Non Discrimination Testing

advertisement

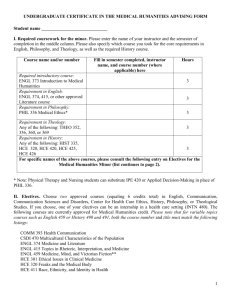

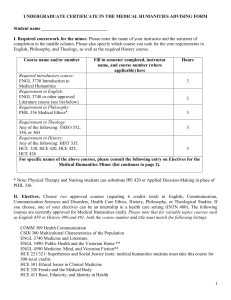

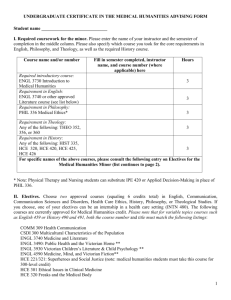

Continuing Education - Presented by Susan P. Luskin, FLMI, CLU, CEBS, RHU Non-Grandfathered plans must comply starting the first plan year following September 23, 2010. Grandfathered plans must comply starting the first plan year following Jan 1, 2014. Applies to group medical, dental and vision plans. ◦ Does not apply to voluntary dental and vision plans ◦ Does not apply to disability, life, or long term care plans Purpose – to eliminate discrimination in favor of key and highly compensated employees. For plan testing purposes, the Internal Revenue Code treats 2 or more employers as a single employer if there is sufficient common ownership or a combination of joint ownership & common activity. Code Sections 414(b), (c) and (m) Applies to corporations, partnerships, sole proprietorships and all forms of business entities ◦ Controlled group of corporations ◦ Trades of businesses under common control ◦ Affiliated service groups Consider constructive ownership and attribution rules. All regular full time employees All leased employees All non-seasonal employees (works more than 120 days per year) Part-time employees may be excluded – less than 20 hours per week Temporary employees may be excluded May exclude employees covered by a collective bargaining plan as long as they have their own benefits. One of the top 5 highest paid officers. A shareholder who owns more than 10% of the employer’s stock One of the highest paid 25% of all employees ◦ Not counting excludable employees who are not participants. ◦ Employees who have not completed 3 years of service. ◦ Employees who have not attained age 25 ◦ Part-time or seasonal employees ◦ Collectively bargained employees ◦ Non-resident aliens with no US income. Constructive ownership rules of Code Section 318 apply Options to acquire stock must be taken into account when determining stock ownership. This is not the same definition of highly compensated that we use for Section 125 Plans. Define – the plan may not discriminate in favor of the HCE as to eligibility to participate. 70% test – 70% or more of all employees must benefit under the plan. 80% test – 80% or more of all employees who are eligible to elect to participate (benefit) under the plan, as long as 70% of all employees are eligible. Safe harbor percentage test – the plan’s ratio percentage must be greater than or equal to the applicable safe harbor percentage. ◦ Determine the plan’s ratio percentage (All non HCE who benefit / All non-excludable non-HCE) (All HCE who benefit / All non-excludable HCE) Safe harbor percentage test – the plan’s ratio percentage must be greater than or equal to the applicable safe harbor percentage. ◦ Determine the plan’s non-HCE concentration percentage All non-excludable non-HCE (non-excludable HCE + non-excludable non-HCE) ◦ Determine the Safe Harbor Percentage from IRS Code Table ◦ Compare the ratio percentage with the Safe Harbor percentage – passed if RP is greater than or equal to SHP. If the Safe Harbor Percentage test fails, as a last resort try the non-SHP test. Same equations, but different requirements. Employees must all satisfy the same employment requirements in order to be eligible. ◦ No class of employee can have a longer waiting period than any other class of employee or the plan will fail. Employees must all satisfy the same employment requirements in order to be eligible. ◦ Compare with similar rule for Section 125 plans ◦ Entry requirement – All individuals who have satisfied the employment requirement must begin participation in the plan no later than the 1st day of the 1st plan year beginning after the date the employment requirement is met. The benefits who are available to the HCE must also be available to the NHCE ◦ No phantom availability. ◦ Employer contributions available on a nondiscriminatory basis. ◦ Benefits available on a non-discriminatory basis. ◦ Same qualified benefits must be available for similarly situated participants at the same price. The benefits who are available to the HCE must also be available to the NHCE ◦ Available employer contributions for similarly situated participants must be the same, and all participants must have the same options to use them. Geographic differences Family member coverage differences The benefits who are available to the HCE must also be available to the NHCE ◦ If optional benefits are offered, all participants must be able to elect each benefit option for the same additional contribution. ◦ Benefits may NOT vary based on age, years of service or compensation. No adverse tax consequence for HCE Excise tax of $100 per day per employee/participant discriminated against. – Section 4980D of the Code ◦ Exception for employer group of 2-50 ◦ Exception may only apply where the discrimination results from the underlying insurance policy itself. ◦ More guidance needed Excise tax may not exceed the lesser of 10% of the group health plan costs or $500,000 No penalty is the failure to pass the test is due to reasonable cause and corrected within 30 days of discovery. Identify individuals to whom the failure relates ◦ Excluded individuals ◦ Individuals receiving “better” benefits PPACA non-discrimination requirements included in ERISA and PHSA ◦ Participant or DOL can bring lawsuit to compel compliance ◦ Lack of clarity regarding whether issues may be subject to the penalty under PHSA (Public Health Service Act) Still unanswered – After tax treatment