Year 11 accounting term 2 homework sheet

advertisement

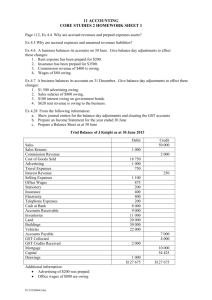

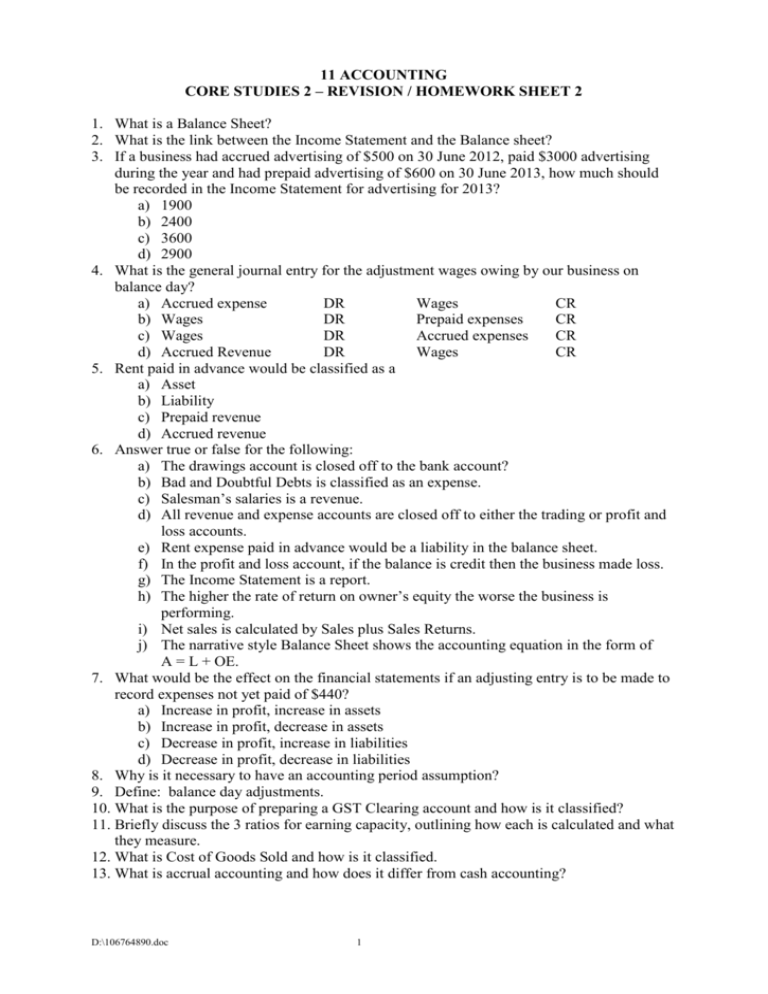

11 ACCOUNTING CORE STUDIES 2 – REVISION / HOMEWORK SHEET 2 1. What is a Balance Sheet? 2. What is the link between the Income Statement and the Balance sheet? 3. If a business had accrued advertising of $500 on 30 June 2012, paid $3000 advertising during the year and had prepaid advertising of $600 on 30 June 2013, how much should be recorded in the Income Statement for advertising for 2013? a) 1900 b) 2400 c) 3600 d) 2900 4. What is the general journal entry for the adjustment wages owing by our business on balance day? a) Accrued expense DR Wages CR b) Wages DR Prepaid expenses CR c) Wages DR Accrued expenses CR d) Accrued Revenue DR Wages CR 5. Rent paid in advance would be classified as a a) Asset b) Liability c) Prepaid revenue d) Accrued revenue 6. Answer true or false for the following: a) The drawings account is closed off to the bank account? b) Bad and Doubtful Debts is classified as an expense. c) Salesman’s salaries is a revenue. d) All revenue and expense accounts are closed off to either the trading or profit and loss accounts. e) Rent expense paid in advance would be a liability in the balance sheet. f) In the profit and loss account, if the balance is credit then the business made loss. g) The Income Statement is a report. h) The higher the rate of return on owner’s equity the worse the business is performing. i) Net sales is calculated by Sales plus Sales Returns. j) The narrative style Balance Sheet shows the accounting equation in the form of A = L + OE. 7. What would be the effect on the financial statements if an adjusting entry is to be made to record expenses not yet paid of $440? a) Increase in profit, increase in assets b) Increase in profit, decrease in assets c) Decrease in profit, increase in liabilities d) Decrease in profit, decrease in liabilities 8. Why is it necessary to have an accounting period assumption? 9. Define: balance day adjustments. 10. What is the purpose of preparing a GST Clearing account and how is it classified? 11. Briefly discuss the 3 ratios for earning capacity, outlining how each is calculated and what they measure. 12. What is Cost of Goods Sold and how is it classified. 13. What is accrual accounting and how does it differ from cash accounting? D:\106764890.doc 1 14. The following list of balances has been extracted from the books of Robert Standing on 30 June 2013. You are required to prepare: a) b) c) d) General Journal entries for the balance day adjustments Income statement Balance sheet Calculate the following ratios, showing all formulae, working and answers (rounded to 2 decimal places): gross profit ratio net profit ratio rate of return on owner’s equity e) Write three paragraphs analysing the above ratios and make recommendations for improvement, where necessary Account Accounts Payable Accounts Receivable Bad Debts Bank Capital Cartage Outwards Commission Revenue Cost of Goods Sold Drawings Electricity Furniture and Fittings GST Clearing Insurance Inventories Land and Buildings Mortgage Motor Vehicles Plant and Equipment Rent Expense Sales Sales Returns Wages Amount 43 100 56 700 1 566 47 322 113 479 789 9 560 115 154 5 000 4 338 35 000 10 320 6 000 37 800 100 000 70 000 30 000 60 000 9 450 301 000 6 000 32 340 Balance Day Adjustments as at 30 June 2013: $250 of electricity is prepaid Insurance expense is prepaid $4 000 Accrued wages is $200 Commission received in advance is $800 Interest revenue earned but not received is $300 D:\106764890.doc 2 15. 