The Prohibition of Riba` and Gharar

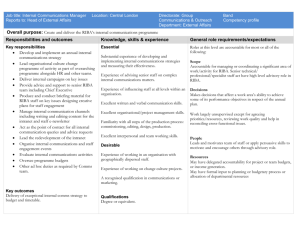

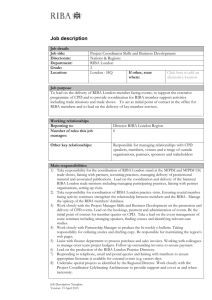

advertisement

Accounting for Islamic Banks (Lecture Week 2) Part 1 Islamic Prohibition of Riba’ The Prohibition of Riba’ and Gharar Meaning of Riba’ Literally: excess, increase, expansion or growth Definitions of Riba’ Ibn al-Arabi: every excess in return of which no reward is paid Mawdudi: predetermined excess or surplus over and above the loan received by the creditor conditionally on relation to a specified period Haque: an increase or excess which, in an exchange or sale of commodity, accrues to the owner (lender) without giving in return any equivalent counter or recompense to the other party Prohibition of Riba’ In the Qur’an - 4 Stages: 1. Surah al-Rum: 39 compare riba’ with Zakat and charity praising Zakat but not riba’ 2. Surah al-Nisa’: 160-161 attaching the practice of riba’ with the Jews Consider the practice as an inequity 3. Surah ali-Imran: 130 Prohibiting the practice of charging double and multiple riba’ Prohibition of Riba’ 4. Surah al-Baqarah: 275-281 Conclusively prohibiting all forms of riba’ Any excess over the capital is disallowed “…they say: trade is like riba’, but Allah has permitted trading and forbidden (haram) riba’ (usury)” Example in the Sunnah: “From Jabir the Prophet s.a.w cursed the receiver and the payer of riba’, the one who records it and the two witnesses to the transaction: they are alike in guilt” Types of Riba’ Riba’ al-Buyu’ (exchange transaction) Riba al-Fadl (due to excess) Riba al-Nasiah (due to delay) Example: (a) Trading commodities of the same commodities (gold – gold; dates – dates) Both commodities must be equivalent Prompt delivery (b) Trading commodities of the same group but different kinds (gold - silver; wheat – barley) Equality not a condition Prompt delivery (c) Trading commodities of different groups and kinds (gold – wheat; silver – barley) No conditions imposed i.e. free trading 1. Types of Riba’ 2. Riba’ al-Duyun (loan/debt transaction) Riba’ al-Nasi’ah (due to delay) Characteristics of Riba’ al-Nasiah 3 Elements: 1. Excess or surplus over and above the loan capital; 2. Determination of surplus in relation to time; and, 3. Stipulation of surplus in the loan agreement. Riba’ vs Trade Wisdom behind prohibition of riba’ Elimination of injustice and encourage cooperation Spirit of brotherhood Riba’ is not trading: Money loaned for self-generating or selfexpanding value is not sale Growth or increase in money is inequitable One party receives an increase without equivalent return to the other party In sale, there is productive exchange such as goods for goods and money for goods Part 2 Islamic Prohibition of Gharar Meaning of Gharar Literally: In Arabic means negative elements e.g. deceit, fraud, uncertainty, danger, risk, hazard etc. that might lead to destruction and loss Technically: uncertainty and ignorance of one or both parties of a contract over the substance or attributes of the object of sale or doubt over its existence and availability at the time of contract Gharar in the Qur’an The word Gharar appeared 27 times in the Qur’an Refer to the need of believers to be aware of the deceptive character of the worldly pleasures, and not to be deceived by such temptations Example in Surah al-Nisa’ (4:29): “O you believe! Eat not your property among yourselves unjustly (bil batil i.e. by falsehood and deception) except in a trade amongst you by mutual consent” Most jurists agreed that al-Batil refers in the above verse includes illegal and deceptive elements in commercial contracts Gharar in the Sunnah In commercial transactions, the Prophet s.a.w in many of his sayings prohibited the sale involving gharar Examples: The prohibition of sale of fish in the sea, bird in the air, unborn animals, etc. Gharar is prohibited by consensus of the jurists (ijma’) since the time of the companions, their followers (tabi’in) and subsequently until now. Reasons for prohibition of Gharar To ensure full consent and satisfaction of all parties in a contract Without full consent and satisfaction the contract is null and void Full consent can only be achieved through certainty, full knowledge, full disclosure and transparency, and zero deceit or fraud Gharar also results in the risk being built into the contract at its inception which may result in a profit for one party and corresponding loss to other party (zero-sum game or gambling) Factors for Gharar in Contracts None or incomplete ownership (“do not sell if you do not have” or cannot legally guarantee delivery Non-possession or cannot guarantee physical delivery to avoid manipulation by the seller and protect the interest of buyer Uncertainty in the contract or conditional sales Exceptions of Gharar The uncertainty is too trivial or too slight and tolerable by both or all parties Charitable contracts (tabarru’at i.e. Waqf etc.) The real public need for the transaction or contracts even gharar is excessive e.g. bay al-Salam (advance purchase), al-Istisna’ (manufacturing contract ) To satisfy people’s immediate need and removal of hardship makes Gharar an exception and need takes priority Exceptions of Gharar Gharar is averted if: Both the price and the subject matter are proved to be in existence at the time the transaction concluded The qualities are known and the quantities are determined The contractual parties have control over them so as to ensure the exchange can take place Term of time can be precisely determined