TRADE IN ISLAM

advertisement

TRADE IN ISLAM

DR. ALIMI SAHEED CIFE,CISSA,CIFA.

Trade Transactions

Trade is permissible according to the Quran,

Sunnah, consensus of Muslim scholars and

analogical deduction.

Allah Says: “...but Allah has permitted trade..” (AlBaqarah:275)

And: “There is no blame upon you for seeking bounty

from your Lord” (Al- Baqarah:198)

Trade Transactions

• “ ...but only {in lawful} business by mutual

consent....” (Quran: An-Nisa: 29)

• “ Selling should be only by mutual consent”. (related

by Ibn Hibban, Ibn Majah)

• “ Do not sell what you do not have (or possess)’.

• “ Allah and His messenger prohibited the trade of

intoxicants, dead animals, pigs, and idols”. ( related

by Al- Bukhari and Muslim)

Legitimacy of Sales (Trading)

Qur’an Texts

Hadith Texts

The prophet was asked: which are the best form of

income generations? He replied: a man’s labour and

every legitimate sale. ( al-jami’ As-saghir).

The truthful and honest trader is among is among

the prophet , the righteous and the martyrs ( AtTirmidhi).

Salaf-as-Saliheen texts:

Imam ash-Shafi’i stated: the general rle for all sales

is permissibility as long as they are concluded by

consenting, capable decisions makers, except for

what the messenger of Allah has forbidden; or what

is sufficiently similar to what the messenger of Allah

has forbidden; anything different from those is

permissible following the permissibility of sales

stated in the book of Allah Almighty. (Al-Fiqh alIslami wa adillatuh).

Ethics of Trading

Avoidance of excessive profit.

Complete disclosure of information: all merchants

are resurrected on the of judgement as sinners,

except those who feared Allah, treated their

customers well and were truthful (at Tirmidhi).

Ease of conduct: Allah is merciful to the man who is

easy when he sells, when he buys and when he

collects his loans(Bukhari).

Avoidance of swearing even if truthful: swearing

destroys the goods and wipes out their blessings

(Bukhari/Muslim).

Frequent paying of charity: O merchants, the devil

and sins are present at each sales, so purify your

sales with charity (Abu Dawood).

Documentation and witnessing of all debts and

future contracts.

Trade Transactions

• “ ...but only {in lawful} business by mutual

consent....” (Quran: An-Nisa: 29)

• “ Selling should be only by mutual consent”. (related

by Ibn Hibban, Ibn Majah)

• “ Do not sell what you do not have (or possess)’.

• “ Allah and His messenger prohibited the trade of

intoxicants, dead animals, pigs, and idols”. ( related

by Al- Bukhari and Muslim)

Basic Concept of Trade

‘Iwad (counter value)

Ghorm (risk)

Kasb (effort)

Daman (guarantee)

Conditions for a valid sale

Halal products

Ownership of commodity

Existence and possession of Commodity

Valid contract

Haram Trade

Habali-il-habala

Musabada ( fresh for dry date)

Muhaqala (sale of wheat in ears)

Selling of animated pictures

Sale of pigs/dead animals

Mulaamasa

Bay’ al -Ina

Types of Invalid Sales

Sale of a non existent object

Sale of undeliverable goods

Sale of liabilities(including debts)

Sale of liabilities with a deferred price

Sale of IOUs

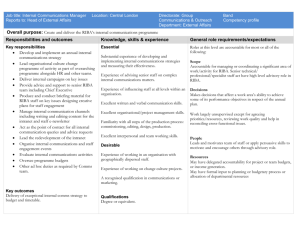

BASIC PRINCIPLES OF IF

It is based on the following principles:

Prohibition of RIBA

Application of AL-BAY’

Avoidance of GHARAR

Prohibition of MAYSIR

Prohibition from HARAM TRADE

RIBA

Definition of Riba

Types of Riba

Prohibiting Dealing in Riba

Definition of Riba

The lexical meaning of “riba” is “increase”.

Allah (SWT) said: “But when we pour down rain on

it, it is stirred to life, and it swells (rabat){22:5}.

Thus, the growth that comes forth from the ground is

labelled as riba.

The definition of Riba covers both riba al-nasi’ah as

well as defective sales.

Prohibition of Riba.

Riba is forbidden in the Quran, as stated in the

verses {2:275-279}:

Those who devour usury (riba) will not stand except

as stands one whom the Evil One by his touch hath

driven to madness. That is because they say: ‘trade is

like riba’, but Allah hath permitted trade and

forbidden riba.

Prohibition of Riba Contd.

‘O you who believe, fear Allah, and and give up what

still remains of riba, if you are believers.

But if you do not, then take notice of a war from

Allah and His messenger but if you turn back, you

shall get your capital sums without increase or

decrease.{Q2:275-276 & 278-279}

Prohibition of Riba

‘Ibn Masud narrated that “the messenger of Allah

(saw) cursed the one who devours riba, the one who

pays it, the one who witnesses it, and the one who

documents it”.