2.38 End-of-year reports incorporating balance-day adjustments The following list of balances has been extracted from the books of C Wessel on 30 June 2013. You are required to prepare: 1. relevant general journal entries 2. income statement 3. balance sheet 4. ratios for net profit, gross profit, rate of return on owner's equity (rounded to 2 decimal places) 5. an analysis of the three ratios in paragraph format Account Amount $ 189 500 321 500 120 400 100 400 600 185 000 123 550 63 000 17 220 50 981 6 000 619 4 500 400 790 900 25 000 76 000 250 15 000 4 100 20 000 8 000 12 000 4 110 20 000 65 000 Accounts receivable Sales Buildings Mortgage Cartage outwards Capital Bank Inventories Accounts payable Cost of goods sold Sales returns Drawings GST clearing Advertising expense Commission revenue Insurance Land Loan Light and power Motor vehicle Bad debts Office furniture Equipment Rent revenue Rent expense Wages Plant and equipment Balance day adjustments as at 30 June 2013: ∎ $76 of cartage outwards is prepaid. ∎ $600 Insurance expense is prepaid. ∎ Accrued rent expense is $200. ∎ Rent received in advance is $1000. ∎ Commission revenue earned but not received is $200. D:\106764890.doc 3 16. 2.39 End-of-year reports incorporating balance-day adjustments The following list of balances has been extracted from the books of C Ryan on 30 June 2013. You are required to prepare: 1. relevant general journal entries 2. income statement 3. balance sheet 4. ratios for net profit, gross profit, rate of return on owner's equity 5. an analysis of the three ratios, approximately 300 – 400 words Account Amount $ 28 870 6 410 170 509 145 29 000 6 000 278 235 000 46 000 120 000 4 709 1 266 10 000 110 025 900 410 800 4 000 150 170 6 700 418 9200 16 510 4 000 120 33 000 186 400 250 71 600 10 000 Cost of goods sold Commission revenue Bank Telephone Land Patents Advertising Sales Inventories Building Sales returns Bad debts Motor vehicle Accounts receivable Insurance Rates Interest revenue Rent expense Delivery expenses Cost of printing Rent revenue Commission expense Office salaries Accounts payable Shares Interest expense Loan Mortgage Drawings Capital Furniture Balance-day adjustments as at 30 June 2013: ∎$42 of the telephone expenses relate to the next accounting period. ∎Interest revenue of $150 has been earned but not received. ∎$160 of rent revenue has been received before it has been earned. ∎$100 of advertising expense has been incurred but not paid. ∎ Office salaries expense incurred but not paid is $1500. D:\106764890.doc 4 17. The following list of accounts was extracted from the books of M Hogan on 30 June 2013. You are required to prepare: a) b) c) d) e) the relevant General Journal entries for adjustments Income Statement Balance Sheet ratios for net profit, gross profit, rate of return on owner's equity an analysis of the three ratios, approximately 300 – 400 words Account Name Amount 53 100 400 23 000 2 000 1 240 33 320 1300 5 080 11 620 480 1 720 1 240 1 192 1 100 2 680 2 080 5 480 600 23 352 12 