Nondiscrimination Testing presentation 3

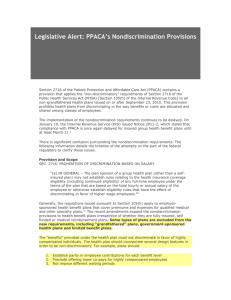

advertisement

Nondiscrimination Testing Rules for Health Plans WASBO Accounting Seminar March 20, 2013 Speakers: Matthew J. Flanary Linda R. Mont Agenda Nondiscrimination Testing Health Plans – Section 105(h) Rules Cafeteria Plans – Section 125 Rules (Briefly) Plans Requiring Testing The Rules Health And Tests Reform Planning Now For Future Changes Nondiscrimination Testing Currently Applies To: Self-Funded Health Plans (Section 105(h) and Cafeteria Plans (Section 125) The testing is different, but the goals are the same – Nondiscrimination Testing Assure Plans Do Not Discriminate In Favor Of: Highly-Compensated Individuals (HCIs) For Section 105(h) Plans Highly-Compensated Participants Or Individuals (HCEs) for Section 125 Plans *Very Different Definitions Definition of Highly Compensated Section 105(h)(5) One of the employer’s five highest-paid “officers” A shareholder owning more than 10% of the employer’s stock Among the top 25% highest-paid non-excludable employees Section 125(e) “Officers” A shareholder owning more than 5% of the voting power or value “Highly Compensated Employees”* Spouses and Dependents of one of the above *Guidance referenced 414(q) rules – Compensation in excess of $115,000 (adjusted for inflation in future years) in the preceding year and, possibly, also one of the highest paid 20% of employees Health Plan Testing If an employer wishes to provide a tax-free health benefit to employees, the employer must ensure, via nondiscrimination testing, that a self-insured health plan does not unduly favor the highly compensated individuals (HCIs) with respect to either eligibility to participate or benefits. Code Section 105(h) Not A New Requirement Currently Applies To Self-Insured Health Plans Testing Is Done Annually (Regardless Of Plan Size) A Self-Insured Health Plan Is One In Which The District Bears The Risk Of Paying The Claims, Including: ◦ Self-Insured Medical/Drug Plans The Existence of Stop-Loss Insurance Doesn’t Matter ◦ Health Reimbursement Arrangements (HRA) Code Section 105(h) Does NOT Apply To Insured Plans Some Insurance Requirements In Wisconsin Without Section 105(h), Fully Insured Plans Can (For Now) Have: Different Eligibility By Employee Classification Different Coverage By Employee Classification Different Medical Coverage For Different Retirees Different Lengths Of Time Or Dollar Amount Of Retiree Medical Coverage Code Section 105(h) Currently Official Guidance Is Limited. More Speculation Than Regulation History Legislation Passed In 1978 Regulations Issued In 1981 A Handful Of IRS Rulings Law Repealed In 1986 Law Retroactively Reinstated In 1989 IRS “No Ruling” Topic Ever Since Health Care Reform Changes In The Future PPACA Expands The Current Rules To NonGrandfathered, Fully-Insured Health Plans But With Very Different Consequences Originally Scheduled For 2011 IRS Notice 2011-1 Delayed The Effective Date Until After Regulations Are Published Later This Year? Consequences of Noncompliance Self-insured plans Excess reimbursements to HCI- Taxable Benefits – 100% of discriminatory benefit Eligibility – percentage paid to HCI A Two-Part Test To Comply With Code Section 105(h), A Plan Must Satisfy Both: The Eligibility The Benefit Test Test Eligibility Test A Plan Must Meet One Of The Following Tests: 70% Or More Of All “Considered” Employees Benefit Under The Plan 70% Or More Of All “Considered” Employees Are Eligible AND 80% Or More Of All Eligible Employees Benefit Under The Plan The Plan Benefits A Classification Of Employees Which The IRS Finds To Be Nondiscriminatory Using Rules Similar To Those Found In Code Section 410(b) The 70% Short-Hand Rule Query: Governmental Plans Are Exempt From 410(b) Excludable Employees 105(h) 125 Employees Subject To Benefits Bargaining Non-Resident Aliens Earnings Under $25,000 Less Than 3 Years Of Service Less Than 1 Year Of Service “Part-Time Employees” “Seasonal Employees” Under Age 25 Under Age 21 x x x 129 410(b) x