Medicaid Dual Eligible Plans and Presumptive Eligibility Updates

advertisement

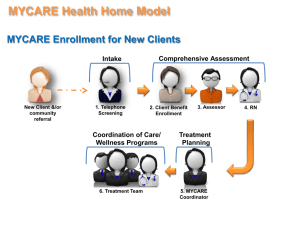

MyCare Ohio (Integrated Care Delivery System) May 6, 2014 John Rogers Manager, Eligibility Services jrogers@improvefinancialhealth.com On December 12, 2012, the Ohio Department of Medicaid entered into a Memorandum of Understanding with CMS to create an Integrated Care Delivery System (ICDS) for Medicare-Medicaid “Dual Eligibles.” https://www.cms.gov/Medicare-Medicaid-Coordination/Medicare-and-Medicaid-Coordination/Medicare-Medicaid-CoordinationOffice/Downloads/OHMOU.pdf 2 Full vs. Partial Benefit Dual Eligibility Full Dual Eligibility Partial Dual Eligibility • • Medicare A and/or B, optional D • Not eligible for full Medicaid, but some or all of Medicare premiums and cost sharing are covered: - QMB (A & B premiums and CS) - SLMB (B premiums) - QI (block grant SLMB, limited) - QDWI (A premium assistance for disabled workers) • Eligible for Special Needs Plan • Less Medicaid stability Medicare A and/or B, and D (most have all three) • Full Medicaid, where Medicaid is secondary payer and covers Medicare premiums, cost-sharing, and many non-covered services, especially nursing facility. • Eligible for Special Needs Plan • Typically receives SSDI/SSI 3 States with automatic Medicaid eligibility for SSI recipients: Alabama Alaska Arizona Arkansas California Colorado Delaware District of Columbia Florida Georgia Idaho Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Mississippi Montana Nebraska Nevada New Jersey New Mexico New York North Carolina Oregon Pennsylvania Rhode Island South Carolina South Dakota Tennessee Texas Utah Vermont Washington West Virginia Wisconsin Wyoming 209(b) states with Medicaid eligibility criteria more restrictive than SSI criteria (No automatic eligibility): Ohio Connecticut Hawaii Illinois Indiana Minnesota Missouri New Hampshire North Dakota Oklahoma Virginia Source: Kaiser Family Foundation, 2013 4 • 182,328 Full-Benefit DualEligibles (FBDE) in Ohio (114,000 / 63% to be enrolled in MyCare Ohio demonstration) • 108,205 Partial Dual-Eligibles • 290,533 total Medicare recipients who are also eligible for some form of Medicaid *Estimates from Kaiser Family Foundation, 2009; CMS, 2010; and State of Ohio, 2012. 5 Source: ODJFS, 2010 6 • Ohio ranks 15th among states in Dual Eligible spending at $2.5B • $20,000 annually per DE • 14% of Medicaid enrollment but 34% of total Medicaid spending • 50% of Medicaid LTC spending • $300 million per annum on Medicare premiums, costsharing, and coverage gaps 7 Dual Eligible Profile • • • • • • • • • Age 65+ or under 65 and permanently disabled. At or below 75% of FPL (64% in Ohio) for SSI-level eligibility. 75100% FPL for state- optional “poverty level” eligibility. >100% FPL for spend-downs, waiver, Medicare Savings Plans. <$2000 in resources ($1500 in Ohio). High chronic comorbidity. Cognitive impairment/mental illness. Functional limitations. Bio-psychosocial risk factors. Often institutionalized (65+) or case-managed (under 65). 8 Dual Eligibles are high users of providers across the health and human services spectrum. 9 Ohio Dual Eligible Cost Factors • Heavy service utilization across provider spectrum • Low managed care enrollment • Most FBDE served in fee-for-service setting • <3% enrolled in Medicare Special Needs Plan* • FBDE are exempt from mandatory Medicaid managed care plans for Aged, Blind, Disabled categories • Redundancies, cost-overlays, cost-shifting (clawbacks, etc.) between Medicare and Medicaid FFS exacerbated by FBDE utilization • Separate eligibility pathways, billing and payment systems • Separate administration and accountability *State of Ohio, ODJFS/Office of Ohio Health Plans ICDS Proposal to CMS, April 2, 2012 10 “MyCare Ohio” will operate in 7 regions comprising 29 counties. 