Wal-Mart Stores, Inc - Fisher College of Business

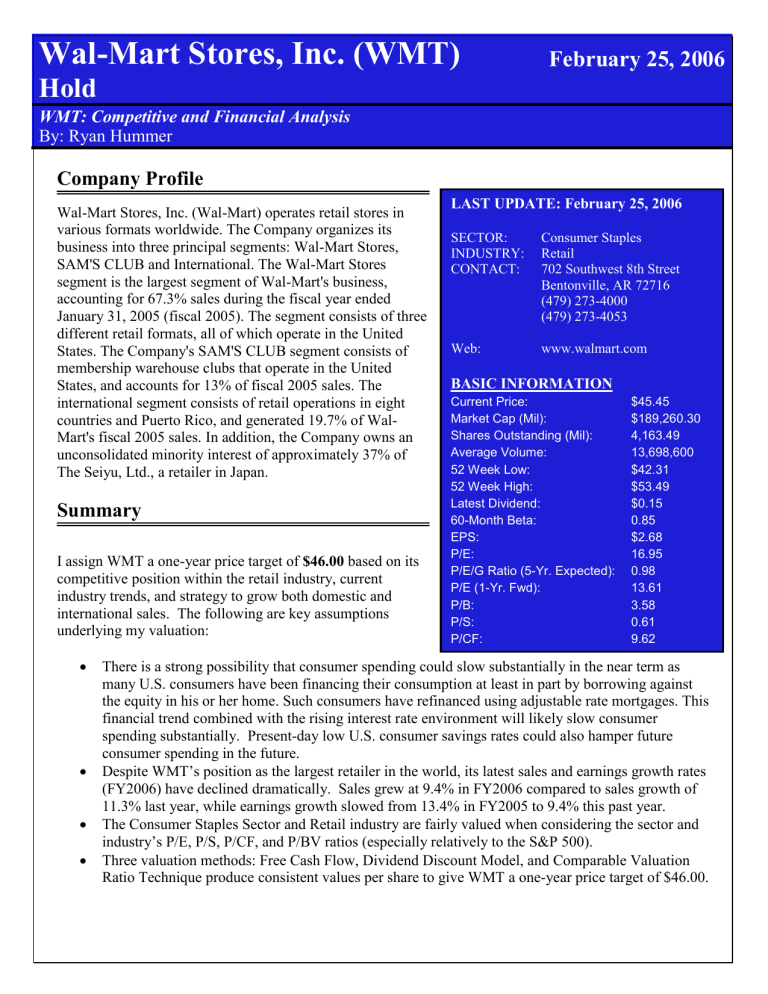

Wal-Mart Stores, Inc. (WMT)

Hold

February 25, 2006

WMT: Competitive and Financial Analysis

By: Ryan Hummer

Company Profile

SAM'S CLUB and International. The Wal-Mart Stores segment is the largest segment of Wal-Mart's business, accounting for 67.3% sales during the fiscal year ended

January 31, 2005 (fiscal 2005). The segment consists of three different retail formats, all of which operate in the United

States. The Company's SAM'S CLUB segment consists of

LAST UPDATE: February 25, 2006

Wal-Mart Stores, Inc. (Wal-Mart) operates retail stores in various formats worldwide. The Company organizes its business into three principal segments: Wal-Mart Stores,

SECTOR: Consumer Staples

INDUSTRY: Retail

CONTACT: 702 Southwest 8th Street

Bentonville, AR 72716

(479) 273-4000

(479) 273-4053

Web: www.walmart.com membership warehouse clubs that operate in the United

States, and accounts for 13% of fiscal 2005 sales. The international segment consists of retail operations in eight

BASIC INFORMATION

Current Price: $45.45 countries and Puerto Rico, and generated 19.7% of Wal-

Mart's fiscal 2005 sales. In addition, the Company owns an

Market Cap (Mil):

Shares Outstanding (Mil):

$189,260.30

4,163.49 unconsolidated minority interest of approximately 37% of

The Seiyu, Ltd., a retailer in Japan.

Average Volume:

52 Week Low:

13,698,600

$42.31

52 Week High: $53.49

Summary

Latest Dividend:

60-Month Beta:

EPS:

$0.15

0.85

$2.68

I assign WMT a one-year price target of $46.00

based on its competitive position within the retail industry, current

P/E: 16.95

P/E/G Ratio (5-Yr. Expected): 0.98 industry trends, and strategy to grow both domestic and international sales. The following are key assumptions

P/E (1-Yr. Fwd):

P/B:

13.61

3.58 underlying my valuation:

P/S:

P/CF:

0.61

9.62

There is a strong possibility that consumer spending could slow substantially in the near term as many U.S. consumers have been financing their consumption at least in part by borrowing against the equity in his or her home. Such consumers have refinanced using adjustable rate mortgages. This financial trend combined with the rising interest rate environment will likely slow consumer spending substantially. Present-day low U.S. consumer savings rates could also hamper future consumer spending in the future.

Despite WMT’s position as the largest retailer in the world, its latest sales and earnings growth rates

(FY2006) have declined dramatically. Sales grew at 9.4% in FY2006 compared to sales growth of

11.3% last year, while earnings growth slowed from 13.4% in FY2005 to 9.4% this past year.

The Consumer Staples Sector and Retail industry are fairly valued when considering the sector and industry’s P/E, P/S, P/CF, and P/BV ratios (especially relatively to the S&P 500).

Three valuation methods: Free Cash Flow, Dividend Discount Model, and Comparable Valuation

Ratio Technique produce consistent values per share to give WMT a one-year price target of $46.00.

Company Overview

Introduction

As of January 31, 2005, WMT operated 1,353 Discount Stores, 1,713 Supercenters, 551 SAM’S CLUBs and 85 Neighborhood Markets in the United States. As of January 31, 2005, the Company operated units in

Argentina (11), Brazil (149), Canada (262), Germany (91), South Korea (16), Mexico (679), Puerto Rico

(54) and the United Kingdom (282). WMT also operated 43 stores through joint ventures in China as of

January 31, 2005. Additionally, WMT recently acquired Seiyu which operates approximately 403 stores throughout Japan and has contributed to WMT’s growing Asian presence. Much of the Company’s international growth in recent years has been due to acquisitions of existing operations in various countries.

The three most notable acquisitions include: 1) the Company’s December 2002 purchase of Supermercados

Amigo, Inc. (“Amigo”), a supermarket chain located in Puerto Rico with 37 supermarkets at the time of the acquisition; 2) the Company’s February 2004 purchase of Bompreço S.A. Supermercados do Nordeste

(“Bompreço”), a supermarket chain in northern Brazil with 118 hypermarkets, supermarkets and minimarkets; and as previously mentioned, Company’s FY2005 acquisition of a 50% stake in Seiyu, a Japanese

Retailer with over 403 stores throughout Japan.

As of January 31, 2005, the Company employed approximately 1.7 million Associates worldwide, with approximately 1.3 million Associates in the United States and approximately 410,000 Associates in foreign countries.

Industry Segments

1

WMT is organized into three operating segments: Wal-Mart Stores, SAM’S CLUB, and International. The

Wal-Mart Stores segment includes Discount Stores, Supercenters and Neighborhood Markets in the United

States as well as Walmart.com. The SAM’S CLUB segment includes the warehouse membership clubs in the United States as well as samsclub.com. The International segment consists of operations in Argentina,

Brazil, Canada, China, Germany, Mexico, Puerto Rico, South Korea and the United Kingdom.

Each operating segments’ business is somewhat seasonal. Generally, the highest volume of sales occurs in the fourth fiscal quarter, which includes the holiday season, and the lowest volume occurs during the first fiscal quarter.

Wal-Mart Stores Segment

The Wal-Mart Stores segment had net sales of $191.8 billion, $174.2 billion and $157.1 billion for the fiscal years ended January 31, 2005, 2004, and 2003, respectively. The sales revenue is well diversified throughout the country as no single Discount Store, Supercenter or Neighborhood Market location accounted for as much as 1% of total Company sales or net income during the most recent fiscal year.

1 Wal-Mart Stores, Inc. FY2005 10-K

2

Wal-Mart Discount Stores operate in all 50 states, Supercenters in 45 states and Neighborhood Markets in

14 states. The Discount Stores range in size from 30,000 square feet to 220,000 square feet, with the average size of a Discount Store at approximately 100,000 square feet. Supercenters range in size from

100,000 square feet to 261,000 square feet, with the average size of a Supercenter falling at approximately

187,000 square feet. Neighborhood Markets range in size from 38,000 square feet to 55,000 square feet, with the average size being approximately 43,000 square feet.

