Forward-looking statement

advertisement

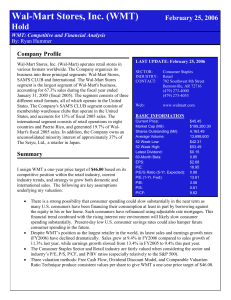

Wal-Mart Stores, Inc. (NYSE: WMT) Charles Holley Executive Vice President & CFO Bank of America Merrill Lynch Consumer & Retail Conference March 11, 2014 1 Wal-Mart Stores, Inc. (NYSE: WMT) Forward-looking statement Walmart includes the following cautionary statement so that any forward-looking statements made by, or on behalf of, Walmart will enjoy the safe harbor protection of the PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995, as amended. Such forward-looking statements, which will describe our objectives, plans, goals, targets or expectations, can be identified by their use of words or phrases such as “anticipate,” “estimate,” “expect,” “forecast,” “plan,” “projected,” “will be” or words or phrases of similar import. Statements of our expectations for FY15, and any subsequent fiscal years are forward-looking. Walmart’s actual results might differ materially from those expressed or implied in a forward-looking statement as a result of factors including, among others, recessionary economic environment, cost of goods, competitive pressures, availability of credit, geopolitical conditions and events, labor and healthcare costs, inflation, deflation, consumer spending patterns, debt levels and credit access, currency exchange fluctuations, trade restrictions, tariff and freight rate changes, fluctuations in fuel, other energy, transportation and utility costs, health care and other insurance costs, accident costs, interest rate fluctuations, other capital market conditions, weather conditions, storm-related damage to facilities, customer traffic, factors limiting our ability to construct, expand or relocate stores, regulatory matters and other risks set forth in our SEC filings. Our most recent Annual Report on Form 10-K and our other filings with the SEC contain more information concerning factors that, along with changes in facts, assumptions not being realized or other circumstances, could cause actual results to differ materially from those expressed or implied in a forward-looking statement. Walmart undertakes no obligation to update any forward-looking statement to reflect subsequent events. 2 Wal-Mart Stores, Inc. (NYSE: WMT) FY 14 underlying consolidated results Continued op inc growth 5-yr. CAGR: 4.1% $B $27.7 $27.8 $26.6 $25.5 $24.0 Strong sales growth 5-yr. CAGR: 3.4% $B $466 $473 FY10 Returned value (EPS) 5-yr. CAGR: 8.8% FY11 FY12 FY13 FY14 FY13 FY14 $4.18 $419 $405 3 $5.11 $4.54 $444 FY10 $5.01 $3.73 FY11 FY12 FY13 FY14 Wal-Mart Stores, Inc. (NYSE: WMT) FY10 FY11 FY12 FY 14 guidance vs. report card Financial priorities Metrics FY 14 guidance Sales growth 2 - 3%* 1.6% Square footage growth 3 - 4% 3% Operating expense < sales 2.0% vs. 1.6% X Operating income growth > sales 0.2% vs. 1.6% X Free cash flow Strong Strong FY 14 actual Report card X Growth Leverage Returns *Revised FY 14 Q2 earnings call Aug. 15, 2013 4 Wal-Mart Stores, Inc. (NYSE: WMT) Walmart U.S. delivered a strong FY 14 Net sales ~$279.4B Increase of 2% or $5B Operating expenses 18 bps of leverage 4 consecutive years 5 Wal-Mart Stores, Inc. (NYSE: WMT) Price investment Gross profit rate -1 bps Operating income ~$22.4B Increase of 4% or $860M Grew profit faster than sales Sam’s Club increased membership income in FY 14 Price investment Net sales ~$50.6B Increase of 1.6% or $785M Membership income Gross profit rate -1 bps 5.9% Operating expenses 14 bps of deleverage Note: All data is without fuel 6 Wal-Mart Stores, Inc. (NYSE: WMT) Operating income ~$2.0B Increase of 5.0% Grew profit faster than sales Walmart International