114,000 FBDE age 18+ (63% of state total), including those with severe and persistent mental illness, are to be enrolled into 5 managed care plans responsible for delivering all covered Medicare and Medicaid services to enrollees. Three passive enrollment periods: • May – July, 2014 Medicare Opt-In period: • May – December, 2014 Automatic Medicare Enrollment: • January, 2015 11 Who is eligible for ICDS demonstration? • • • Age 18 and older at the time of enrollment. Eligible for full Medicare Parts A, B, and D and full Medicaid. Reside in an ICDS Demonstration county. Excluded: • • • • • • Individuals under the age of 18. Individuals who are Medicare and Medicaid eligible and are on a delayed Medicaid spend-down. Individuals enrolled in both Medicare and Medicaid who have other third party creditable health care coverage. Individuals with Intellectual Disabilities (ID) and other Developmental Disabilities (DD) who are otherwise served through an IDD 1915(c) HCBS waiver or an ICF‐IDD Individuals enrolled in PACE. Individuals participating in the CMS Independence at Home (IAH) demonstration. 12 Consumer Enrollment Process Enrollment letters sent to eligible consumers 60 days prior to enrollment. Consumers may select a plan in following ways: • • • By phone with enrollment contractor (800.324.8680) In person, during regional enrollment events Through face-to-face enrollment counseling Eligible consumers who currently receive services through a Medicaid waiver will be transitioned to a MyCare Ohio waiver. 37,000 waiver consumers expected to transition. Not all Medicaid waiver consumers will be eligible, hence not all your Medicaid waiver consumers will transition to MyCare. 13 • • • • • • • Northeast: Cuyahoga, Geauga, Lake, Lorain, Medina Northwest: Fulton, Lucas, Ottawa, Wood Northeast Central: Columbiana, Mahoning, Trumbull Southwest: Butler, Clermont, Clinton, Hamilton, Warren East Central: Portage, Stark, Summit, Wayne Central: Delaware, Franklin, Madison, Pickaway, Union West Central: Clark, Greene, Montgomery Source: ODM, 2014 14 Dual vs. Medicaid-Only MyCare Membership • • • • • • Eligible Medicare-Medicaid enrollees must choose a MyCare Ohio plan. MyCare Ohio members may enroll for both Medicare and Medicaid services, to maximize coordination of care and benefits. These members are called “Dual Benefits Members”. MyCare Ohio members may also choose to enroll as “Medicaid Only Members” solely for Medicaid benefits, while maintaining traditional Medicare or a Part C (Medicare Advantage) plan that is not a contracted MyCare Ohio plan. The Medicaid portal will be updated to provide enrollees’ MyCare Plan name and Dual Benefits or Medicaid Only enrollment status. Medicaid MyCare Ohio enrollment is mandatory for eligible MedicareMedicaid individuals. Dual Members can change plans monthly. Medicaid Only can change during first 90 days, then only during annual open enrollment. Source: ODM, 2014 15 Medicare Opt-In Enrollment Timeline Source: Ohio OMA, 2013 16 MyCare Ohio Plans • • • • • • • Northeast: Cuyahoga, Geauga, Lake, Lorain, Medina Northwest: Fulton, Lucas, Ottawa, Wood Northeast Central: Columbiana, Mahoning, Trumbull Southwest: Butler, Clermont, Clinton, Hamilton, Warren East Central: Portage, Stark, Summit, Wayne Central: Delaware, Franklin, Madison, Pickaway, Union West Central: Clark, Greene, Montgomery Source: ODM, 2014 17 Example Cards Dual Member Medicaid Only Dual Member Dual Member Medicaid Only Note: Back of Buckeye MedicaidOnly says “Medicaid Only” 18 Wrap-around Care Plan Development • Plan must conduct an initial care assessment within 90 days of enrollment in the plan. • High-need beneficiaries will receive an in-person assessment, while low or medium risk beneficiaries will receive a telephonic assessment. • Based on the initial assessment, for each enrollee, the plan will assemble a care management team, called a Trans-disciplinary Care Management Team (the team). The team will work with the beneficiary to create the person-centered care plan. • The team will be led by an personal care manager, and also include the beneficiary, the primary care provider, the waiver services coordinator, and, as appropriate, specialists, and the individual's family and caregiver supports. • If the beneficiary requires 1915(c) waiver services, the waiver services coordinator designated by the ICDS plan will also serve as the care manager. 