Wal-Mart Discount Stores and the general merchandise area of Supercenters carry apparel for women, girls, men, boys and infants, domestics, fabrics and notions, stationery and books, shoes, housewares, hardware, electronics, home furnishings, small appliances, automotive accessories, horticulture and accessories, sporting goods, toys, pet food and pet accessories, cameras and supplies, health and beauty aids, pharmaceuticals, jewelry and optical and provide photo processing services. In addition, WMT’s stores offer an assortment of grocery merchandise. The grocery assortment in the Supercenters consists of a full line of grocery items including meat, produce, deli, bakery, dairy, frozen foods and dry grocery. Most of the

Discount Stores carry a limited assortment of dry grocery merchandise while a number of the larger

Discount Stores in some markets carry a broader assortment of grocery items, including perishable items.

Neighborhood Markets are generally organized into departments such as: dry grocery, meat, produce, deli, bakery, dairy, frozen foods, pharmaceuticals, photo processing, health and beauty aids, household chemicals, paper goods, general merchandise and pet supplies.

Nationally advertised merchandise accounts for a significant portion of sales in the Wal-Mart Stores segment. WMT also market lines of merchandise under private-label store brands including “Sam’s

Choice,” “One Source,” “Great Value,” “Everstart,” “Everactive,” “Ol’ Roy,” “Puritan,” “Equate,” “No

Boundaries,” “George,” “Athletic Works” and “Kid Connection.” The Company also markets lines of merchandise under licensed brands, some of which include “Faded Glory,” “General Electric,” “Disney,”

“Catalina,” “McDonald’s,” “Mary-Kate and Ashley” and “Starter.”

During the fiscal year ended January 31, 2005, sales in Discount Stores and Supercenters (which are subject to seasonal variance) by product category were as follows:

CATEGORY

Grocery, candy and tobacco

Hardgoods

Softgoods and domestics

Pharmaceuticals

Electronics

Health and beauty aids

Sporting goods and toys

Stationery and books

Photo processing

Jewelry

Shoes

PERCENTAGE

OF SALES

28 %

19 %

16 %

9 %

9 %

7 %

6 %

3 %

1 %

1 %

1 %

100 %

3

SAM’S CLUB Segment

The SAM’S CLUB segment had net sales of $37.1 billion, $34.5 billion and $31.7 billion for the fiscal years ended January 31, 2005, 2004 and 2003, respectively. The SAM’s Club segment is also well diversified as no single club location accounted for as much as 1% of total Company sales or net income during the most recent fiscal year.

WMT operates SAM’S CLUBs in 48 states. Facility sizes for SAM’S CLUBs generally range between

70,000 and 190,000 square feet, with the average SAM’S CLUB facility at approximately 128,000 square feet.

SAM’S CLUB offers bulk displays of brand name merchandise, including hardgoods, some softgoods, institutional-size grocery items, and selected private-label items under the “MEMBER’S MARK,”

“BAKERS & CHEFS” and “SAM’S CLUB” brands. Generally, each SAM’S CLUB also carries software, electronics, jewelry, sporting goods, toys, tires, stationery and books. Most clubs have fresh departments, which include bakery, meat, produce, floral and Sam’s Cafe. Additionally, a significant number of its clubs offer photo processing, pharmaceuticals, optical departments and gasoline stations.

During the fiscal year ended January 31, 2005, sales in the SAM’S CLUB segment, which are subject to seasonal variance, by product category were as follows:

CATEGORY

Food

Sundries

Hardgoods

Service Businesses

Softgoods

PERCENTAGE

OF SALES

31 %

28 %

19 %

16 %

6 %

100 %

SAM’S CLUBs are membership only, cash-and-carry operations. Limited credit facilities are available, including the “SAM’S Direct” commercial finance program and “Business Revolving Credit” available to qualifying business members. WMT provides “Personal Credit” program available to qualifying club members and accept the Discover Card in all clubs. Credit extended to members under these programs is without recourse to the Company. Typical club members include business owners and operators. Individuals who are not business owners can become “Advantage” members by paying a membership fee. In fiscal

2005, business members paid an annual membership fee of $30 for the primary membership card with a spouse card available at no additional cost. In addition, business members can add up to eight business associates for $30 each. The annual membership fee for an individual “Advantage” member is $35 for the primary membership card with a spouse card available at no additional cost. The SAM’S CLUB PLUS

Membership program offers additional benefits and value on services. The annual membership fee for a

PLUS Member is $100.

4

International Segment

WMT’s International segment is comprised of operations through wholly-owned subsidiaries in Argentina,

Canada, Germany, Puerto Rico, South Korea, and the United Kingdom; operations through majority-owned subsidiaries in Brazil and Mexico; and operations through joint ventures in China. Additionally, Wal-Mart has an unconsolidated 37% minority interest in the Japanese retailer, Seiyu (as of FY2005). The

International segment’s net sales for the fiscal years ended January 31, 2005, 2004 and 2003, were $56.3 billion, $47.6 billion and $40.8 billion, respectively. Again, the sales are diversified as no single unit accounted for as much as 1% of total Company sales or net income during the most recent fiscal year.

Operating formats vary by country, and include Discount Stores in Canada and Puerto Rico; Supercenters in

Argentina, Brazil, China, Germany, South Korea, Mexico, Puerto Rico and the United Kingdom; SAM’S

CLUBs in Brazil, Canada, China, Mexico, and Puerto Rico; Superamas (traditional supermarket), Bodegas

(combination discount and grocery store), Suburbias (specialty department store) and Vips (restaurant) in

Mexico; Todo Dias (combination discount and grocery store) and Balaios (discount food and general merchandise store) in Brazil; Neighborhood Markets (traditional supermarkets) in China; ASDA stores

(combination grocery and apparel store) and George stores (apparel store) in the United Kingdom; and

Amigo supermarkets in Puerto Rico.

The merchandising strategy for the International operating segment is similar to that of WMT’s operations in the United States in terms of the breadth and scope of merchandise offered for sale. While brand name merchandise accounts for a majority of sales, several store brands not found in the United States have been developed to serve customers in the different markets in which the International segment operates.

Macro-economic, Sector, and Competitive Analysis

Macro-economic Analysis

Introduction

WMT falls within the consumer staples sector which is typically a defensive or counter-cyclical sector.

WMT operates as a discount (food, drug, and merchandise) retail company that is renowned for its ability to offer consumers “every day low prices”. WMT will typically see increased sales during downturns in the economic cycle (and throughout a recession), because consumers divert their spending from luxury goods to consumer staples that are necessary for every-day life. The demand for staples that WMT sells such as groceries, clothing, and pharmaceutical drugs is inelastic, that is consumers will continue to purchase these goods in comparable quantities regardless of the state of the economy.

Many consumer staples equities move inversely to the market (S&P 500), and therefore have low market betas (around 0.50). WMT historical stock prices have not displayed the typically negative correlation. On the following page is a stock price chart of WMT compared to the S&P 500 (SP5A) over the past ten years and a regression analysis output:

5

WMT Price Vs. SP5A Price REGRESSION SUMMARY OUTPUT

Regression Statistics

Multiple R 0.585140785

R Square

Adjusted R Square

Standard Error

Observations

0.342389739

0.341125104

0.034424929

522

ANOVA

Regression

Residual

Total df

1

520

521

SS MS F

0.320849671 0.320849671

270.7419191

0.616239367 0.001185076

0.937089038

Significance F

2.79716E-49

Intercept

WMT Market Beta

Coefficients

0.001703865

1.030748765

Standard Error

0.001511081

t Stat

1.12758022

P-value

0.260017256

0.062643364 16.45423712

2.79716E-49

Lower 95% Upper 95%

-0.001264708 0.004672438

0.907683631 1.153813898

Regressing WMT stock price returns against the SP5A price returns shows that WMT’s stock price is positively correlated with the market price movements. The output gives an adjusted R

2

of 34.0%, which means the SP5A’s price movements explain 34.0% of WMT’s stock price variation. The regression was performed over a period of ten years and yields a 1.03 (10-year) market beta for WMT. In my analysis throughout this report, I will use the 60-month market beta of 0.85, because using the latest market data should improve the accuracy of my projections. Most equity stocks within the consumer staples sector have

60-month betas well below 0.85 and 10-year betas well below 1.03 (i.e., BUD’s 60-month beta is 0.55). In other words, while typical consumer staple equities move conversely to the market, WMT moves coincidentally with the market.

Consumer Spending

Since WMT does not exhibit the typical counter-cyclical stock price behavior that most firms within the consumer staples sector exhibit (or is less defensive), adverse shocks to the market will presumably lead

WMT’s stock price to fall. One such potential shock that would be detrimental to the retail industry in general is a sudden, unexpected slowdown in consumer spending and consumption.

The charts to the right show that consumer spending and consumption has been increasing steadily over time taking into account seasonality.