Riba is like committing Adultery 36 times after the

advent of Islam.(Ahmad)

Riba is 72 degrees of (evil) the least of which

resembles committing adultery with ones mother

(Ibn Majah)

The Prophet (SAW) also says:

‘There will come a time for people when they will

consider riba lawful by means of trade’.

‘If you sell to one another with inah , hold the tails of

cows, are pleased with agriculture, and give up jihad

, Allah will make disgrace prevail over you and will

not withdraw it until you return to your

religion’.(Abu Dawud)

‘There will come a time when people will eat riba

even the one who will not eat it may not spare its

dust’.

Types of Riba

Riba al-nasi’ah(Delay Usury): this was the

only type known to pre-Islamic Arabia. This is the

riba collected in compensation for deferring a due

debt to a new term of deferment.

Types of Riba Contd.

• Riba al-buyu(Excess/Trade Usury), :It is also

known as riba al-fadl, which is the trading of one set

of goods that are eligible for riba for another set of

the same goods, with an increase of one

compensation over the other.

Riba al Fadl

The prophet (SAW) states this type of transaction is

prohibited in six items: “Gold is to be paid for gold,

silver for silver, wheat for wheat, barley for barley,

dates for dates and salt for salt, like for like and

equal for equal and payments is to be made hand for

hand.

The prophet also states, ‘if this classes defer, then

sale as you wish, if payment is made hand to hand.’

Islamic Finance Options

MUSHAARAKAH(PARTNERSHIPS)

MUDAARABAH

MURAABAHAH

IJAARAH

DIMINISHING MUSHAARAKAH

SALAM

ISTISNA’

Mushaarakah

This refers to partnerships, which involves partners

sharing in provision of capital, as well as profit and

loss.

Generally speaking, the profit and loss sharing is

based on ratio of invested capital.

It helps to dissipate risk among partners while

facilitating a large capital base for the project.

A lead partner may head and be paid his wages.

Mudarabah

This refers to silent partnership, where an investor

(rabb-al- maal) partners with an entrepreneur

(mudarib) in a business venture.

The rabb-al- maal funds the venture fully while the

mudarib manages the venture.

Profit sharing ratio is determined ab initio.

In event of a loss, the mudarib losses his efforts while

the rabb-al-maal losses his funds.

Murabahah

Cost Plus Sales

It refer to a sale where the buyer and seller are both

aware of the initial price, profit margin and requires

the price be fungible.

It is a form of trust sales.

It is used mainly to finance purchases of items like

cars, business equipments etc

It is usually a two stage process requiring a request

to purchase an item and then a resell to the client,

with a profit margin and repayment in instalment

usually.

IJAARAH

Lease

This refers to the transfer of ownership of permitted

usufruct for a known period in exchange for a

compensation.i.e.to give something on rent.

This is not a form of sale

However, an approved form of sale is the Al Ijaarah

thumm al bay’(AITAB/AIMAT)

AITAB is a lease with promise to sell.

It differs from conventional hire purchase

Diminishing Musharakah (DiM)

Another form of Musharakah, developed in the

near past, is ‘Diminishing Musharakah’.

In this concept, a financier and his client

participate jointly either in ownership of a

property, equipment, or in a commercial venture.

The share of the financier is further divided into a

number of units and

Diminishing Musharakah (DiM)

It is understood that the client will purchase the

units of the share of the financier one by one

periodically, thus increasing his own share till all the

units of the financier are purchased by him so as to

make him the sole owner of the property, or the

commercial enterprise, as the case may be.

It is widely used in house financing

SALAM

Salam is a sale whereby the seller undertakes to supply

some specific goods to the buyer

at a future date in exchange of an advanced price fully

paid at spot.

Here the price is cash, but the supply of the purchased

goods is deferred.

The buyer is called “rabb-us-salam”, the seller “muslam

ilaih”, the cash price is “ra’s-ul-mal” and the purchased

commodity is termed as “muslam fih”.

For simplicity, I shall use the English synonyms of these

terms.

SALAM

Salam was allowed by the Holy Prophet (SW)

subject to certain conditions.

The basic purpose of this sale was to meet the needs

of small farmers who needed money to grow their

crops and to feed their families up to the time of

harvest. After the prohibition of riba, they could not

take usurious loans ,therefore, it was allowed for

them to sell the agricultural products in advance

Benefits of Salam

Salam is beneficial to the seller, because he receives

the price in advance

It is beneficial to the buyer also, because normally,

the price in salam is lower than

the price in spot sales.

It is a viable tool capable of revamping the

agricultural sector.

It is a spectacular finance option capable of

transforming the real sector of the economy

especially the small and medium enterprises

ISTISNA’

Istisna’ is the second kind of sale where a

commodity is transacted before it comes into

existence.

It means to order a manufacturer to manufacture a

specific commodity for the purchaser.

It is necessary for the validity of istisna’ that the

price is fixed with the consent of the parties

and that necessary specification of the commodity

(intended to be manufactured) is fully

agreed to.