The Middle Class Family Paying for College

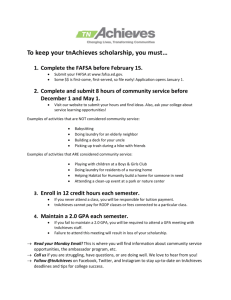

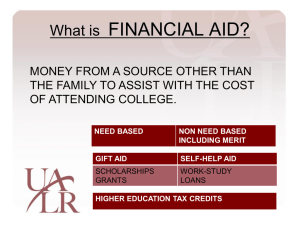

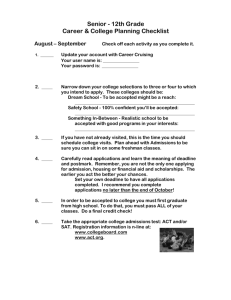

advertisement

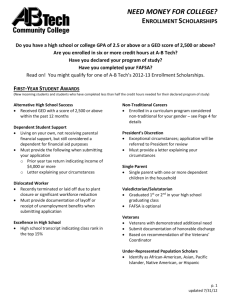

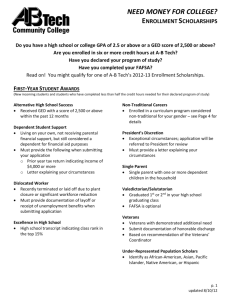

2012-2013 High School Financial Aid Presentation Bob Montez Outreach Financial Aid Advisor COST OF ATTENDANCE (COA) Estimated Cost for 9 months 24 credit hours for Fall/Spring Tuition & Fees Housing Books & Supplies Miscellaneous Transportation __ ($7084) ($9020) ($992) ($1475) ($953)__ $19,524 • • • Amount family can reasonably be expected to contribute. Stays the same regardless of college. Calculated using FAFSA data and a federal formula Texas Grant Eligible Pell Grant Max Grant $5550 Max EFC 5000 12 semesters at full-time (6 years) or equivalent of 24 semester at half-time. First priority students awarded requirements: EFC less than 4000 & meeting 2 of the four categories below I. Advanced Academic Programs Earn 12 hours of college credit courses (e.g. dual credit, AP); or Graduate under the Distinguished Achievement High School Plan or Graduate under the International Baccalaureate High School Program. II. Advanced Math Complete a math course beyond Algebra II III. Class Standing Rank in top 25% of high school class; Attain a B average GPA (e.g. 3.0 GPA on a 4.0 scale) IV. College Readiness Achieve college readiness threshold as determined by the Texas Success Initiative (TSI) (e.g. THEA, COMPASS, ASET); or Be TSI exempt (e.g. meet minimum score on SAT/ACT, TAKS). Once all priority students are awarded, the students who meet the requirements below will be awarded pending available funding. $2000/year scholarship Must be in top 10% of high school class Renewable with 3.25 GPA Enrolled in 30hrs/yr. Must have “financial need” (At least $1) Must submit FAFSA by March 15th Federal College Work Study State College Work Study Community Service Jobs FEDERAL DIRECT STUDENT LOAN RATES FOR 2012-2013 Direct Subsidized Loans • Fixed 3.4% int. rate, no payments while in school. Direct Unsubsidized Loan • Fixed 6.8% int. rate, no payments while in school. Parent Loan for Students (PLUS) • Fixed 7.9% int. rate, payment plan varies, 10 year repayment plan. The state has programs for students who: • • • • • Were in foster care Were adopted (after age 13) Were the highest ranking scholar for their school Are blind or deaf Are Texas Veterans (Hazelwood) Visit www.collegefortexans.com for fact sheets & links to other higher education resources for students www.FAFSA.ed.gov Cost of Attendance Expected Family Contribution ____________________________ = Financial Need • • • • • • Presidential Scholars Islander Scholar Academic Achievement The Student Leader Scholarships Rising Scholars Scholarship And many others… • • • • • Presidential Top Scholar: $8000/year Presidential Finalist Scholar: $4000/year Presidential Scholarship: $3000/year Islander Scholar: $2500/year Academic Achievement: $2000 per year Must meet one of the following qualifications: • Rank in the top 15% of senior class • SAT (V+Q) score of 1100 or higher • ACT composite score of 24 or higher • • • • First-time freshmen Top 50% of their high school class Recipients of another University Scholarship of $1000 or greater are not eligible for this scholarship program $1000 per year Apply through ApplyTexas.org • • • Now combined with online admissions application Application available September 1 Deadline to apply is December 1 • Financial aid is intended to make a college education available to families in a number of different financial situations; everyone qualifies for something. • Income is only one of many factors considered. • A growing number of institutional and private scholarships require that students fill out the FAFSA as part of their application process. • If your parent(s) are still alive, federal guidelines require that biological parent’s information be used to fill out the Free Application for Federal Student Aid (FAFSA) unless someone else is your legal guardian. • Guardianship as determined by a Judge or Court of law in your state of residence. Student may file as an independent. A student is NOT considered independent between the ages of 18-24 unless they are married, a veteran, have children and provide 50% of support to the child, are in legal guardianship, or have been declared a homeless/unaccompanied youth (proof needed). A student filing their own taxes does NOT make them independent. A student living separate from their parents does Not automatically make them independent. • The parent whom the student resided with the longest over the last 12 months provides their information on the FAFSA; both parents are not required. • If you lived with each parent for an equal number of days, use the income information from the parent who provided you with the most support during the last 12 months. • "Support" means money for such things as housing, food, clothing, transportation, medical care and school. • Stepparent's information must be included on your financial aid application if you lived in the stepparent's household for 6 weeks (42 days) or more during the previous or current year or if a stepparent contributed more than $750 in "support" during the previous or current year. • "Support" means money for such things as housing, food, clothing, transportation, medical care and school. Satisfactory Academic Progress (SAP) Students receiving Financial Assistance: Must maintain 2.0 GPA-undergrad Must complete 67%+ of credit hours attempted Failure to meet this standard results in Financial Aid suspension Students may appeal with OSFA Students will not receive aid until their SAP is sufficient Students must pay for classes while on suspension themselves Satisfactory Academic Progress (SAP) Counselors please be aware, that due to recent federal regulations, A students dual credit course work can impact their ability to receive financial assistance as an incoming freshmen. Example: History 1301 English 1301 3hrs 3hrs Dropped Class D Student will have a 50% completion rate and a 1.0 GPA coming into college. This student will be on financial aid suspension and will now have to appeal with the college’s Financial Aid office. PRIVATE SCHOLARSHIPS Tips for finding scholarships: • • • • Parent & student’s employers Student’s middle school and elementary. Local community & church organizations. Websites offering scholarship searches: Fastweb.com AIE.org studentscholarshipsearch.com Institutional Scholarships • December 1st 2013-2014 Fall/Spring Financial Assistance March 15th (Top 10%) March 31st (FAFSA at TAMUCC) Summer Financial Assistance • February 15 Contact Information Bob Montez Outreach Financial Aid Advisor Office: 361-825-5622 Fax: 361-825-6095 Email: Robert.Montez@tamucc.edu