History (see the charts to the right) has shown that it does not pay to bet against the U.S. consumer. On the other hand, there are new factors that have a consequential impact on consumer spending that we must now consider including: Adjustable Rate

Mortgages and Consumer Indebtedness and importantly, how the two factors relate and how their affects can potentially slowdown consumer spending in the near future. Adjustable Rate

Mortgages (ARMs) provide an alternative for the consumer to finance his or her home and the use of ARMs has grown in popularity throughout the past five years, primarily due to extremely low interest rates. ARM interest rates are typically

6

priced off of financial instruments with shorter maturities that match the length of the initial adjustment period

2

. Since the U.S. Fed Funds rate reached a low at 1.00% in FY2002, the FED has increased rates a quarter point at a time to where we stand now at 4.50%. This scenario has caused ARM interest costs to rise. Below is a chart

3

that shows the interest rate used to compute interest cost for 1-year ARMs:

Since there is evidence that many consumers financed or refinanced their homes with ARMs through the past five years (ARMs accounted for approximately 30% of jumbo mortgages in 3Q05 down from about 40% a year earlier

4

), it is reasonable to believe the rising interest rate environment, in which we are currently experiencing, will slow consumer spending. Many analysts are projecting the FED to raise the Fed

Funds rate to 4.75% by April of this year, where they expect it to remain at least until July

5

. Given that nearly half of all consumer debt and about onequarter of total mortgage debt is currently based on adjustable rates

6

, the question is, will this additional expected rate hike be enough to rein in spending, which will intern slow WMT’s sales growth in the U.S.?

Furthermore, personal savings as a percentage of disposable personal income has dipped down to negative levels (-0.5% for FY2005: see table 7 above and to the right) for the first time since 1933 when the country was struggling to cope with the Great Depression. This data indicates that the U.S. consumer has dipped into his or her savings to fuel consumer spending growth in the past year. Much of this savings may have originated from the consumer borrowing against the equity in his or her home through refinancing with an

ARM. When you take this together with the rising interest rate environment, it is very realistic that U.S. consumer spending could slow at a material rate.

2 MortgateDailyNews.com. “Freddie Mac Issues Annual Adjustable Rate Mortgage Survey”. http://www.mortgagenewsdaily.com/172005_Freddie_Mac_Adjustable_Rate_Mortgage_Survey.asp

3 HSA online: http://library.hsh.com

4 Simon, Ruth. “A Trendy Mortgage Falls From Favor”. The Wall Street Journal. November 29, 2005. pg D1

5 http://www.forecasts.org/fedfunds.htm

6 Valueline. Retail Store Industry Report. February 10, 2006

7 U.S. Department of Commerce

7

To further investigate the effects of financial strain on the U.S. consumer and its potential effects on WMT’s sales, I performed a series of regression analyses by regressing WMT’s sales growth to various economic data. The best predictor of WMT’s sales growth with regard to a

“consumer debt ratio” was the “Homeowner

Financial Obligation Ratio”. The regression results (see chart to the left) did show a negative relationship, this means that as U.S. homeowners augment debt, WMT sales are adversely impacted.

Although the inverse relationship between

WMT’s qoq Revenue Growth and Homeowner’s

Financial Obligation Ratio supports the claim that

WMT is not the typically counter-cyclical consumer staple, the R 2 is a meager 26%. Out of the various

“consumer debt ratios” I used to regress WMT’s sales growth, this was the closest relationship I found (e.g., the highest R

2

).

Sector& Industry Valuation

Sector Valuation

Since the economy has been in the recovery stage of the economic cycle for the last two to three years, investors have pulled their money out of large-cap consumer staple stocks like WMT and have found opportunity in other sectors, such as energy. With most experts forecasting FY2006 GDP growth in the neighborhood of 3.0% 8 the stock market (SP5A) is expected to rise anywhere from 4% to 10%. It is probable that money will continue to flow out of consumer staples into cyclical sectors where opportunity for stock price appreciation may be greater. As a result of people investing in other sectors aside from consumer staples, the consumer staples sector as a whole is approximately fairly-valued based on valuation ratios: P/E, P/S, P/CF, P/BV.

1.40

1.20

1.00

0.80

0.60

0.40

Cons Staples P/E Relative to SP5A

P/E

1.20

1.00

0.80

0.60

0.40

Cons Staples P/S Relative to SP5A

P/S

2.00

1.60

1.20

0.80

0.40

Cons Staples P/CF Relative to SP5A

P/CF

2.40

2.00

1.60

1.20

0.80

0.40

Cons Staples P/BV Relative to SP5A

P/BV

8 Valueline. Retail Store Industry Report. February 10, 2006.

8

Consumer Staples Relative to SP5A

P/E P/S P/CF P/BV

High 1.27 0.98

Low 0.69 0.50

1.54

0.79

2.20

1.07

Mean 1.07 0.80

Current 1.21 0.74

1.26

1.16

1.76

1.38

The charts and data above show that the consumer staples index is currently trading at a premium relative to the market (SP5A) when considering each index’s forward P/E ratio. The forward relative P/E ratio of consumer staples index is trading well above its ten-year average of 1.21. When analyzing the other three ratios, we find that the consumer staples index is trading close to its ten-year average. It depends on which valuation ratio the investor considers most valuable, but regardless, this analysis gives us evidence that the consumer staples sector is fairly- to over-valued relative to its long-run (ten-year) average.

Industry Valuation

WMT operates within the Retail Industry, which is traditionally a difficult industry in which to increase earnings mainly because margins are slim to due intense competition. Other firms that operate within the value-chain, both up-stream (the manufacturer) and down-stream (the consumer) have the power to extract the majority of the value created in the value-chain. Because growth within the retail industry is limited, the market typically assigns lower valuation ratios (P/E, P/S, P/CF, P/BV) to retail firms. Like the consumer staples of which WMT is a part, the retail industry is fairly-valued based on the aforementioned relative valuation ratios:

Retail Industry P/E Relative to SP5A Retail Industry P/S Relative to SP5A

4.50

4.00

3.50

3.00

2.50

2.00

1.50

1.00

0.50

0.00

P/E

0.60

0.50

0.40

0.30

0.20

0.10

0.00

P/S

Retail Industry P/CF Relative to SP5A Retail Industry P/BV Relative to SP5A

3.50

3.00

2.50

2.00

1.50

1.00

0.50

0.00

P/CF

1.40

1.20

1.00

0.80

0.60

0.40

0.20

0.00

P/BV

Retail Industry Relative to SP5A

P/E P/S

High 4.13 0.48

Low 0.97 0.21

Mean 1.65 0.34

Current 1.39 0.34

P/CF

3.18

0.87

1.41

1.14

P/BV

1.30

0.58

0.97

1.02

9

Notice the break in the relative forward P/E ratio chart is the result of not meaningful P/E ratios during that period due to very low earnings (extremely low EPS in the denominator creates very high and, hence, not meaningful P/E ratios). The data shows that the Retail Industry is trading close to its average for all four valuation rations and therefore can be considered fairly-valued.

Summary

The Consumer Staples Sector and Retail Industry valuations support my valuation of WMT at “HOLD”. If both WMT’s sector and the industry are fairly valued, there is a higher probability that WMT is fairly valued.

Competitive Analysis: Five Forces & Current Strategy

Five Forces Analysis

WMT operates in the retail industry as the preeminent low-cost retailer. WMT’s strategy is built around its pricing philosophy of providing “EDLP- Everyday Low Prices”. WMT’s broad assortment of merchandise that provides one-stop shopping and high in-stock levels provide confidence to customers that WMT will have what they need, and its long operating hours allow customers to shop at their convenience. These qualities provide WTM with an additional competitive advantage.

In order to determine whether or not WMT maintains sustainable competitive advantages within the retail industry as a low-cost retailer, it was necessary to conduct a five forces analysis.

Barriers To Entry (BTE)

Immediate BTEs are relatively low since 1) opening a retail store is relatively low-capital intensive, 2) fixed costs are low, and 3) specific knowledge of operating a retail store is realistically obtainable. Evidence of this typically exists in your local strip mall, where proprietary retail operations are common. On the other hand, when a Wal-Mart store opens in a neighborhood, smaller proprietary retail operations are frequently driven out of business, because WMT has the ability to set prices below the long-run average operating cost of a smaller proprietary retailer. WMT is able to do this because, as the largest retailer in the world, its long-run average operating cost is much lower due to economies of scale it realizes.

Supplier Power

Supplier power is fairly nonexistent. As the largest retailer in the world, WMT maintains a tremendous amount of buyer power to demand volume discounts from suppliers. In many cases, WMT’s business represents a large percentage of any one supplier’s business, further strengthening WMT’s ability to demand discounts from its suppliers.

Supplier power from a human capital standpoint is also very low since most positions within WMT can be classified as unskilled labor positions. Furthermore, WMT does not cater to labor unions and no union is represented in WMT’s business.

10

WMT avoids distribution hold-up by operating its own distribution centers. WMT is well known for its proprietary “pull” inventory management system that allows it to avoid inventory build-up and shortages.