19 Trans-Disciplinary Care Management 20 Network Adequacy Standards • At least two community Long Term Services & Support (LTSS) Providers in each region for the following services: Enhanced Community Living, Homemaker, Waiver, Transportation, Nutritional Consultation, Assisted Living, Social Work Counseling, Out of Home Respite, Home Medical Equipment and Supplemental Adaptive and Assistive Devices, Independent Living Assistance and Community Transition. • At least two community LTSS agency providers in each region for Personal Care and Waiver Nursing. • At least one adult day health and one assisted living provider within 30 miles of each zip code within the region. • At least five LTSS independent providers (in addition to self-directed care options) in each region for the following services: Personal Care, Home Care Attendant, and Waiver Nursing. • At least one community LTSS provider in each ICDS region for the following services: pest control, home delivered meals, emergency response, home modification maintenance and repairs and chores services. 21 Plans will cover all Medicare A,B and D services, plus Ohio Medicaid state plan services, including long term care, home and community supports and behavioral health services. 22 Transition Period • CMS and ODM specify service transition periods for new members, during which they will be required to transition to providers within their interdisciplinary care network in order to maximize continuity of care, service delivery and payment efficiency. High-needs consumers may be transitioned within 90 days. • For specified period of time (generally 365 days), plans will honor consumers’ existing service levels and providers in order to minimize disruption. • During transition periods, non-contracted providers will be paid according to Medicare and Medicaid fee-for-service secondary payment methodologies. • Providers can verify MyCare enrollment in MITS portal. 23 Provider Payment • Contracted providers must refer to plan payment schedules within contracts. Many MyCare Ohio contracts contain separate payment amounts for Medicare and Medicaid services. Service transition timeframes may also apply. • For Medicaid Only members using services paid by Medicare or Medicare Advantage, the fee-for-service Medicaid secondary payment methodology will be paid by the MyCare Ohio plan. • The transition period for non-contracted providers extends for a period of one year after the member’s initial MyCare Ohio effective date. (Members who are identified by the plan for high-risk care management may transition to plan network physicians after 90 days). For Dual Benefits members using noncontracted providers, the current Medicare and FFS Medicaid secondary payment rates apply. For Medicaid Only members, Ohio Medicaid For Medicaid Only members, Ohio Medicaid requires MyCare Ohio plans to pay noncontracted physician “crossover” , or secondary claims, in accordance with the fee-for-service Medicaid claims payment methodology. Source: ODM, 2014 24 Provider Payment (cont’d) • Claims are submitted directly to plan. • Providers must first work directly with the plan on claims and any other issues regarding MyCare. • Provider issues not resolved with plan can be escalated to: https://pitd.hshapps.com/external/epc/aspx. Source: ODM, 2014 25 Ohio ICDS Risk-based Capitation Model • CMS, ICDS plans, and state entered into 3-way contracts and conducted plan readiness reviews. • Providers must negotiate rates with plans (Medicare rates are likely floor). • If providers rejected rates, CMS may have considered plan “not ready”. • Medicare and Medicaid contribute to total capitation payment per CMS rate-setting process guidelines. • Medicare rate based on estimate of A & B expenditures on enrollees in absence of ICDS, and Medicare FFS standardized