PowerPoint - Tennessee Hospital Association

advertisement

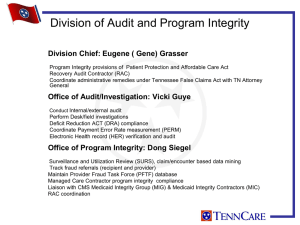

Presentation to Tennessee Hospital Association D E N N I S J . G A R V E Y, J D DI R EC TOR , OFFI C E OF P ROG R A M I N TEG R ITY BUR EAU OF TEN N C A R E What is “RAC”? “RAC” stands for Recovery Agent Contractor Pursuant to the Affordable Health Care Act, the State has established a program under which it will contract with one (or more) recovery audit contractors (RACs). This contract is for the purpose of identifying underpayments and overpayments of Medicaid claims under both the State plan and under any waiver of the State plan. Our Authority to Perform Recovery Department of Health & Human Services Centers for Medicare & Medicaid Services 61 Forsyth St., Suite 4T20 Atlanta, Georgia 30303-8909 February 3, 2012 Mr. Darin J. Gordon, Director Department of Finance and Administration Bureau of TennCare 310 Great Circle Rd Nashville, 1N 37243 Re: Tennessee Title XIX State Plan Amendment, Transmittal #11-012 Dear Mr. Gordon: We have reviewed Tennessee State Plan Amendment (SPA) 11-012, which was submitted to the Atlanta Regional Office on November 7, 2011. This amendment requested an exemption to the required three (3) year look-back period by the Medicaid Recovery Audit Contractor (RAC). Due to Tennessee's Medicaid program being operated as a managed care delivery system and to allow the Managed Care Contractors time to complete their internal claims processing and program integrity operations, CMS approves an exemption with a five (5) year look-back period. Based on the information provided, the Medicaid State Plan Amendment 1N 11-012 was approved on February 3, 2012. The effective date of this SPA is November 15,2011. The signed HCFA-179 and the approved plan pages are enclosed. If you have any questions regarding this amendment, please contact Kenni Howard at (404) 562-7413. Jackie Glaze ~by David Kimble Associate Regional Administrator Division of Medicaid & Children's Health Operations Enclosures Look-back Period CMS has granted approval for TennCare to look-back five (5) years from the date of a paid claim. TennCare RAC Facts Tennessee currently contracts with HMS to perform RAC recoveries. HMS has a three-year contract with TennCare; from February 1, 2011 through January 31, 2014; with two allowable one-year contract extensions through January 31, 2016. . HMS is the RAC contractor for twenty-six (26) states. What does RAC cover? All TennCare Providers All TennCare claims (Fee-for-service, Encounter and Capitation) All improper payments, including, but not limited to: Incorrect payments Non-covered services Incorrectly coded services Duplicate services Services not rendered Excessive Reimbursements Reimbursement Errors Coverage or Eligibility Errors Types of RAC Audits Automated Audits Data Matching Data Mining Desk Audits Complex On-site Audits Financial Clinical Additional RAC requirements The contractor shall refer any and all suspected fraud cases to the Bureau of TennCare. TennCare will coordinate the payment integrity efforts of the MCOs, the PBM and DBM and remove them from HMS reviews as appropriate. Scenario Development The RAC request shall document the overpayment scenario, explaining the methodology used to identify the finding and citing state and federal regulations to establish good cause for the review of the claim. RAC contractor is required to present two new scenarios per quarter for approval, but are currently delivering two new scenarios each month. Records Request There is a maximum limit of three-hundred (300) record requests per provider for any 45-day period. A statistically valid random sample (SVRS) may be used for providers to decrease the amount of records needed for a suitable sample. HMS does not and shall not pay for copying medical records. Audit Findings A Preliminary Recovery Findings letter will be sent to a designated contact person at each provider. It contains: Summary of provider’s response options Audit Report - containing a listing of each claim Evidence supporting the determination Information and instructions for requesting a reconsideration and/or appeal. Review Audit Personnel Medical Director Relevant Medicaid experience in a role that involves developing coverage or medical necessity policies and guidelines Good standing with the relevant State licensing authorities and has relevant work and educational experience Board-certification in a medical specialty and at least three (3) years of medical practice as a board-certified physician Professional Nursing and Coding Staff RAC Questions Answers to Frequently Asked Questions about the RAC may be found at: www.tn.gov/tenncare/forms/RACFAQ.pdf What is an “overpayment”? “(B) OVERPAYMENT—The term ‘‘overpayment’’ means any funds that a person receives or retains under title XVIII (Medicare) or XIX (Medicaid) to which the person, after applicable reconciliation, is not entitled under such title.” Important distinction: “funds”, not “benefit” Some Reasons for Overpayments Payment exceeds the usual, customary, or reasonable charge for the service Duplicate payments of the same service(s) Incorrect provider payee Incorrect claim assignment resulting in incorrect payee Payment for non-covered, non-medically necessary services Services not actually rendered Payment made by a primary insurance Payment for services rendered during a period of non-entitlement (patient's responsibility) More Reasons for Overpayments Failure to refund credit balances Excluded ordering or servicing person Patient deceased Servicing person lacked required license or certification Billing system error Service induced by false statement of ordering provider Service inconsistent with physician order or treatment plan Service not documented as required by regulation No order for service Service by an provider who is not enrolled that is “billing through” an enrolled provider False Claims Section 6402(g): In addition to the penalties provided for in 6402, a claim that includes seeking reimbursement for provision of items or services that violate this section constitutes a false or fraudulent claim for purposes of Subchapter III of Chapter 37 of Title 31 USC. False Claims Act (FCA) Expands FCA liability to indirect recipients of federal funds Expands FCA liability for the retention of overpayments, even