This system can help mitigate any supplier power as well. Additionally, during fiscal 2005, approximately

81% of the Wal-Mart Stores segments’ purchases of merchandise were shipped from Wal-Mart’s 99 distribution centers, of which 37 are general merchandise distribution centers, 34 are grocery distribution centers, seven are clothing distribution centers and 16 are specialty distribution centers. The balance of merchandise purchased was shipped directly to stores from suppliers. In addition to serving the Wal-Mart

Stores segment, some of the grocery distribution centers also serve the SAM’S CLUB segment for perishable items.

Buyer Power

The end consumer, WMT’s customer, maintains the ultimate buyer power. WMT’s pricing philosophy is to provide “Everyday Low Prices” to consistently draw consumers who trust WMT will provide the lowest price available and concurrently avoid erratic price changes due to promotional activity. By being the most consistent and lowest cost retailer in the market, WMT business model is appealing to the end consumer.

Online shopping also strengthens the end consumers’ buyer power by giving them quick and easy access to pricing information on many comparable goods sold at various retail outlets. To this point, there is not significant evidence that online sales have harmed retail store sales materially.

Substitutes

A major substitute for shopping at retail stores is shopping online. Trends show that online shopping is growing rapidly year-over-year. WMT does provide online shopping on www.walmart.com

and the threat of online shopping cannibalizing sales has not been a significant factor to this point. It is possible that once

WMT saturates the market with its retail stores, online shopping could become detrimental to its store sales.

Competition

Competition is fierce within the retail industry as evidenced by notoriously tight margins: Ave. Gross

Margin (Retail Industry/Market: 26.5% vs. 48.3%); Ave. Operating Margin (Retail Industry/Market: 8.5% vs. 12.6%); Ave. Net Margin (Retail Industry/Market: 3.4% vs. 7.0%) 9 . WMT competes within many different retail sub-industries: discount, department, drug, variety and specialty stores and supermarkets, many of which are national chains. WMT also compete with other retailers for new store sites. As of

January 31, 2005, the Wal-Mart Stores segment ranked first, based on net sales, among all retail department store chains and among all discount department store chains.

Summary

WMT maintains a strong, sustainable competitive advantage in a highly competitive industry based its lowest-cost, one-stop-shop business model. WMT’s realizes many cost advantages through its tremendous buyer power which is generated by its sheer size (volume of business). Unlike many other Fortune 500 companies, WMT has managed to avoid the problems that labor unions present for earnings growth by strategically avoiding labor unions all together. WMT’s business model works with the end consumers’

9 Hoovers Online. Available at http://premium.hoovers.com

11

demand for consistent, low-cost retail products and helps to mitigate buyer power. Meanwhile, WMT is consistently able to eliminate competition though setting low prices and subsequently driving competition out of business.

Current Strategy

10

Wal-Mart has started to drive sales by attracting the “selective customer” – that is, customers that shop at

Wal-Mart for basics but do not see it as an alternative for home, apparel or electronics. For example, Metro

7 continues to perform well and Wal-Mart plans to expand the number of stores that carry this brand to

1,500 by September 2006.

Wal-Mart has reorganized their field operations to allow an Associate to take ownership and improve customer service. Wal-Mart will change its field organization to better improve the customer experience.

This includes changes related to:

1) Store cash office redesign

2) Front-end service

3) Customer needs scheduling

4) Positive associate experience and store manager routines

5) Merchandise flow

6) Increasing customer touch points

This structure will enable Wal-Mart to extract more market knowledge from the customer, which should help it improve profitability.

As part of the new structure, Wal-Mart announced several changes at its year-beginning meeting, including a completely redesigned compensation program which rewards all store associates based on achieving their individual store goals, including sales and return on inventory. With this planning process, the Company hopes to significantly improve execution and close the gap between strategy and performance.

As Wal-Mart makes progress with its in-store process redesign, the Company should continue to see improvements in its cost structure. Wal-Mart is also upgrading existing stores to provide customers with an environment that looks and feels like the Company’s most recent prototypes (similar to the one opened last summer in Rogers, Arkansas). Wal-Mart has undertaken a very aggressive remodel program that will impact 1,800 stores within the next 18 months. This remodel program is being executed by market and will focus on five areas: home, apparel, electronics, food and the restrooms. In 300 stores, Wal-Mart will introduce a new concept for its pharmacies that will have pharmacists more accessible to customers.

The Company has a TV ad campaign that illustrates to consumers that they can find what they need at low prices. The Company has also made changes to its printed circular advertisements. The Company is increasing the number of circulars to 23 this year, up from 12 last year, but the overall page count will be reduced (and as a result, the associated expense is not expected to increase).

10 Tang, Charmaine; Weinswig, Deborah. “WMT: 4Q05 EPS Review: Lackluster Sales Saved by SG&A and Gross Margin”.

Citigroup. February 21, 2006.

12

Wal-Mart has made significant investments in its marketing organization led by John Fleming. His team now includes Stephen Quinn, Senior Vice President Marketing, formerly Chief Marketing Officer at Frito

Lay; Julie Roehm, Senior Vice President of Marketing & Communications, formerly Director of Marketing

Chrysler; Robert Atencio, formerly Director of Insight & Consumer strategy for Frito Lay; and Steve

Bertschy, Vice President Category Marketing and who formerly was the Senior Vice President and Chief

Marketing Officer at Specialty Brands. Another example here Wal-Mart is investing in people is in operations. The Company tries to grow talent internally, and it has developed a detailed selection process to identify the best talent and is providing formal training to build the skills required in these new and expanded roles. Wal-Mart has also complemented its senior leadership teams and operations by offering these new roles to high potential senior executives from other areas of the Company, such as merchandising and logistics. Additionally, the company has also brought in external talent to complement internal promotions. This has been particularly important, as the Company decentralizes its field organization, placing the business units' key leadership teams in the market that they are responsible for.

During 4Q05, Wal-Mart continued its international growth through acquisitions. The company acquired the

Sonae retail operations in Southern Brazil and increased its ownership of Seiyu to 53%, up from 42% (at

3Q05-end) resulting in the consolidation of Seiyu in Wal-Mart’s financial statements beginning in January

2006. Wal-Mart is now in 15 countries and expects that number to increase. The company acquired 545 new international stores and 50,000 associates in just one week through acquisition. Wal-Mart plans to build or relocate another 220 international stores in 2006.

Accounting Analysis

It is necessary to conduct an accounting review of WMT’s financial statements before developing projections and a valuation of its current and future operations. There were a few necessary adjustments to make to WMT’s current financial statements in order to paint a more accurate picture of its financial standing. The adjustments were made to WMT’s Balance Sheet and Income Statement to account for its off-balance sheet debt obligations, namely its operating leases and contingency exposures. See Exhibit VI on page 29 for pro forma financial statements that take into account these adjustments.

Operating Leases

In order to get a more complete picture of WMT’s financial standing by analyzing financial measures such as ROE, it was appropriate to capitalize WMT’s off-balance sheet financing. Off-balance sheet obligations mainly took the form of operating leases. In addition to operating leases mentioned in WMT’s 10-K, WMT also mentioned that leases amounting to $30M in annual expenses were (at the time) being finalized, but not included in the operating lease table given in its 10-K. On the next page is the operating lease schedule provided in WMT’s 10-K.

13

Fiscal year

2006

2007

2008

2009

2010

Thereafter

Leases

730

700

626

578

530

5,908

Total minimum rentals 9,072

In order to capitalize the operating leases, I needed to determine the present value of the future total minimum operating rentals. I also added in an additional $30M annually for new leases mentioned in the

10-K. I determined an average annual operating lease expense to be $633M by averaging operating lease expense numbers given from FY2006 to FY2010. The weighted-average effective interest rate on long-term debt was given in the 10-K to be 4.08%. With an average annual operating lease expense of $633M and a total of $9,072, the average life over which the present value of the minimum operating rentals would be amortized was approximately fourteen years ($9,072M/$633M). See graphic below for present value calculations:

Average Annual Op. Lease Expense (FY06-FY10)

Weighted-Average Effective Interest Rate on LT Debt

633

4.08%

Projected Off-Balance Sheet Obligations

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

Operating Leases Additional Proj. Leases

730

700

30

30

626

578

530

633

30

30

30

30

633

633

633

633

633

633

633

633

30

30

30

30

30

30

30

30

Present Value

760.00

701.38

605.58

539.26

477.22

542.68

521.41

500.97

481.33

462.46

444.33

426.92

410.18

394.10

2020 213 30 138.82

Total $9,072 $450 $7,407

I added the present value of WMT’s operating leases of $7,407M to its FY2006 balance sheet under fixed assets and capital leases. Furthermore, when capitalizing leases, one must not only add the present value of the assets (PV of minimum rent payments) to the balance sheet, but must also account for the affects on the income statement.

