PowerPoint - Tennessee Hospital Association

advertisement

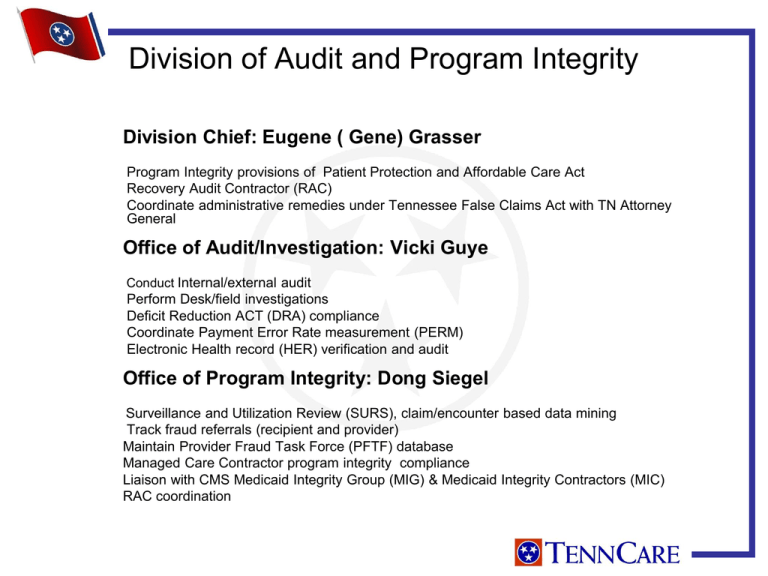

Division of Audit and Program Integrity Division Chief: Eugene ( Gene) Grasser Program Integrity provisions of Patient Protection and Affordable Care Act Recovery Audit Contractor (RAC) Coordinate administrative remedies under Tennessee False Claims Act with TN Attorney General Office of Audit/Investigation: Vicki Guye Conduct Internal/external audit Perform Desk/field investigations Deficit Reduction ACT (DRA) compliance Coordinate Payment Error Rate measurement (PERM) Electronic Health record (HER) verification and audit Office of Program Integrity: Dong Siegel Surveillance and Utilization Review (SURS), claim/encounter based data mining Track fraud referrals (recipient and provider) Maintain Provider Fraud Task Force (PFTF) database Managed Care Contractor program integrity compliance Liaison with CMS Medicaid Integrity Group (MIG) & Medicaid Integrity Contractors (MIC) RAC coordination CMS: Center for Program Integrity Medicaid Program Integrity Provisions Presentation based on new Medicaid Program Integrity provisions of HR 3590 – Patient Protection and Affordable Care Act Some final regulations have been issued by CMS ( Provider Enrollment and Screening – 2/2/11) and others are still in the NPRM status (RAC 11/10/2010) CMS has also issued clarifying State Medicaid Letters Letters to State Medicaid Agencies – Preliminary Guidance on CMS Website Medicaid Program Integrity Provisions – Section 6401 Provider Screenings and Enrollment Requirements - Medicare Medicaid Screening Process Must Parallel Medicare Medicare and Medicaid Screening provisions are not applicable to providers enrolled in Part C Medicare managed care plans or Part D Medicare drug plans or Medicaid Managed Care Plans Medicare requirements for New Providers Level of Screening - Depends on classification of provider Limited: individual practitioner, hospital, ASC , FQHC,SNF,.. Moderate: Ambulance, CMHC, CORF, hospice, … High: newly enrolling HHA & DME Medicaid Program Integrity Provisions – Section 6401 Provider Screenings and Enrollment Requirements - Medicare Medicare (Medicaid) requirements for each Level Limited: exclusion database checks, license verification, disclosure Moderate: Limited level plus: additional on-site visit High: Moderate level plus: criminal background checks, fingerprinting, unscheduled and unannounced site visits Required Enrollment and Screening Application Fees 2010 - $500 and adjusted for inflation Providers are only required to pay one fee per enrollment period to Medicare or a state Medicaid program Medicaid Program Integrity Provisions – Section 6401 Provider Screenings and Enrollment Requirements - Medicare New Providers - Medicare Provisional Period – 1 Year Enhanced Oversight Prepayment review , Payment caps, etc. Increased Disclosure – Affiliations on Disclosure - Reasons to Deny Enrolment Uncollected Overpayments Suspension or Revocation of Billing Privileges Medicare or Any State DHHS Secretary may Issue Temporary Moratoriums on Enrollment if necessary for F&A issues & States may request a state moratorium Medicaid Program Integrity Provisions – Section 6401 Provider Screenings and Enrollment Requirements - Medicare Current Providers – Medicare Revalidation of Enrollment Starting 180 days after passage Procedures apply to providers within two years of enactment Within 3 years of Enactment - No providers will remain without revalidation Medicaid Program Integrity Provisions – Section 6401 TennCare MCO Provider Enrollment and Screening Requirements Although Providers in TennCare MCO’s will not be subject to the new enhanced Medicare & Medicaid Fee For Service provider Enrollment and Screening Requirements, TennCare MCO’s must continue to perform the following enrollment procedures, as well as, Provider Credentialing and getting a TennCare ID# for the provider in addition to any additional requirements mandated by the MCO’s internal rules and procedures Collect Basic demographic information Collect W-9 form (taxpayer ID) Verify NPI number Require submission of Disclosure of ownership & control information Verify License Collect SSN # Check against: HHS OIG exclusion list Tax delinquency Death file Request a TennCare Provider number prior to reimbursing the provider Medicaid Program Integrity Provisions – Section 6401 Increased Disclosure Requirements Who Medicaid providers, fiscal agents and managed care entities What 1. Name and address of individual or corporation with ownership or control interest 2. Date of birth and SSN for individual 3. Other Tax information corporation with ownership & control and subcontractor in which the disclosing entity has a 5% interest 4. Information must be provided whether the person with ownership is related to another person with ownership or control in the disclosing entity or whether the person or entity with the ownership or control interest in a subcontractor has a 5% or more interest is related to another party with ownership or control in the disclosing entity 5. Name, address, DOB, & SSN of managing employees of disclosing entity 6. Medicaid/Medicare convictions and/or exclusions When Providers: 1. Submitting application, 