Solution to MQ 1 - The University of Texas at Arlington

advertisement

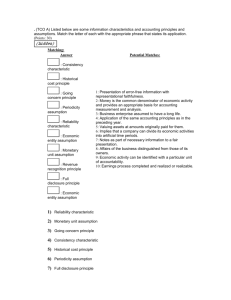

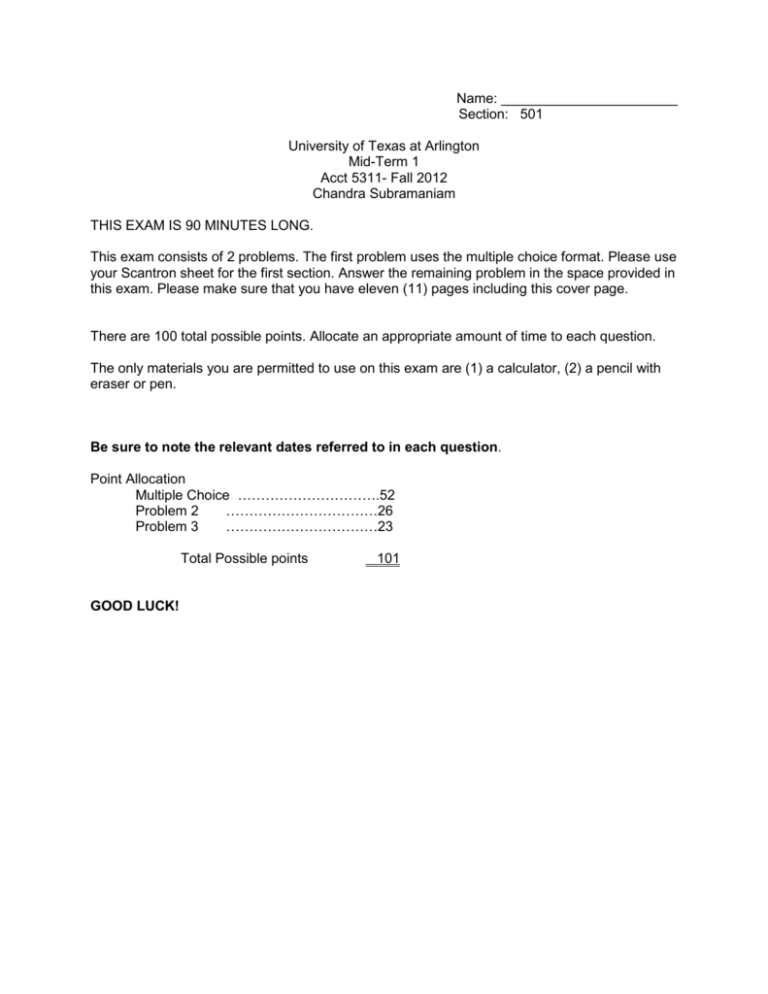

Name: _______________________ Section: 501 University of Texas at Arlington Mid-Term 1 Acct 5311- Fall 2012 Chandra Subramaniam THIS EXAM IS 90 MINUTES LONG. This exam consists of 2 problems. The first problem uses the multiple choice format. Please use your Scantron sheet for the first section. Answer the remaining problem in the space provided in this exam. Please make sure that you have eleven (11) pages including this cover page. There are 100 total possible points. Allocate an appropriate amount of time to each question. The only materials you are permitted to use on this exam are (1) a calculator, (2) a pencil with eraser or pen. Be sure to note the relevant dates referred to in each question. Point Allocation Multiple Choice ………………………….52 Problem 2 ……………………………26 Problem 3 ……………………………23 Total Possible points GOOD LUCK! 101 Problem 1 Multiple Choice (2 points each x 26=52 points) Identify the letter of the choice that best completes the statement or answers the question. 1. The financial statements most frequently provided include all of the following except the a. balance sheet. b. income statement. c. statement of cash flows. d. statement of retained earnings. 2. Accrual accounting is used because a. cash flows are considered less important. b. it provides a better indication of ability to generate cash flows than the cash basis. c. it recognizes revenues when cash is received and expenses when cash is paid. d. none of the above. 3. What is the relationship between the Securities and Exchange Commission and accounting standard setting in the United States? a. The SEC requires all companies listed on an exchange to submit their financial statements to the SEC. b. The SEC coordinates with the AICPA in establishing accounting standards. c. The SEC has a mandate to establish accounting standards for enterprises under its jurisdiction. d. The SEC reviews financial statements for compliance. 4. Why was it believed that accounting standards that were issued by the Financial Accounting Standards Board would carry more weight? a. Smaller membership. b. FASB board members are well-paid. c. FASB board members must be CPAs. d. Due process. 5. Which of the following is not a publication of the FASB? a. Statements of Financial Accounting Concepts b. Accounting Research Bulletins c. Interpretations d. Technical Bulletins 6. Which of the following is not a part of generally accepted accounting principles? a. FASB Interpretations b. CAP Accounting Research Bulletins c. APB Opinions d. All of these are part of generally accepted accounting principles. 7. The objectives of financial reporting include all of the following except to provide information that a. is useful to the Internal Revenue Service in allocating the tax burden to the business community. b. is useful to those making investment and credit decisions. c. is helpful in assessing future cash flows. d. identifies the economic resources (assets), the claims to those resources (liabilities), and the changes in those resources and claims. 8. Which of the following is a fundamental characteristic of useful accounting information? a. Comparability. b. Relevance. c. Neutrality. d. Materiality. 9. Which of the following is an ingredient of relevance? a. Verifiability. b. Neutrality. c. Timeliness. d. Materiality. 10. Changing the method of inventory valuation should be reported in the financial statements under what qualitative characteristic of accounting information? a. Consistency. b. Verifiability. c. Timeliness. d. Comparability. 11. The pervasive criterion by which accounting information can be judged is that of a. decision usefulness. b. freedom from bias. c. timeliness. d. comparability. 12. In classifying the elements of financial statements, the primary distinction between revenues and gains is a. the materiality of the amounts involved. b. the likelihood that the transactions involved will recur in the future. c. the nature of the activities that gave rise to the transactions involved. d. the costs versus the benefits of the alternative methods of disclosing the transactions involved. 