000 1 000 560 1 600 10 000 Sales Delivery Expense Premises Goodwill Rent Revenue Cost of Goods Sold GST Clearing Sales Salaries Accounts Receivable Sales Returns Office Salaries Sundry Office Expenses Cash at Bank Electricity Drawings Office Furniture Accounts Payable Interest Received Capital Loan from bank Commission Received Insurance Advertising Inventories Additional information Sales Salaries owing to sales staff $120 Insurance paid in advance $80 Rent not yet received $400 Advertising of $400 was for the next financial year Interest of $360 is due on the loan from the bank. D:\106764890.doc 5 18. The following list of accounts was extracted from the books of Brett Gavin on 30 June 2013. You are required to prepare: a) b) c) d) e) the relevant General Journal entries for adjustments Income Statement Balance Sheet ratios for net profit, gross profit, rate of return on owner's equity an analysis of the three ratios, approximately 300 – 400 words At the end of the financial year the following adjustments were determined to be necessary Rent of $90 owing. Insurance of $50 was paid in advance. Interest revenue was owing to us of $100. LEDGER BALANCES OF BRETT GAVIN Capital Bank overdraft Insurance Electricity Accounts payable Cost of goods sold Drawings Accounts receivable Sales Sales returns Telephone Motor vehicle Stationery expenses Rent expense GST collected GST credits received Bad debts Mortgage Land Delivery expenses Rates Salaries Inventories Fixtures and fittings D:\106764890.doc 6 16 600 7 500 4 200 1 400 36 000 165 500 13 800 37 000 285 800 2 000 1 000 20 000 1 600 7 900 6 000 3 600 3 800 50 000 50 000 2 100 1 500 25 000 24 000 37 500 19. From the following list of account balances extracted from the General Ledger of Coastal Properties, you are required to prepare: a) b) c) d) the necessary balance day adjustment entries in the general journal; the Income Statement; the Balance Sheet (narrative style); the three earning capacity ratios. Coastal Properties Account Balances as at 30 June 2013 Account Balance Accounts Payable Capital (1/7/12) Shares in Rio Tinto Cash at Bank Accounts Receivable Commission Revenue Cost of Goods Sold Wages and Salaries Rent Revenue Inventories Sales GST Clearing Insurance Sales Returns Drawings Land and Buildings 2 550 99 500 14 000 11 260 2 530 3 040 32 000 28 000 4 500 12 000 127 000 1 400 (CR) 1 500 2 000 4 000 130 700 Balance day adjustments as at 30 June 2013: Rent of $400 was received in advance The insurance premium of $850 was paid in advance Commission revenue owing at 30 June 2013 of $200 $1 000 wages and salaries are owing 20. Using Excel, type general journal entries for the following transactions. a) b) c) d) e) f) g) h) i) j) k) l) m) n) o) p) D:\106764890.doc Insurance of $6600 was paid in advance Sales Salaries owing are $1500 Rent owing to the business at 30 June is $1500 Commission of $300 was received in advance Prepaid insurance expense $500 Unearned commission revenue $1000 Wages & salaries owing $1000 Accrued interest revenue $600 Rent received in advance $100 Prepaid Insurance $300 Accrued Interest Expense $250 Advertising of $50 was paid in advance Interest revenue was owing to us of $100 The insurance premium of $750 was paid in advance Commission revenue owing at 30 June of $100 $100 owing for advertising 7