14

Operating Lease Capitalization Schedule

2012

2013

2014

2015

2016

2017

2018

2019

2020

FY

2006

2007

2008

2009

2010

2011

Beg. Principal Total Pmt Principal Pmt Interest Pmt Ending Principal Depreciation

$7,116

$6,744

$663

$663

$373

$388

$290

$275

$6,744

$6,356

$508

$508

$6,356

$5,952

$5,532

$5,095

$663

$663

$663

$663

$404

$420

$437

$455

$259

$243

$226

$208

$5,952

$5,532

$5,095

$4,640

$508

$508

$508

$508

$4,640

$4,166

$3,673

$3,160

$2,626

$2,070

$1,491

$889

$262

$663

$663

$663

$663

$663

$663

$663

$663

$273

$474

$493

$513

$534

$556

$579

$602

$627

$262

$189

$170

$150

$129

$107

$84

$61

$36

$11

$4,166

$3,673

$3,160

$2,626

$2,070

$1,491

$889

$262

$0

$508

$508

$508

$508

$508

$508

$508

$508

$633

WMT’s annual rent expense, after capitalizing its operating leases, grows to $1,186M annually. This figure is larger than the annual operating lease expense of $730M in FY2006. The expense on the income statement is higher after capitalizing the operating leases because now WMT would have to charge an additional depreciation expense since the assets are now on its balance sheet (see Exhibit VI on page 29 for pro forma balance sheet).

Other Concerns

Aside from operating leases WMT, does not have many accounting issues of which an investor needs to be aware. The only other minor concerns are potential liabilities which WMT may be subject to pay in the future due to litigation and contingency agreements with affiliates and suppliers. There are currently multiple lawsuits currently being tried in the U.S. court system. WMT was unable to estimate financial impacts of such lawsuits. WMT mentions that it has contracts in place with certain suppliers and affiliates and that, if “unlikely events were to occur,” WMT could be liable to pay out $394M in contingency fees.

Specifically, WMT mentions three of these types of contingency contracts, which amounts to the $394M.

Financial Analysis

In order to accurately assess WMT’s financial health, it was necessary to conduct both a time-series analysis and a cross-sectional analysis of its financial ratios that measure the Company’s: 1) Cash Flow, 2)

Profitability, 3) Efficiency, 4) Liquidity and, 5) Leverage. See Exhibit VIII on page 30 for a compilation of

WMT’s financial ratios.

15

Cash Flow

Time-Series Analysis

WMT’s cash flow seems to be healthy and growing (See Exhibit V on page 28 for WMT’s Statement of

Cash Flows). WMT’s cash flow from operations (CFO) has seen double-digit growth from FY2002 to

FY2006, with one year of negative growth (from FY2004 to FY2005) primarily due to cash outflow in its working capital accounts (mostly due to inventory build-up). From FY2001 to FY2006, Net Income as a percentage of CFO has remained relatively constant ranging from 60% to 68%, aside from FY2004 when NI was 55% of CFO mostly due to slower yoy net earnings growth. Overall cash flow has been positive and fairly steady.

Cross-Sectional Analysis

Since WMT operations span multiple retail industries, I compared WMT to both the retail drug industry and retail department stores. WMT is in the middle of the pack with regards to Free Cash Flow/Total Cash

Flow:

Company

STEIN MART INCORPORATED

FEDERATED DEPARTMENT STORES INC

GOTTSCHALKS INCORPORATED

PENNEY J C INCORPORATED

RITE AID CORPORATION

NORDSTROM INCORPORATED

LONGS DRUG STORES INCORPORATED

DILLARDS INCORPORATED

TARGET CORPORATION

WAL-MART STORES INCORPORATED

WALGREEN COMPANY

KOHLS CORPORATION

JACOBSON STORES INCORPORATED

RETAIL VENTURES INCORPORATED

BON-TON STORES INCORPORATED

CVS CORPORATION

Median

Mean

Free CF/

Ticker Total CF

SMRT

FD

83.56

69.01

GOT

JCP

RAD

JWN

64.33

63.44

63.2

59.29

LDG

DDS

TGT

WMT

WAG

KSS

JCBSQ

RVI

BONT

CVS

49.72

48.5

19.71

14.3

9.75

6.13

5.93

5.24

-9.08

-47.42

34.11

31.60

FCF is important to investors because it is commonly regarded as the amount of cash generated by operations remaining (after changes in working capital and cap ex) that can be devoted to pay shareholders, both debt-holders and equity-holders.

Profitability

Time-Series Analysis

WMT’s Net Income along with EPS has exhibited double-digit growth since FY2002 until this past year.

16

Earnings Growth (YOY) 2002 2003 2004 2005 2006

Diluted net income per common share 6.4% 20.1% 15.6% 16.4% 11.2%

Net Income 6.0% 19.2% 13.8% 13.4% 9.4%

The major contributor to WMT’s net income growth in the future should be its International segment, which has shown substantially increasing growth in its sales and operating margin.

Sales:

YOY (QOQ) Growth

Wal-Mart Stores

Sam's Club

International

2002

14.1%

9.7%

10.5%

2003

12.9%

7.8%

15.0%

2004

10.9%

8.9%

16.6%

2005

10.1%

7.5%

18.3%

2006

9.4%

7.2%

11.4%

Operating Margin:

Operating Margin

Wal-Mart Store Operating Margin

ROE

2001

7.9%

2001 2002

2002

7.3%

2003

2003

7.5%

2004

2004

7.4%

2005

2005

7.4%

2006

2006

7.3%

Sam's Club Margin

International Margin

3.5%

3.0%

3.5%

3.7%

3.2%

4.9%

3.3%

5.0%

3.4%

5.3%

3.5%

5.3%

Return on Equity (ROE) is an important measure for measuring the return generated on the stockholder’s investment. Below is WMT’s ROE from FY2001 to FY2006. It is broken down into components (using the DuPont Analysis method):

Adjusted

2006

Profitability

ROE

Net Margin

20.1%

3.3%

20.1%

3.1%

21.4%

3.5%

21.8%

3.5%

22.1%

3.6%

21.9%

3.6%

21.5%

3.5%

Asset Turnover 2.4

2.7

2.6

2.6

2.5

2.4

2.3

Leverage Ratio 2.5

2.4

2.4

2.4

2.4

2.5

WMT’s ROE has been very consistent over the past five years and has grown slightly. Included in

“Adjusted 2006” numbers is the capitalization of operating leases and its effects on WMT’s balance sheet

2.7

and income statement (which are relatively non-material). The only change has come in asset turnover

(decreasing from 2.7 in FY2002 to 2.3 in

FY2006) and an increase in leverage ratio. This is to be expected given WMT’s asset growth

ROE

(mainly through debt financing) from its recent international acquisitions and domestic store growth. WMT’s ten-year average ROE is 21.1%, and in the long-run, assuming a mean-reversion scenario, WMT’s ROE should settle around

25

23

21

19

17

15

21.1%.

Cross-Sectional Analysis

On the next page is a comparison chart for the retail industry (drug and department stores) that compare yoy revenue and EPS growth (for the past three years).

17

Stock Name

BON-TON STORES INCORPORATED

CVS CORPORATION

KOHLS CORPORATION

WALGREEN COMPANY

TARGET CORPORATION

WAL-MART STORES INCORPORATED

NORDSTROM INCORPORATED

RETAIL VENTURES INCORPORATED

FEDERATED DEPARTMENT STORES INC

RITE AID CORPORATION

STEIN MART INCORPORATED

PENNEY J C INCORPORATED

LONGS DRUG STORES INCORPORATED

GOTTSCHALKS INCORPORATED

DILLARDS INCORPORATED

JACOBSON STORES INCORPORATED

WAL-MART DE MEXICO SA ADR CL V

Mean (not incld. "NM" or "NEG")

Median

Symbol

BONT

CVS

KSS

WAG

TGT

WMT

JWN

RVI

FD

RAD

SMRT

JCP

LDG

GOT

DDS

JCBSQ

WMMVY

Rev Grw EPS Grw

Rate Rate

3yr PTP 3yr PTP

5.17

2.39

2.38

1.81

1.15

-0.66

-2.25

-6.09

21.7

15.23

13.99

13.43

11.33

10.88

8.9

5.88

8.62

NMN

33

67.15

4

9.77

-17.19

NEG

18.56

16.32

9.59

15.21

19.61

14.39

46.99

NEG

8.79

5.525

23.04

15.21

Stock Name

NORDSTROM INCORPORATED

WAL-MART STORES INCORPORATED

PENNEY J C INCORPORATED

WALGREEN COMPANY

STEIN MART INCORPORATED

WAL-MART DE MEXICO SA ADR CL V

TARGET CORPORATION

CVS CORPORATION

KOHLS CORPORATION

FEDERATED DEPARTMENT STORES INC

LONGS DRUG STORES INCORPORATED

BON-TON STORES INCORPORATED

GOTTSCHALKS INCORPORATED

DILLARDS INCORPORATED

RETAIL VENTURES INCORPORATED

JACOBSON STORES INCORPORATED

RITE AID CORPORATION

Mean

Median

Symbol

JWN

WMT

JCP

WAG

SMRT

WMMVY

TGT

CVS

KSS

FD

LDG

BONT

GOT

DDS

RVI

JCBSQ

RAD

The above list is sorted by Revenue Growth and WMT is near the top of the list, but remains below its

ROE

T4Q

15.03

10.9

7.48

6.28

4.93

3.89

-22.58

-99.9

NMN

26.65

22.17

19.32

18.1

17.76

17.31

17.15

15.3

4.99

15.17

major competitors in both the retail department store and retail drug industries. It remains in the middle of the pack with regards to EPS growth (a relative measure considering that the calculation depends on weighted-average number of shares outstanding which can be manipulated through share-buyback programs).