13. Which basic element of financial statements arises from peripheral or incidental transactions? a. Assets. b. Liabilities. c. Gains. d. Expenses. 14. What accounting concept justifies the usage of depreciation and amortization policies? a. Going concern assumption b. Fair value principle c. Full disclosure principle d. Monetary unit assumption 15. A journal entry to record a payment on account will include a a. debit to accounts receivable. b. credit to accounts receivable. c. debit to accounts payable. d. credit to accounts payable. 16. Charging off the cost of a wastebasket with an estimated useful life of 10 years as an expense of the period when purchased is an example of the application of the a. consistency characteristic. b. expense recognition principle. c. materiality characteristic. d. historical cost principle. 17. The failure to properly record an adjusting entry to accrue an expense will result in an: a. understatement of expenses and an understatement of liabilities. b. understatement of expenses and an overstatement of liabilities. c. understatement of expenses and an overstatement of assets. d. overstatement of expenses and an understatement of assets. 18. At the time a company prepays a cost a. it debits an asset account to show the service or benefit it will receive in the future. b. it debits an expense account to match the expense against revenues earned. c. its credits a liability account to show the obligation to pay for the service in the future. d. more than one of the above. 19. Unearned revenue on the books of one company is likely to be a. a prepaid expense on the books of the company that made the advance payment. b. an unearned revenue on the books of the company that made the advance payment. c. an accrued expense on the books of the company that made the advance payment. d. an accrued revenue on the books of the company that made the advance payment. 20. 21. 22. An unearned revenue can best be described as an amount a. collected and currently matched with expenses. b. collected and not currently matched with expenses. c. not collected and currently matched with expenses. d. not collected and not currently matched with expenses. Panda Corporation paid cash of $30,000 on June 1, 2012 for one year’s rent in advance and recorded the transaction with a debit to Prepaid Rent. The December 31, 2012 adjusting entry is a. debit Prepaid Rent and credit Rent Expense, $12,500. b. debit Prepaid Rent and credit Rent Expense, $17,500. c. debit Rent Expense and credit Prepaid Rent, $17,500. d. debit Prepaid Rent and credit Cash, $12,500. Starr Corporation loaned $150,000 to another corporation on December 1, 2012 and received a 3-month, 8% interest-bearing note with a face value of $150,000. What adjusting entry should Starr make on December 31, 2012? a. Debit Interest Receivable and credit Interest Revenue, $3,000. b. Debit Cash and credit Interest Revenue, $1,000. c. Debit Interest Receivable and credit Interest Revenue, $1,000. d. Debit Cash and credit Interest Receivable, $3,000. 23. The income statement of Dolan Corporation for 2012 included the following items: Interest revenue $131,000 Salaries and wages expense 170,000 Insurance expense 15,200 The following balances have been excerpted from Dolan Corporation's balance sheets: December 31, 2012 December 31, 2011 Interest receivable $18,200 $15,000 Salaries and wages payable 17,800 8,400 Prepaid insurance 2,200 3,000 The cash received for interest during 2012 was a. $112,800. b. $127,800. c. $131,000. d. $134,200. 24. Garcia Corporation received cash of $24,000 on August 1, 2012 for one year's rent in advance and recorded the transaction with a credit to Rent Revenue. The December 31, 2012 adjusting entry is a. debit Rent Revenue and credit Unearned Rent Revenue, $10,000. b. debit Rent Revenue and credit Unearned Rent Revenue, $14,000. c. debit Unearned Rent Revenue and credit Rent Revenue, $10,000. d. debit Cash and credit Unearned Rent Revenue, $14,000. 