2. Request by Medicaid & 3. Ownership change Fiscal Agents & MCO’s: 1. RFP proposals, 2. Execute Contract, 3. Renewal & 4. Ownership Change *Disclosure is also required by TN statue: T.C.A.71-5-137 & T.C.A.8-50-502 Medicaid Program Integrity Provisions – Section 6402 Data matching - Integrated Data Repository a data repository Medicare (A, B, and C &D), Medicaid, CHIP, VA, DOD, SSI, IHS, etc. Beneficiary in Health Care Fraud Scheme - Administrative Remedy for Knowing Participation by a Beneficiary in Health Care Fraud Scheme will be assessed against enrollees that participated in health care schemes. *TN Statute T.C.A.71-5-2601 also makes certain actions of this type a Class E Felony National Provider Identifier - January 2011 Requires all providers and suppliers that qualify for a national provider identifier to include this identifier on all applications for enrollment. Medicaid Statistical Information System (MSIS) - Permits the withholding of federal matching payments for states that fail to report enrollee encounter data. Permissive Exclusions - Allows permissive exclusions for individuals or entities that knowingly make false statements or misrepresentations of material facts. Medicaid Program Integrity Provisions – Section 6402 Deterrence/Civil and Criminal Penalties - Amends the Anti-Kickback statute so that a claim that includes items or services violating the statute would also constitute a false or fraudulent claim. These CMP’s can be up to $50,000 or up to 3 times the amount of the claim for each item or service for which the payment was made based on the application containing the false statement or misrepresentation of a material fact. Subpoena Authority - Grants the Secretary subpoena authority in exclusion-only cases. The DHHS OIG will be given subpoena authority. Medicare and Medicaid Integrity Programs - Requires entities that are enrolled in Medicare and Medicaid to submit performance statistics on the number of fraud referrals, overpayments recovered, and return on investment. (Sec. 6402 of H.R. 3590) Section 6402 – Overpayments A provider, supplier, Medicare Part C or Part D plan and Medicaid managed care plans must report and return overpayments to Medicaid with 60 days of their identification or be subject to the Federal False Claims Act. MCO’s were notified in March 2011 and tasked to notify providers. Medicaid Program Integrity Provisions – Section 6402 Suspension of Payments for a Credible Allegation of Fraud 455.2 - Definitions - May be verified from any source but not limited to: 1. Fraud hot line 2. Claims Data mining 2. Patterns from provider audits, civil false claims, law enforcement investigation with an indicia of reliability which has been reviewed by Medicaid 455.23 – 1. Agency must suspend after determining a credible allegation of fraud for which there is an investigation pending unless good reason not to suspend 2. May suspend without first notifying 3. Provider may request and must be granted administrative review 4. Within 5 days of suspension unless requested not to by law enforcement 5. Within 30 days if law enforcement requests not to notify 6. Suspension is temporary and will not continue if Agency or prosecuting authority determines insufficient evidence or legal proceedings of alleged fraud are completed. Medicaid Program Integrity Provisions Section 6403 - National Practitioner Data Bank DHHS will maintain a national fraud and abuse data bank for reporting adverse actions against providers. Section 6411 – Recovery Audit Contractor (RAC) By 12/31/2010 states shall contract with a contingency fee based RAC. NPRM issued on 11/10 2011 TennCare’s competitive procurement selected HMS as Medicaid RAC Contract effective 2/1/2011 and is being implemented Section 6501 - Termination of Provider participation States shall terminate any individual or provider that has been excluded from Medicare or another state. Medicaid Program Integrity Provisions Section 6502 – Medicaid Exclusion from Participation Requires State Medicaid agencies to exclude from participation for a period any entity that has unpaid overpayments, is suspended or excluded from participation or is affiliated with an entity suspended or excluded. Section 6503 - Required Registration under Medicaid Requires agents, clearinghouses or alternate payees to register. Section 6505 Prohibits paying for services to institutions located outside the US. Recovery Audit Contractor Introduction In accordance with Section 6411 of the Patient Protection and Affordable Care Act, TennCare issued an RFP, HMS, was selected with an effective date of February 1, 2011. A required Medicaid State Plan Amendment was submitted. Reimbursement The RAC contractor will be funded on a contingency fee basis and only receive reimbursements from recovered funds in accordance with 42 CFR 455.510. Funds will only be considered recovered at the conclusion of any and all appeals available to the provider pursuant to TennCare Rule 1200-13-18. Coordination of PI efforts between TennCare, the MCOs and the RAC All Potential RAC recoveries must be presented to TennCare OPI for review. The RAC will not be allowed to pursue a recovery for a provider & issue previously identified by an MCC, TennCare or law enforcement.