WMT’s ROE is high compared to the market (13.4% on average 11

), but about average for the entire retail industry (20.0%

12

). Notice that the ROE numbers in the chart above are 4Q05 (in WMT’s case, 4Q06) numbers. Compared to its major competitors, WMT does have a substantially higher ROE. If we again consider a reversion to the mean scenario, we would expect to see WMT’s ROE figure drop to the industry average at about 20.0%.

Efficiency

Time-Series Analysis

WMT’s degree of operational efficiency can be measured by calculating its margins: 1) Gross Margin, 2)

Operating Margin, and 3) Net Margin. Gross Margin normally measures how efficiently a firm can produce a product, but in this case since WMT is a retailer, gross margin measures the spread WMT makes on the products it sells. Meanwhile, Operating Margin will measure how efficiently it can bring these products to market. Below is a breakdown of WMT’s margins over time.

Margins

Gross Margin (% of Net Sales)

Operating Margin

Wal-Mart Store Operating Margin

Sam's Club Margin

International Margin

Other

Total Operating Margin

Net Margin

2001

22.4%

7.9%

3.5%

3.0%

-0.1%

5.9%

3.3%

2002

22.1%

7.3%

3.5%

3.7%

-0.3%

5.4%

3.0%

2003

23.2%

7.5%

3.2%

4.9%

-0.6%

5.7%

3.4%

2004

23.4%

7.4%

3.3%

5.0%

-0.5%

5.8%

3.5%

2005

23.9%

7.4%

3.4%

5.3%

-0.5%

6.0%

3.6%

2006

24.1%

7.3%

3.5%

5.3%

-0.5%

5.9%

3.6%

11 Hoovers Online. Available at http://premium.hoovers.com/

12 Hoovers Online. Available at http://premium.hoovers.com/

18

Each of WMT’s three margins is increasing over time. I would expect all margins to increase at a decreasing rate in the future, aside from WMT’s International Segment’s operating margin. I would expect this to near the Wal-Mart Store Segment’s operating margin of 7.3%. Since WMT’s major sales growth comes from the International Segment (a trend which should continue), it is important that WMT

International continue to increase its operating margin. This will be the key factor affecting WMT’s overall earnings growth in the near-future.

Cross-Sectional Analysis

Below is a chart that compares WMT’s margins to those of its competitors (note, margins are computed five-year averages for each company). WMT stands above average with regards to net margin and EBITDA

Margin, which is equivalent to operating margin, but below average when it comes to gross margin.

WMT’s margin figures makes sense considering its low-cost retailer strategy -- WMT charges a smaller mark-up, but is more efficient than many of its competitors at bringing products to market, given its aforementioned competitive advantages. WMT’s higher than average operating and net margins make sense given its tremendous, world-leading volume of sales.

Stock Name Symbol

Gross EBITDA Net Prof

Margin Margin Marg Adj

5yr Avg 5yr Avg 5yr Avg

KOHLS CORPORATION

FEDERATED DEPARTMENT STORES INC

TARGET CORPORATION

NORDSTROM INCORPORATED

WALGREEN COMPANY

WAL-MART STORES INCORPORATED

CVS CORPORATION

STEIN MART INCORPORATED

PENNEY J C INCORPORATED

BON-TON STORES INCORPORATED

DILLARDS INCORPORATED

LONGS DRUG STORES INCORPORATED

GOTTSCHALKS INCORPORATED

RETAIL VENTURES INCORPORATED

RITE AID CORPORATION

JACOBSON STORES INCORPORATED

Mean

Median

KSS

FD

TGT

JWN

WAG

WMT

CVS

SMRT

JCP

BONT

DDS

LDG

GOT

RVI

RAD

JCBSQ

34.18

39.98

34.94

34.09

27.08

22.39

25.89

25.18

35.46

36.44

32.73

25.45

35.13

37.2

23.83

31.33

34.09

12.92

13.19

10.11

10.3

6.88

7.58

6.47

4.35

6.41

6.19

7.82

3.51

4.34

1.16

1.59

6.85

6.47

1.99

1.68

1.56

1.07

1.05

0.58

-0.47

-1.34

-1.58

2.06

6.31

4.53

3.75

3.61

3.6

3.47

3.09

1.84

Liquidity

Time-Series Analysis

In order to measure WMT’s degree of liquidity or solvency, I used three ratios: 1) Interest Coverage Ratio,

2) Current Ratio, and 3) Quick Ratio. These three ratios will give an investor insight as to any dangers

WMT might run into with regard to having cash on hand to service immediate obligations. I calculated the ratios in the following manner: Interest Coverage Ratio (FCF/Interest Expense); Current Ratio (Current

Assets/Current Liabilities); Quick Ratio (Cash and Cash Equivalents plus Accounts Receivable/Current

Liabilities).

19

Liquidity 2001 2002 2003 2004 2005 2006

Adjusted

2006

Interest Coverage Ratio

Current Ratio

Quick Ratio

15.3

0.92

0.13

15.7

1.02

0.15

24.8

0.93

0.15

31.7

0.91

0.17

28.7

0.90

0.17

28.0

0.90

0.19

22.2

0.89

0.18

WMT, the largest retailer in the world, has plenty of free cash flow to meet its annual, short-term debt obligations. Its interest coverage ratio increased dramatically from FY2001 to FY2006 an account of

WMT’s rapidly growing CFO. Despite the fact that adjustments from capitalizing operating leases brings down the interest coverage ratio from 28.0 to 22.2, it is still a high number and it is evident that WMT does not have much solvency risk at this point.

Cross-Sectional Analysis

WMT ranks absolute last for Current Ratio and Quick Ratio with regards to its peers (See chart to the right). This is not a problem for

WMT since it holds $6.4B of cash and its

CFO was $17.6B (both figures from FY2006).

In my opinion, WMT is doing a good thing by maintaining low liquidity ratios, because it forces management to manage WMT’s cash and cash flows efficiently and provides less freedom to squander cash on investments that will decrease the return to shareholders

(ROE).

Stock Name

KOHLS CORPORATION

PENNEY J C INCORPORATED

BON-TON STORES INCORPORATED

DILLARDS INCORPORATED

STEIN MART INCORPORATED

GOTTSCHALKS INCORPORATED

NORDSTROM INCORPORATED

WALGREEN COMPANY

RITE AID CORPORATION

FEDERATED DEPARTMENT STORES INC

TARGET CORPORATION

RETAIL VENTURES INCORPORATED

CVS CORPORATION

LONGS DRUG STORES INCORPORATED

JACOBSON STORES INCORPORATED

WAL-MART STORES INCORPORATED

Mean

Median

Symbol

KSS

JCP

BONT

DDS

SMRT

GOT

JWN

WAG

RAD

FD

TGT

RVI

CVS

LDG

JCBSQ

WMT

1.92

1.86

1.8

1.75

1.69

1.66

1.63

1.51

1.21

0.9

1.86

1.83

Current Quick

Ratio Ratio

2.5

2.44

2.38

2.19

2.19

2.18

1.1

1.48

0.66

0.49

0.56

0.15

0.78

0.55

0.39

1

0.89

0.1

0.44

0.46

0.5

0.17

0.61

0.53

Leverage

Time-Series Analysis

WMT’s leverage ratios were not as high as one would expect. As a result of its reasonable debt structure and plush cash flow from operations, WMT continues to maintain an AA S&P credit rating

WMT’s: 1) Leverage Ratio, 2) Debt/Equity, and 3) Long-term Debt/Total Capital.