25. In November and December 2012, Lane Co., a newly organized magazine publisher, received $75,000 for 1,000 three-year subscriptions at $25 per year, starting with the January 2013 issue. Lane included the entire $75,000 in its 2012 income tax return. What amount should Lane report in its 2012 income statement for subscriptions revenue? a. $0. b. $4,167. c. $25,000. d. $75,000. 26. Colaw Co. pays all salaried employees on a biweekly basis. Overtime pay, however, is paid in the next biweekly period. Colaw accrues salaries expense only at its December 31 year end. Data relating to salaries earned in December 2012 are as follows: Last payroll was paid on 12/26/12, for the 2-week period ended 12/26/12. Overtime pay earned in the 2-week period ended 12/26/12 was $15,000. Remaining work days in 2012 were December 29, 30, 31, on which days there was no overtime. The recurring biweekly salaries total $270,000. Assuming a five-day work week, Colaw should record a liability at December 31, 2012 for accrued salaries of a. b. c. d. $81,000. $96,000. $162,000. $177,000. Problem 2 (26 points) Listed below are several information characteristics and accounting principles and assumptions. Match the letter of each with the appropriate phrase that states its application. (Items a through k may be used more than once or not at all.) a. b. c. d. e. f. Economic entity assumption Going concern assumption Monetary unit assumption Periodicity assumption Historical cost principle Revenue recognition principle g. h. i. j. k. Expense recognition principle Full disclosure principle Relevance characteristic Faithful representation characteristic Consistency characteristic ____ 1. Stable-dollar assumption (do not use historical cost principle). ____ 2. Earning process completed and realized or realizable. ____ 3. Numbers and descriptions match what really existed or happened. ____ 4. Yearly financial reports. ____ 5. Accruals and deferrals in adjusting and closing process. (Do not use going concern.) ____ 6. Useful standard measuring unit for business transactions. ____ 7. Notes as part of necessary information to a fair presentation. ____ 8. Affairs of the business distinguished from those of its owners. ____ 9. Company assumed to have a long life. ____ 10. Valuing assets at amounts originally paid for them. ____ 11. Application of the same accounting principles as in the preceding year. ____ 12. Summarizing significant accounting policies. ____ 13. Presentation of timely information with predictive and feedback value. Solution 2-137 1. c 2. f 3. j 4. d 5. g 6. c 7. h 8. a 9. b 10. e 11. k 12. h 13. i Problem 3. (23 points) Part A Prepare the appropriate transactional journal entries for each transaction below: (8 points) a. Interest Receivable: Jan. 1 accrued, $3,000, Dec. 31 accrued, $2,100, earned for the year, $35,000. Prepare the entry to record cash interest received. Cash $35,900 Interest receivable $35,900 b. Accounts Payable: Jan. 1, balance $25,000, Dec. 31, balance $44,000, purchases on account for the year, $120,000. Prepare the entry to record payments on account. Accounts payable Cash $101,000 $101,000 Part B Prepare the appropriate adjusting journal entries you would have prepared on 12/31/2008 for the information provided below. (15 points) a. Unearned rent at 1/1/08 was $5,300 and at 12/31/08 was $8,000. The records indicate cash receipts from rental sources during 2008 amounted to $40,000, all of which was credited to the Unearned Rent Account. Unearned Rent Revenue ......................................................... Rent Revenue …………………………………………………. 37,300 37,300 b. Allowance for doubtful accounts on 1/1/08 was $50,000. The balance in the allowance account on 12/31/08 after making the annual adjusting entry was $65,000 and during 2008 bad debts written off amounted to $30,000. Bad Debt Expense .................................................................. Allowance for Doubtful Accounts…………………………….. 45,000 45,000 c. Prepaid rent at 1/1/08 was $9,000. During 2008 rent payments of $120,000 were made and charged to "rent expense." The 2008 income statement shows as a general expense the item "rent expense" in the amount of $125,000. Rent Expense .................................................................... Prepaid Rent …………………………………………. 5,000 5,000