Relevant life policy Employee pays premium from salary

advertisement

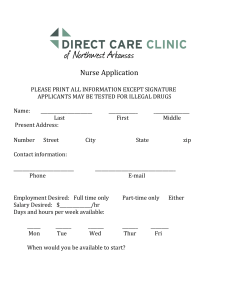

Relevant life policies Sales opportunity Relevant life policies – qualifying rules Income Tax (Earnings and Pensions) Act 2003 • Life cover only • Single life assured • Benefits to an individual or a charity • Placed in relevant life policy trust from outset • No surrender value • Policy must end before age 75 • Main purpose of the policy must not be tax avoidance 2 Employee benefits • Pensions • • • – auto enrolment Protection benefits – group life/death in service – group critical illness – group income protection Health care benefits – group private medical insurance – health cash plans – employee assistance programme Flexible benefits / salary sacrifice – cycle to work – employee discounts – childcare vouchers – technology 3 Why a relevant life policy instead of group life? Advantages • • • • • • • No minimum scheme numbers High max coverage amount Tailored to individuals Attraction, reward, retention High net worth market Annual/Lifetime Pension Allowance More tax efficient for employer • Individual application and trusts form Disadvantages • Individual underwriting – no salary exemptions 4 Relevant life policies A tax-efficient way of arranging life cover for employees Employer • Premiums paid by employer are a deductible business expense • Premiums not assessable for National Insurance Contributions Employee • Premiums paid by employer are not a benefit in kind and so no income tax for employee • Benefits paid free of income tax • Benefit is free of inheritance tax (not part of employee’s estate due to a trust) • Does not form part of the employee’s annual or lifetime pension allowance 5 Relevant life policies in practice Option A: Ordinary life cover policy Option B: Relevant life policy Employee pays premium from salary Employer pays the premium Cost to employee Monthly premium Employee national insurance Employee income tax Gross earnings needed £600 £105.88 £176.47 £882.35 Cost to employee Premium Employee national insurance Employee income tax £0 £0 £0 Cost to employer Premium Employer national insurance contribution £121.76 Cost to employer Premium Total national insurance (on gross pay) Total gross cost £1004.11 Total cost to employer & employee £600 Less corporation tax £200.82 Less corporation tax £120 Total cost £803.29 Total cost £0 £600 £0 £480.00 6 Online tools 7 What are the barriers? Business owners • Lack of awareness • Lack of concern • Cost Advisers • Lack of awareness • Low priority • Out of practice • Complexity and time • Low collaboration Product • Price • Indexation • Continuation • Online portal restrictions 8 Qualification for a relevant life policy Eligible for a relevant life policy • An employee of a: – Sole trader – Partnership – LLP – Limited company • A shareholding director of a limited company Not eligible for a relevant life policy • A sole trader • An equity partner • An LLP member • A contractor 9 Opportunities • How many SMEs do you see that are not eligible for group life? • Which of your clients: - would like to reward their top employees? would like to be able to offer a benefit to retain their top people? would like to make their recruitment package more attractive? • How would you market relevant life policies? 10 Thank you