13

. I analyzed

Liquidity

Leverage Ratio

Debt/Equity

Debt/Total Capital

2001

2.5

49.9%

28.5%

2002

2.4

53.4%

30.9%

2003

2.4

49.8%

29.7%

2004

2.4

46.1%

28.2%

2005

2.4

47.9%

28.9%

2006

2.5

56.7%

33.2%

Adjusted

2006

2.7

70.0%

41.2%

13 Business Week Online. Available at http://research.businessweek.com

20

Here, the affects of capitalizing WMT’s operating leases are profound. Notice that the D/E ratio rises from

56.7% to 70% and D/TC grows from 33.2% to 41.2%. While WMT’s debt ratios are increasing with time, it is not in much danger of being over-levered at its current capital structure. Again, given its vast amounts of cash on hand and CFO, WMT can easily handle the debt service at this point. I would expect WMT’s debt level to continue to grow slightly given its plans for international and domestic expansion, and its recent quest to refurbish over 1,800 of its stores already in existence.

Stock Name

RITE AID CORPORATION

RETAIL VENTURES INCORPORATED

TARGET CORPORATION

GOTTSCHALKS INCORPORATED

PENNEY J C INCORPORATED

NORDSTROM INCORPORATED

DILLARDS INCORPORATED

FEDERATED DEPARTMENT STORES INC

BON-TON STORES INCORPORATED

WAL-MART STORES INCORPORATED

KOHLS CORPORATION

LONGS DRUG STORES INCORPORATED

CVS CORPORATION

STEIN MART INCORPORATED

WALGREEN COMPANY

JACOBSON STORES INCORPORATED

Mean

Median

LT Debt

/Tot Cap

Symbol 5Yr Avg%

RAD

RVI

TGT

GOT

JCP

JWN

DDS

FD

BONT

WMT

KSS

LDG

CVS

SMRT

WAG

JCBSQ

100

59.25

47.44

45.37

45.19

44.48

41.12

36.5

32.76

32.39

23.47

18.96

15.21

11.16

0.14

36.90

36.50

Cross-Sectional Analysis

When it comes to the retail industry, WMT maintains a capital structure that puts it in the middle of the pack with regard to its use of debt. Adding in the changes made by capitalizing WMT’s operating leases, its five-year average

LTD/TC would most likely increase to approximately

40%. One would also have to capitalize WMT’s competitors’ operating leases and make the necessary adjustments to make an apples-to-apples comparison.

Assuming most of WMT’s competitors maintain a comparable percentage of operating leases, WMT would most likely remain near the industry average for LTD/TC.

Valuation Analysis

I used three different techniques to value WMT: 1) Free Cash Flow Model, 2) Dividend Discount Model, and 3) Comparable Valuation Ratio technique. Each valuation turns out very similar numbers for a oneyear price target, all of which are in the vicinity of where WMT is trading today ($45.45). The FCF valuation assigns WMT an intrinsic value of $46.73. The DDM model gives WMT an intrinsic value of

$44.50. The Comparable Valuation Ratio technique gives WMT an average intrinsic value of $47.20.

Considering all three models, I give WMT a one-year target price of $46.00.

FCF Valuation Model

See Exhibits I, II, and III on pages 24, 25, and 26 for a complete description of the FCF valuation model used, including all major assumptions used in calculating WMT’s intrinsic value of $46.73, which is a 2.8% discount compared to its current price of $45.45. Below is a list of major assumptions that were made:

Discount Rate used was 10%, which is relatively high compared to its computed average cost of capital.

Earnings projections were made up to and including FY2015, and afterward, a terminal growth of

5.5% was used to calculate the terminal present value of future cash flows.

Changes in working capital would remain consistent and would near zero.

Depreciation and Amortization would remain a constant percentage (1.5%) into the future. It has been very consistent, near 1.5% in the past five years.

21

Cap Ex would decrease as a percentage of assets due to decreasing growth prospects.

The terminal growth rate coupled with the discount rate would give WMT a terminal intrinsic value to earnings ratio that could be compared with WMT’s present day P/E ratio.

Furthermore, I performed a stress test to note the affects of using different discount and terminal growth rates.

5%

$258.65

NM

NM

NM

NM

8%

$59.07

$75.53

$108.45

$207.20

NM

Discount Rate

10%

$37.26

$42.94

$51.47

$65.68

$94.11

12%

$26.53

$29.17

$32.69

$37.61

$44.99

15%

$17.97

$19.06

$20.39

$22.05

$24.18

4%

5%

6%

7%

8%

The stress test gives us an idea of what WMT’s intrinsic value would be if our assumptions were different.

WMT’s intrinsic value grows as the terminal rate gets bigger and as the discount rate gets smaller.

Normally, one would discount the FCFs using the company’s WACC. I computed the WACC for WMT, but it was abnormally low at about 6.8% (See WACC Calculation in Exhibit VII on page 30). I felt 6.8% was too low and does not accurately capture the risk of owning WMT. Discounting WMT’s expected cash flows by its WACC gives WMT a target price of $177, which is a 288% discount. Apparently the market agrees that discounting WMT at its WACC does not account for all risk of owning WMT.

Dividend Discount Model

The DDM values WMT at $44.50. The DDM discounts expected dividends a stockholder would receive in the future. I kept the discount rate at 10%, but I used a different terminal growth for WMT’s dividends. I assumed dividend growth would be higher than WMT’s FCF growth at 8.3%. I believe this assumption is justified because WMT’s current dividend payout ratio is relatively low (22%). Assuming that WMT is a maturing company, many investors would expect WMT to begin paying out more of its earnings at a higher payout rate (30%+).

Below is a graphic that contains the DDM valuation and assumptions.

DDM

2003 2004 2005 2006 2007 2008 2009 2010 Termimal

Dividends Per Share yoy % Change

0.30

0.36

20.0%

0.52

44.4%

0.60

15.4%

0.69

15.0%

0.79

15.0%

0.91

1.05

15.0% 15.0%

66.85

Terminal Growth Rate

Discount Rate

PV of Expected Divs. Per Share

8.3%

10.0%

$44.50

To arrive at the $44.40 valuation, I assumed WMT’s dividend would grow at 15% for each of the next four years, and at a terminal 8.3% afterwards.

22

Comparable Valuation Ratio Technique

The Comparable Valuation Ratio technique produced an average intrinsic value for WMT of $47.20. Since

I wanted to determine a one-year price target, I assumed WMT would trade at the same levels that it currently is trading at with regard to P/E-1year forward, P/S, P/CF, and P/BV. Using this method to determine a 5-year (or longer price target), one would use long-term “mean” or “median” data for the firm’s

P/E, P/S, P/CF and P/BV. Using my earnings, sales, book value and cash flow estimates for FY2007, I determined projected EPS, Sales per Share, Cash Flow per Share, and Book Value per Share. Next, I used that data to compute WMT’s intrinsic value today.

The major assumption that I made here is that WMT would be trading at its current multiples one year from now. This scenario will mostly likely not be the case. See the graphs below for a historical range of

WMT’s valuation ratios. Currently,

WMT is trading at low multiples, and in the long-run, an investor should expect to see a reversion to the mean for each ratio. It is also important to consider

WMT’s relative (to SP5A) valuation ratio range, which shows that WMT is trading at normal valuation multiples

(See Exhibit IX on page 31).

Comparable Valuation Ratios

Price/"X"

P/E-1yr Fwd

P/S

P/CF

P/BV

Current Expected "X" per Share Implied Value

13.61

0.61

3.08

86.88

41.89

53.00

Average

Discount (Premium)

9.62

3.58

4.63

13.80

44.50

49.40

$47.20

3.8%

Notice with this more imprecise methodology for valuing a firm’s shares, there is a wider value per share range. The range in this case is from $41.89 (using the P/E ratio and EPS estimate for FY2007) to $53.00

(using the P/S ratio and Sales per share estimate for FY2007). Given the impreciseness of this method, the average implied price is $47.20 (averaging all four implied price figures from the above chart). This number is still very consistent with the figures generated by the other two valuation methodologies.

WMT P/E (1-Yr Forward) WMT P/S

60

50

40

30

20

10

0

2.5

2

1.5

1

0.5

0

WMT P/CF WMT P/BV

50

45

40

35

30

25

20

15

10

5

0

14

12

10

8

6

4

2

0

Summary

All three valuation models provide a consistent one-year forward valuation of WMT’s firm value per share that I averaged to get $46.00 per share. I have taken into account all data mentioned in this report concerning the consumer staples sector, the retail industry, and WMT’s firm-specific competitive advantages to develop specific sales growth estimates, cost estimates, and earnings estimates for the coming years.