of S Corp Shareholders and LLC members Q- What happens in an S corporation or LLC if the corporation or LLC pays 100% of the owner premium, and then the same lower amount for all of the other employees, whether highly compensated or not? I am assuming that they are reporting this premium on the K1 as imputed income, and then deducting it back on the 1040. Assume they want to change their health plan at open enrollment and will not be grandfathered. Also, what about partners in a partnership? That would be true equity partners and not income partners. This was never an issue for Section 125, as none of the above could pretax anything. They are always outside of a Cafeteria Plan. Still unanswered – After tax treatment of S Corp Shareholders and LLC members A- Code section 105(g) excludes self-employed individuals under Code section 401(c)(1) from this provision; therefore if the owner is not an employee-owner (defined in section 401(c)(3)), it is reasonable to not trigger 105(h) violations under this approach. With respect to partners, the definition of employee-owner may cover more than 10% partner. In that event, differences in premiums charged to highly versus nonhighly compensated individuals could trigger 105(h) penalties. Q - If an employer has both union and non-union employees, must they be given the same plan, or can you test the non-union employees separately? Although there is no clear guidance on this issue, benefits attorneys take the position with respect to differences in benefits between union and non-union groups is that there are arguments in support of the view that such distinctions comply with Code sec. 105(h). For example, if there are some highly compensated individuals on both the union and non-union side, that would support an argument that the union/ non-union classification is reasonable, which would mean that as long as each group receives the same benefits as the other members of the group, the 105(h) rules could be satisfied (e.g., by designating the benefits provided to that group as being provided under a separate plan). See Treas. Reg. sec. 1.105-11(c)(4). Even if all union employees are non-highly compensated individuals, this same argument could be made, given the differences in how benefits are decided upon in the collectively bargained context (although there is no direct support for this position). Alternatively, it may be possible for the employer to rely on the exception under the 105(h) eligibility test that allows collectively-bargained employees who are not participating in the plan to be excluded from the plan, although this exception leaves open the question of how the benefits test applies. See Code § 105(h)(3)(B); Treas. Reg. § 1.105-11(c)(2)(iii)). Overall, attorneys believe that it is more difficult to make a case that distinctions between management/non-management and salaried/hourly are reasonable and not violations of Code sec. 105(h) than it is to make a case that union/non-union distinctions are not violations of Code sec. 105(h). However, for any of these distinctions, the IRS would likely apply a facts and circumstances analysis, giving weight to whether there is a mixture of highly/non-highly compensated individuals in each group. A- On December 23, 2010, the IRS issued Notice 2011-1 which postpones the implementation of these nondiscrimination rules until further guidance has been issued. We believe that the rules will not apply until the plan year following the time that the guidance is issued. Plan sponsors will not be required to pay excise taxes associated with noncompliance until that time. Here are some of the areas on which the IRS has requested comments: 1. Whether the rate of employer contributions should be tested as a nondiscriminatory benefit 2. Whether application of nondiscrimination standards should be conducted on a geographic basis 3. Guidance on safe harbor plan designs Here are some of the areas on which the IRS has requested comments: 1. Whether the rate of employer contributions should be tested as a nondiscriminatory benefit 2. Whether application of nondiscrimination standards should be conducted on a geographic basis 3. Guidance on safe harbor plan designs 4. 5. 6. 7. The potential aggregation of substantially similar coverage options for testing purposes. The application of the nondiscrimination rules in 2014 when the individual mandate takes effect The use of the definition of HCE in Section 414(q) instead of the top 25% Whether to disregard coverage provided to HCE if paid on an after tax basis A. An Unauthorized Entity is an insurance company that is not licensed by the Florida Office of Insurance Regulation. Agents and Brokers have responsibility for conducting reasonable research to ensure they are not writing policies or placing business with Unauthorized Entities. Lack of careful screening can result in significant financial loss to Florida residents due to unpaid claims and/or theft of premiums. Under Florida law Insurance Agents and Brokers can be held liable for unpaid claims. Agents may be held liable when representing these Unauthorized Entities. It is the Agents and Brokers responsibility to give fair and accurate information regarding the companies they represent. Any question about the authorized status of a company can be checked by calling the Florida Department of Financial Services at 1-877-693-5236 in Florida or 1-850-413-3089 outside the state of Florida. We urge all agents and brokers to adhere to this admonition. The state of Florida has taken a very strong position on the issue of Unauthorized Entities.