county rates. Existing Part D rules apply. Medicaid based state 1915(b) waiver spending. • Rates adjusted for acuity levels of enrollees, based on community or institutional level of acuity per waiver assessments and other data. 26 Ohio ICDS Provider Impacts • New Payer Contracts for FBDE: Providers will negotiate rates with ICDS plans. Medicare rates will be likely floor. If providers reject plan rates, CMS may consider plan “not ready.” • Minimum Medical Loss Ratio: Plans penalized for not meeting 90% threshold for payment and quality. • Medical Necessity: Plans will use existing Medicare and Medicaid medical necessity definitions when making coverage decisions for ICDS beneficiaries, and “apply the more generous” standard in cases where Medicare and Medicaid medical necessity definitions overlap. • ED admissions: Better coordination of care through ICDS Transitional Care Management Teams may lead to increased primary care intervention and lower ED admissions for FBDE. • Discharge Planning: Discharge planning to SNF, home care, and other institutional & community care may be more seamless under managed care, wraparound model. • Continuity of Care: Plans must allow enrollees to continue seeing existing medical and non-medical providers for reasonable lengths of time; in some cases, up to a year. • Beneficiary Appeals Process: Beneficiaries will be notified of Medicare A, B and Medicaid appeals rights in a single, integrated notice. Medicare service denials must first be appealed to the ICDS plan. Medicaid denials, terminations, and reductions appeals must be filed with the plan or the Bureau of State Hearings (BSH). Unfavorable Medicare appeals decisions will be automatically forwarded to an Independent Review Entity (IRE). Unfavorable Medicaid appeals decisions may be appealed by the beneficiary to the BSH. Plan appeals must be resolved within 15 days or 72 hours if expedition requested. Plan must continue to pay for services during appeal, if appeal was filed timely. 27 Minimum Medical Loss Ratio • Unique to Ohio. • Each plan will be required to meet a Minimum Medical Loss Ratio (MMLR) requirement. • The MMLR sets a minimum percentage of the plan’s capitated payment that must be used for providing care (i.e. paying claims) and addressing quality. • If ICDS plan has an MLR above 90%, meaning, a minimum of 90% of the gross joint Medicare and Medicaid payments are used to pay for beneficiary care, the plan is in compliance with the MMLR requirement. • If the plan spends 85%-90% of its rate on services, the State and CMS may issue a corrective action plan or levy a fine. • If the plan spends less than 85% of its rate on services, resulting in an MLR below 85%, the plan will be required to return any funds it received above the 85% mark, multiplied by the total applicable contract revenue, back to Medicare and Medicaid. 28 ICDS Plan Contacts Source: ODM, 2014 29 9 million Dual Eligibles comprise 2.8% of the national population but account for 10% of national healthcare expenditures and 1.6% of GDP.* By 2024, total national DE expenditures could reach $775B, or $80,000 per DE.* *The Lewin Group, 2008: Increasing Use of Capitated Model for Dual Eligibles: Cost Savings Estimates and Public Policy Opportunities 30 Eleven states have signed MOU with CMS for ICDS Demonstration Project. Seven others have proposals pending with CMS. Signed: • • • • • • • • • • • Ohio Massachusetts California Illinois Colorado Michigan Minnesota New York South Carolina Virginia Washington Pending: • • • • • • • Connecticut Iowa Missouri North Carolina Oklahoma Rhode Island Texas 31 Additional Resources Ohio ICDS Demonstration MOU with CMS: https://www.cms.gov/Medicare-Medicaid-Coordination/Medicare-and-MedicaidCoordination/Medicare-Medicaid-Coordination-Office/Downloads CMS ICDS Homepage: http://www.cms.gov/Medicare-Medicaid-Coordination Ohio Governor’s Office of Health Transition: http://www.healthtransformation.ohio.gov Ohio Hospital Association ICDS News Page: http://www.ohanet.org/ 32