where there is no false claim Adds a materiality requirement to the FCA, defining it broadly Expands protections for whistleblowers Expands the statute of limitations Provides relators with access to documents obtained by government Reporting and returning of overpayments: Section Adds 6402(a) Section 1128J(d)(1)(A) to the Social Security Act Reporting and returning of overpayments: “In general, if a person has received an overpayment, the person shall: 1. (A) report and return the overpayment to the Secretary, the State, an intermediary, a carrier, or a contractor, as appropriate, at the correct address; and 2. (B) notify the Secretary, State, intermediary, carrier, or contractor to whom the overpayment was returned in writing of the reason for the overpayment.” PPACA Section 6402 Medicare & Medicaid Program Integrity Provisions ‘‘(d) REPORTING AND RETURNING OF OVERPAYMENTS— (1) IN GENERAL — If a person has received an overpayment, the person shall— (A) report and return the overpayment to the Secretary, the State, an intermediary, a carrier, or a contractor, as appropriate, at the correct address; and (B) notify the Secretary, State, intermediary, carrier, or contractor to whom the overpayment was returned in writing of the reason for the overpayment.” What Are Funds “Not Entitled”? Kickback STARK Eligibility Conditions of payment Violation without Intention Section 6402(f)(2): Adds new subsection 1128B(g) of the Social Security Act Amends the federal health care program antikickback statute by adding a provision to clarify that “a person need not have actual knowledge of this section or specific intent to commit a violation of this section.” Who must return the overpayment? A “person” (which includes corporations and partnerships) who has either “received” or “retained” the overpayment Focus on “receipt”; payment need not come directly from Medicaid; if “person” “retains” overpayment due the program, violation occurs A “person” includes a managed care plan or an individual program enrollee, as well as a program provider or supplier When is an overpayment “identified”? “Identified” for an organization means that the fact of an overpayment, not the amount of the overpayment, has been identified. (e.g., patient was dead at time service was allegedly rendered, APG claim includes service not rendered, charge master had code crosswalk error) Compare with language from CMS proposed 42 CFR 401.310 overpayment regulation 67 FR 3665 (1/25/02 draft later withdrawn) “If a provider, supplier, or individual identifies a Medicare payment received in excess of amounts payable under the Medicare statute and regulations, the provider, supplier, or individual must, within 60 days of identifying or learning of the excess payment, return the overpayment to the appropriate intermediary or carrier.” When is an overpayment “identified”? Employee or contractor identifies overpayment in hotline call or email Patient advises that service not received RAC advises that dual eligible Medicare overpayment has been found TennCare sends letter re: deceased patient, unlicensed or excluded employee or ordering physician Qui tam or government lawsuit allegations Criminal indictment or information Government is Using Data to Detect Overpayments Excluded persons Deceased enrollees Deceased providers Credit balances Overpayment Identification in Error An employee, contractor, patient or State may make a mistake. That is the reason why the statute gives providers 60 days to report after the identification Need for internal review and assessment No obligation to report allegation if your investigation shows that it is inaccurate BUT - risk is on provider who decides not to report Reduced Protection From Limitations Periods What is effect on statute of limitations? Under federal and state false claims acts, statute of limitations runs from 60 days after date of identification, not date of claim or date of payment. Credible Allegation of Fraud State agency makes determination of credible allegation of fraud that has “indicia of reliability” Can come from any source: Complaint made by former employee Fraud hotline Claims data mining Patterns identified through: Audits Civil false claims Investigations Important Points TennCare is required to review evidence and carefully consider the totality of facts and circumstances. Suspension or even partial suspension is an extraordinary action, not a routine matter. This action is reserved only for cases where there are pending investigations of credible allegations of fraud. What is a “Good Cause Exception”? CMS regulations allow for discretion in cases where the best interest of law enforcement or the Medicaid program come into play as a result of an allegation of fraud. These are called “good cause exceptions”. Law Enforcement Good Cause There are valid law enforcement-related reasons to not suspend payments to providers, such as where: There are requests by law enforcement. Suspension of payments might give a “heads up” to a perpetrator, or expose undercover investigators, whistleblowers or confidential sources. Other Reasons for Good Cause Certain other Good Cause exceptions may be invoked, such as in cases where: Suspension is not in the best interest of the Medicaid program; and/or Access to necessary items or services may be jeopardized. This situation involves working with other regulating agencies on access to care. More Reasons for Good Cause Examples could fall into either category depending on context, such as where: Other available remedies could more effectively or quickly protect Medicaid funds than would implementing (or continuing) a payment suspension; and/or There is immediate enjoinment of potentially unlawful conduct. Suspension Process Notes The suspension process must be documented and maintained by TennCare. The 6402(h) suspension process will be coordinated with TennCare and the TBI Medicaid Fraud Control Unit. TennCare and MCOs may be required to work with providers to accommodate patients who need care. Questions? RAC Overpayments Credible Allegations of Fraud Reporting Allegations To TennCare PHONE Fraud Hotline 1-800-433-3982 Fax: 615-256-3852 EMAIL MAIL Go to: www.tncarefraud.tennessee. gov or email us at: Programintegrity.TennCare @tn.gov Bureau of TennCare Office of Program Integrity 310 Great Circle Road Nashville, TN 37243