invested in price in FY 14 Net sales ~$136.5B Increase of 1.3% or $1.8B Operating expenses 18 bps of deleverage 7 Wal-Mart Stores, Inc. (NYSE: WMT) Price investment Gross profit rate -10 bps Operating income ~$6.3B decrease of 4.7% FY 15 guidance Financial priorities Metrics FY 15 guidance* Updated FY 15 guidance** Sales growth 3 - 5% At low end Square footage growth 33 - 37M sq. ft. 35 - 39M sq. ft. Operating expense < sales < sales Operating income growth > sales May not grow faster, or at the same rate as sales Free cash flow Strong Strong Growth Leverage Returns *October 15, 2013 **February 20, 2014 8 Wal-Mart Stores, Inc. (NYSE: WMT) Keys to Walmart’s success in FY 15 Continue strong financial position Strengthen global compliance & ethics model Drive EDLC & EDLP Develop associate talent Increase comp sales Grow e-commerce & m-commerce 9 Wal-Mart Stores, Inc. (NYSE: WMT) Walmart U.S. FY 15 agenda Priorities Increase comp sales Small format acceleration E-commerce Product and brand innovation Drive productivity Headwinds Bottom 10% Inconsistent execution 10 Wal-Mart Stores, Inc. (NYSE: WMT) Deflation Weather Macroeconomic headwinds Sam’s Club FY 15 agenda Priorities Merchandise differentiation Increase member access/e-commerce Enhance member experience Personalize with Big Data Headwinds Small business challenges 11 Deflation Wal-Mart Stores, Inc. (NYSE: WMT) Weather Macroeconomic headwinds International FY 15 agenda Priorities Increase comp sales in each market Invest in price Drive productivity loop Improve capital discipline Headwinds Macroeconomic headwinds 12 Extending credit Wal-Mart Stores, Inc. (NYSE: WMT) Wholesale formats Key market challenges Global Ecommerce FY 15 agenda Priorities • Continue incremental investments • Add strategic acquisitions • Launch Pangaea • walmart.com enhancements • Increase fulfillment capabilities • Drive greater sales in 4 key markets – Launch, expand others 13 Wal-Mart Stores, Inc. (NYSE: WMT) Driving innovation to combine physical & digital Walmart’s full assortment Supercenter walmart.com GM & fresh Endless aisle Express Convenient mix of assortment & services 14 Wal-Mart Stores, Inc. (NYSE: WMT) Leveraging global best practices Accelerated roll-out of Walmart U.S. small stores Total Neighborhood Market & Walmart Express Total units by year FY 11 – FY 15 Up to ~645 Up to 120 +320% ◄Walmart Express growth in 4 years 20 ~500 to 525 13 10 153 168 FY11 FY12 ◄Neighborhood Market 346 241 FY13 FY14 FY15 Expansive growth to continue in the next 3 years Based on fiscal year -end unit counts 15 Wal-Mart Stores, Inc. (NYSE: WMT) Capital expenditure detail (US$ billions) Actual FY14 FY 15 guidance* Updated FY 15 guidance** Walmart U.S. $6.4 $5.8 - $6.3 $6.4 - $6.9 Sam’s Club $1.1 $1.0 $1.0 Walmart International $4.4 $4.0 - $4.5 $4.0 - $4.5 Corporate and Support $1.2 $1.0 $1.0 $13.1 $11.8 - $12.8 $12.4 - $13.4 Segment Total Additional $600M in Walmart U.S. small store growth *October 15, 2013 **February 20, 2014 16 Wal-Mart Stores, Inc. (NYSE: WMT) Disciplined capital allocation drives efficiency 1. Grow the business o Cash from operations Organic growth • Stores • e-commerce • Leverage o Acquisitions 2. Dividends 3. Share repurchases AA-rated Balance Sheet 17 Wal-Mart Stores, Inc. (NYSE: WMT) Capital allocation priorities FY 14 Sources of cash & Uses of cash $12.8 Cash flow from operations FY 15 E Share repurchases Cash flow & dividends from operations $26.3 net debt growth Uses of cash Excess cash Share repurchases, dividends & acquisitions & $13.1 AA rated balance sheet *Not drawn to scale 18 Sources of cash* Wal-Mart Stores, Inc. (NYSE: WMT) CapEx net debt growth $12.4 $13.4 AA rated balance sheet CapEx Lead on issues important to Walmart customers Sustainability Associate opportunity - Veterans Community giving 19 Wal-Mart Stores, Inc. (NYSE: WMT) Women’s economic empowerment U.S. manufacturing - Suppliers Healthy eating/nutrition Key takeaways for Walmart this year Grow comp sales Drive operational efficiencies, productivity Deliver disciplined capital allocation Continue investing in Global eCommerce Deliver strong shareholder returns 20 Wal-Mart Stores, Inc. (NYSE: WMT) Q&A 21 Wal-Mart Stores, Inc. (NYSE: WMT) Q&A 22 Wal-Mart Stores, Inc. (NYSE: WMT) Appendix 23 Wal-Mart Stores, Inc. (NYSE: WMT) Underlying EPS The underlying diluted earnings per share from continuing operations attributable to Walmart (“Underlying EPS”) for the three months and the fiscal year ended Jan. 31, 2014 is considered a non-GAAP financial measure under the SEC’s rules because the Underlying EPS for each such period includes certain amounts not included in the diluted earning per share from continuing operations attributable to Walmart calculated in accordance with GAAP (“EPS”) for the three months and the fiscal year ended Jan. 31, 2014. Management believes that the Underlying EPS for the three months and the fiscal year ended Jan. 31, 2014 is a meaningful metric to share with investors because that metric, which adjusts EPS for each of such periods for certain items recorded in the three months and fiscal year ended Jan. 31, 2013, respectively. In addition, the metric affords investors a view of what management considers Walmart’s core earnings performance for the three months and the fiscal year ended Jan. 31, 2014 and also affords investors the ability to make a more informed assessment of such core earnings performance for each of such periods when compared to Walmart’s earnings performance for the three months and the fiscal year ended Jan. 31, 2013 respectively. We have calculated the Underlying EPS for the three months and the fiscal year ended Jan. 31, 2014 by adjusting the EPS for each period for the amount of the dilutive impact of (1) Brazil non-income tax contingencies (“Brazil Taxes”); (2) Brazil employment claim contingencies (“Brazil Employment Matters”); (3) the closure of 54 underperforming Brazil and China stores (“Store Closures”); (4) China store lease expense charges (“Lease Matters”); (5) the India transaction (“India Transaction”); and (6) Sam’s Club U.S. staff restructuring and club closure (“Sam’s Restructuring”). 24 Wal-Mart Stores, Inc. (NYSE: WMT) Underlying EPS impacts Fiscal Year Ended January 31, 2014 Diluted net income per common share: Underlying EPS $5.11 Adjustments to underlying EPS Brazil taxes (0.06) Brazil employment matters (0.05) Store closures (0.06) Lease matters (0.03) India transaction (0.05) Sam’s restructuring (0.01) Total impact (0.26) EPS 25 Wal-Mart Stores, Inc. (NYSE: WMT) $4.85 Underlying performance FY14 Q4 D D FY’14 D D Wal-Mart, Inc. Operating expenses percent to sales 18.23% n/a 2bps 19.12% n/a 8bps Operating income $8,258 ($322) (3.8%) $27,783 $58 0.2% Income from continuing operations $5,408 ($455) (7.8%) $17,415 ($289) (1.6%) Diluted EPS $1.60 ($0.7) (4.2%) $5.11 $0.10 0.2% Walmart International Operating expenses percent to sales 18.35% n/a 11bps 19.42% n/a 18bps Operating income $2,162 ($254) (10.5%) $6,306 ($311) (4.7%) Diluted EPS $1.60 ($0.7) (4.2%) $5.11 $0.10 0.2% Sam’s Club Operating expenses percent to sales 11.84% n/a 46bps 11.75% n/a 14bps Operating income $471 ($18) (3.7%) $2,008 $95 5.0% Diluted EPS $1.60 (4.2%) $5.11 $0.10 0.2% 26 ($0.7) Wal-Mart Stores, Inc. (NYSE: WMT)