x x x x x x x x x x Excludable employees are only excluded for 105(h) eligibility test – not benefits test and only if not participating in any self-insured plan of the employer Nondiscriminatory Classifications Reasonable: Salaried vs. Hourly Geographic Location Similar Bona Fide Business Criteria Not Acceptable: Naming Individuals Criteria Having Substantially The Same Effect The Benefits Test For a plan to be considered nondiscriminatory with respect to benefits, the plan must provide the same benefits for both highly compensated and non-highly compensated individuals. What’s A “Benefit” Contributions and waiting periods are considered benefits (See, PLR 8411050, 8411051, 8336065 and 8423036) Contributions based upon compensation are per se discriminatory (See Treas. Reg. §1.105-11(e)(4), Example 6) Question about dollar amount per year of service – is that considered a different contribution? Example: HRA Benefit Classification Contribution Per Year Maximum Contribution Eligibility/Vesting Administrators $2,000 $60,000 Vested after 5 years Teachers $2,500 No maximum Vested at age 56 with 15 years of service NonRepresented Staff $1,000 $30,000 Vested after 5 years What’s A “Plan” An employer may designate two or more plans as constituting a single plan that is intended to satisfy the requirement of [Code] section 105(h)(2) and paragraph (c) of this section, in which case all plans so designated shall be considered as a single plan in determining whether the requirements of such section are satisfied by each of the separate plans. . . . A single plan document may be utilized by an employer for two or more separate plans provided that the employer designates the plans that are to be considered separately and the applicable provision of each separate plan. - Treas. Reg. §1.105-11(c)(4)(i) Health Reform Did Not Change Existing Tests New Rules Will Eventually Require Non-Grandfathered Insured Group Health Plans To Satisfy Similar Nondiscrimination Rules Originally Applied To Plan Years Beginning On Or After September 23, 2010 IRS Announced Compliance Will Not Be Required Until The Plan Year After It Issues Regulations Or Other Guidance For Insured Plans Until These Rules Apply, Such Plans Are Only Subject To Indirect Requirements Like The Cafeteria Plan Rules Retiree Only Plans PPACA Exempt Retiree-Only Plans From Many Of The New Requirements It’s Possible That The Yet-To-Be Published Insured Plan Regulations Will Also Exempt Retiree-Only Plans. It’s Also Possible That Non-Federal Government Plans Will Be Exempt Section 125 Implication If employees make a pretax contribution for health insurance coverage (for a fully insured or self-insured plan), there is required nondiscrimination testing for Section 125 cafeteria plans that your flex administrator should currently be performing on an annual basis. Employee Contributions? Fully-Insured Medical Plan Contributions on Pretax Basis: Administrators pay 5% of premium Teachers pay 8% of premium Custodians pay 10% of premium Section 105(h) rules do not apply Section 125 apply This plan would likely violate the cafeteria plan Contributions and Benefits Test, causing the value of the coverage to be taxable to HCIs. What To Do Now Review Current Plans: Section 105(h) Plan Testing Section 125 Plan Testing Consider Potential Changes Add Protective Language To All Contracts And Handbooks Consider Adding Multiple Plan Language And Retiree-Only Plan Language Reserve Your Rights Consider Adding To Contracts And Handbooks: “The District reserves the right to make changes to coverage if future testing rules or plan structure makes it impossible to provide coverage.” Consider Adding To Plan Documents: “This Plan Document describes benefits for multiple classes of employees and the Employer reserves the right to treat reasonable classifications of employees and employee groups as multiple health plans for purposes of satisfying the requirements of Code Section 105(h), as permitted under Treasury Regulation Section 1.105-11(d)(4)(i).” Thank You