23

Exhibit I: Pro Forma Income Statement

2001 2002 2003 (Amounts in millions except per share data)

Fiscal years ended January 31,

Revenues:

Wal-Mart Stores

Sam's Club

International

Other

Net sales

Other income, net

Total Revenue

Costs and expenses:

Cost of sales

Operating, selling, general and administrative expenses

Operating Income:

Wal-Mart Stores

Sam's Club

International

Other

Operating income

Interest:

Debt

Capital leases

Interest income

Interest, net

Income from continuing operations before income taxes and minority interest

Provision for income taxes:

Current

Deferred

Total Provision for Taxes

Income from continuing operations before minority interest

Minority interest

Income from continuing operations

Income from discontinued operation, net of tax

9,600

942

949

(196)

$11,311

10,200

1,028

1,305

(617)

$11,937

11,840

1,023

1,998

(1,290)

$13,295

12,916

1,126

2,370

(1,387)

$15,025

1,104

279

(188)

1,195

10,116

3,350

342

3,692

6,424

(129)

6,295

1,083

274

(171)

1,186

10,751

3,712

185

3,897

6,854

(183)

6,671

799

260

(132)

927

12,368

3,883

474

4,357

8,011

(193)

7,818

137

Actual

2004 01/31/2005

729

267

(164)

832

14,193

4,941

177

5,118

9,075

(214)

8,861

193

3,552

272

774

(176)

$4,422

1,620

2,667

(40)

2,627

86

80

(31)

135

4,287

2005 04/30/2005 07/31/2005 10/31/2005 01/31/2006

121,889

26,798

32,100

10,542

191,329

1,787

139,131

29,395

35,485

13,788

217,799

1,873

157,120

31,702

40,794

229,616

1,961

174,220

34,537

47,572

256,329

2,352

$193,116 $219,672 $231,577 $258,681

150,255

31,550

171,562

36,173

178,299

39,983

243,656

198,747

44,909

42,133

7,976

11,958

62,067

469

$62,536

191,826

37,119

56,277

285,222

2,767

$287,989

48,447

9,667

219,793

51,105

14,163

1,280

2,988

(1,340)

$17,091

934

253

(201)

986

16,105

5,326

263

5,589

10,516

(249)

10,267

47,641

9,155

14,112

70,908

772

$71,680

54,571

13,168

3,307

295

667

(328)

$3,941

1,212

2,529

(68)

2,461

199

53

(52)

200

3,741

51,809

9,969

15,033

76,811

709

$77,520

58,787

14,054

3,992

371

750

(434)

$4,679

1,503

2,874

(69)

2,805

301

60

(59)

302

4,377

50,243

10,019

15,174

75,436

817

$76,253

57,988

14,216

3,312

342

797

(402)

$4,049

1,254

2,446

(72)

2,374

348

60

(59)

349

3,700

60,218

10,655

18,400

89,273

854

$90,127

209,911

39,798

62,719

312,428

3,152

$315,580

69,045

15,222

Projected

2006 4/30/2006E 7/31/2006E 10/31/2006E 1/31/2007E

240,391

56,660

4,714

377

1,116

(347)

$5,860

15,325

1,385

3,330

(1,511)

$18,529

1,835

3,703

(114)

3,589

324

76

(78)

322

5,538

1,172

249

(248)

1,173

17,356

5,804

11,552

0

0

(323)

11,229

51,929

9,704

15,805

77,438

811

$78,249

59,240

14,645

3,635

330

790

(391)

$4,364

1,404

2,725

(68)

2,657

235

78

(78)

235

4,129

57,249

10,567

16,837

84,653

744

$85,397

64,760

15,856

4,007

359

842

(427)

$4,782

1,539

2,987

(75)

2,912

256

85

(85)

256

4,525

64,131

15,016

4,126

368

925

(421)

$4,998

1,614

3,132

(78)

3,054

252

84

(84)

252

4,746

81,214

19,506

5,013

398

1,463

(535)

$6,339

16,782

1,456

4,020

(1,774)

$20,483

2,046

3,972

(99)

3,873

321

107

(107)

321

6,018

2007E

6,602

12,816

0

0

(320)

12,496

2008E

55,016

10,821

17,450

83,287

858

$84,145

66,842

11,721

27,600

106,162

897

$107,059

231,036

42,812

77,693

351,541

3,310

$354,850

251,829

45,809

93,231

390,869

165

$391,035

269,345

65,022

1,065

355

(355)

1,065

19,418

295,888

71,968

18,635

1,558

4,941

(1,955)

$23,179

1,173

391

(391)

1,173

22,006

7,482

14,524

(363)

14,161

Net income

Basic net income per common share:

Income from continuing operations

Income from discontinued operation

Basic net income per common share

Diluted net income per common share:

Income from continuing operations

Income from discontinued operation

Diluted net income per common share

Weighted-average number of common shares:

Basic

Diluted

Dividends per common share

$6,295 $6,671 $7,955 $9,054 $2,627 $10,267

1.41

1.40

4,465

4,484

1.49

1.77

0.03

1.80

1.76

0.03

1.79

1.49

4,465

4,481

4,430

4,446

0.30

16.8%

4,363

4,373

0.36

17.4%

2.03

0.05

2.08

2.03

0.04

2.07

0.59

0.59

4,259

4,266

0.0%

4,259

4,266

0.52

21.6%

2.41

2.41

2.41

2.41

$2,461

0.58

0.58

4,228

4,234

0.0%

$2,805 $2,374

0.67

0.67

4,175

4,180

0.0%

0.57

0.57

4,165

4,169

0.0%

$3,589 $11,229

4,166

4,170

0.0%

0.86

0.86

0.86

0.86

4,166

4,170

0.60

22.4%

0.86

2.68

0.86

2.68

$2,657

4,124

4,128

0.0%

0.64

0.64

0.64

0.64

$2,912

4,083

4,087

0.0%

0.71

0.71

0.71

0.71

$3,054

4,042

4,046

0.0%

0.76

0.76

0.75

0.75

$3,873 $12,496 $14,161

4,002

4,006

0.0%

0.97

0.97

0.97

0.97

4,042

4,046

0.0%

3.08

3.08

3.08

3.08

4,002

4,006

0.0%

3.54

3.54

3.54

3.54

Exhibit II: Pro Forma Income Statement Assumptions

Assumptions

2001 2002 2003

Actual

2004 01/31/2005

As a % of Net Sales

Wal-Mart Stores

Sam's Club

International

63.7%

14.0%

16.8%

63.9%

13.5%

16.3%

68.4%

13.8%

17.8%

68.0%

13.5%

18.6%

67.9%

12.9%

19.3%

2005 04/30/2005 07/31/2005 10/31/2005 01/31/2006

67.3%

13.0%

19.7%

67.2%

12.9%

19.9%

67.4%

13.0%

19.6%

66.6%

13.3%

20.1%

67.5%

11.9%

20.6%

YOY (QOQ) Growth

Wal-Mart Stores

Sam's Club

International

Net Sales

Other income, net

Total Revenue

Weighted Ave. Shares:

Basic

Diluted

Margins

Gross Margin (% of Net Sales)

Operating Margin

Wal-Mart Store Operating Margin

Sam's Club Margin

International Margin

Other

Total Operating Margin

Net Margin

Interest as a % of Sales:

Debt

Capital leases

Interest income

Interest, net

Taxes as % of EBTMI:

Current

Deferred

Total Provision for Taxes

22.4%

7.9%

3.5%

3.0%

-0.1%

5.9%

3.3%

0.6%

0.1%

-0.1%

0.6%

33.1%

3.4%

36.5%

2002

14.1%

9.7%

10.5%

13.8%

4.8%

13.8%

0.0%

-0.1%

22.1%

7.3%

3.5%

3.7%

-0.3%

5.4%

3.0%

0.5%

0.1%

-0.1%

0.5%

36.7%

1.7%

36.2%

2003

12.9%

7.8%

15.0%

5.4%

4.7%

5.4%

-0.8%

-0.8%

23.2%

7.5%

3.2%

4.9%

-0.6%

5.7%

3.4%

0.3%

0.1%

-0.1%

0.4%

38.4%

3.8%

35.2%

2004 01/31/2005

10.9% 11.3%

8.9%

16.6%

7.8%

48.0%

11.6% 16.4%

19.9% 171.1%

11.7% 16.9%

-1.5%

-1.6%

-1.5%

-1.6%

23.4%

7.4%

3.3%

5.0%

-0.5%

5.8%

3.5%

0.3%

0.1%

-0.1%

0.3%

48.8%

1.2%

36.1%

22.7%

8.4%

3.4%

6.5%

-0.3%

7.1%

4.2%

0.1%

0.1%

0.0%

0.2%

0.0%

0.0%

37.8%

7.4%

3.4%

5.3%

-0.5%

6.0%

3.6%

0.3%

0.1%

-0.1%

0.3%

2005 04/30/2005 07/31/2005 10/31/2005 01/31/2006

10.1% 9.3% 10.4% 9.5% 42.9%

7.5%

18.3%

5.9%

12.4%

5.9%

12.3%

10.3%

12.0%

33.6%

53.9%

11.3%

17.6%

11.3%

9.5%

13.5%

9.5%

10.2%

-3.8%

10.0%

10.1%

7.2%

10.1%

43.8%