TPVs) 2 Deal Structure Options 3 RAD Deal Prototypes 1. Conversion/No Rehab (includes conversion-only HUD mixed-finance transactions) 2. FHA/No LIHTC; Basic Rehab/Conversion 3. 4% LIHTC/Bond/FHA; Substantial Rehab/Conversion 4. 4% LIHTC/Bond/Private Financing; Substantial Rehab/Conversion 5. 9% LIHTC/FHA or Private; Substantial Rehab/Conversion or New Construction 4 Sample Deals 5 9% LIHTC/Conventional Debt • CHAP on 100-unit public housing development; divided redevelopment into two phases • Demolished existing project • On-site New construction; de minimis reduction in unit count • Phase 1: 55 unit development, of which 44 are RAD units and remaining market rate • Funding: LIHTC equity, construction loan, private perm debt, and PHA subordinate loan • PHA could increase rents with MTW authority • Phase 2: 51 unit development (all RAD units) 6 9% LIHTC/No Perm Debt • CHAP on 50-unit public housing development • Converted to 40 RAD units with de minimis unit reduction and reconfiguration of units (fewer larger units) • Gut rehab of existing project • Funding: LIHTC equity, construction loan, no perm debt, and FHLB AHP 7 FHA/RAD/4% LIHTC • Substantial Rehab of 100- Unit Family Development • Self-Developed by Housing Authority • Financing: Tax Exempt Bonds with FHA 221(d)(4) Mortgage Insurance, 4% LIHTC equity, HA Capital and RHF Funds, HOME Funds • Challenging to coordinate FHA and RAD processes – although this was an early RAD deal and HUD now has a streamlined process (FHA submission includes RAD docs) 8 RAD In Practice –Issues • RAD requirements can conflict with LIHTC program income limits (e.g. existing PH resident > 60% AMI) • Creative Financing Plans - mortgagees for RAD properties must be paid from project income • Relocation – pairing URA with RAD relocation req’ts • • See RAD Relocation Notice PIH 2014-17 (H 2014-09), July 14, 2014 Prior to Closing – Must be HUD approved • Demolition/Disposition 1:1 replacement requirements • • Asking HUD for flexibility to allow de minimis reductions Demolition prior to closing – difficult to obtain HUD approval • Duel Tracking – pursuing redevelopment while on the RAD waiting list • • Concerns with losing LIHTC allocations Mixed Finance as a pathway to RAD – being discussed for RAD waitlisted deals that have 9% LIHTC allocations but not formalized yet 9