1099 reporting powerpoint

advertisement

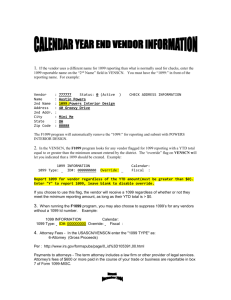

1099 Reporting And other related issues What is the purpose of this training? To enable University of Arizona employees To understand why we are required to obtain tax information for 1099 reporting. To identify 1099 reportable payments. To obtain Tax Identification Numbers for reportable payments. To setup vendor numbers in a manner that will comply with IRS requirements. Agenda What does the law say Who is 1099 reportable What information do we need to obtain from them How do we document W9 information How do we code vendors for 1099 status How do we code vouchers for 1099 status What payments are not 1099 reportable How does the IRS check TINs How should Vendor Numbers be setup What does the law say? The Federal law requires that The University of Arizona report payments for services, fees, etc. to the IRS using Form 1099. In order to do this the university needs a Federal Taxpayer Identification Number for each vendor. If a vendor fails to provide a TIN for a reportable payment, the university should not set up contracts with them or, if the service has already been performed, must withhold 28% from their payment. Who should provide a TIN? Section 6109 of the Internal Revenue Code requires a vendor who receives a payment to give their correct TIN to persons who must file information returns with the IRS. The vendor must provide their TIN, when it is requested by the university, whether or not they are required to file a tax return or whether or not the payment is reportable. What do we need to obtain? A TIN A TIN (Federal Tax Identification Number) can be either: – A SSN (Social Security Number if an individual) – An EIN (Employer Identification Number) which can be used by both organizations and individual. If the vendor is an individual you need to ask: 1. Whether they are a US citizen irregardless of where they live. If they are not a US citizen you need to contact FSO-Operations as there are other tax issues that need to be addressed. 2. Are you an employee of the University of Arizona or any other State of Arizona agency. If they are a state employee contact FSO-Operations as there are other tax issues to be addressed. Is this a Foreign Vendor? If a foreign company or individual performs a service in the US or is paid for royalties, they are 1042 reportable and you need to contact FSO-Operations. If the vendor resides outside of the US but says they are a US citizen, the U of A requires proof of citizenship (e.g.birth certificate) as a SSN is not proof of US citizenship. US citizens who reside outside the US are reported on a 1099. FYI – Canada has SSNs that look just like the US SSNs and even duplicate some. If the individual is a Canadian citizen or resident we need to verify (preferably with a copy of the SSN card) that it is a US SSN. Can we obtain TINs verbally? We are allowed to obtain Tax Identification Numbers verbally but we are required to document Who took the information, Who we took it from and When. The documentation is scanned/faxed into Docuware so we also need the Vendor # and Vendor Name on the documentation. The required information can be put on Vendor Notes (10N or 20N) in FRS and faxed into Docuware. Be careful of franchises as each has a different EIN. What else do we need to obtain? Tax exempt status. Vendors who are exempt from 1099 reporting include government agencies, corporations, 501C Non-Profit Organizations and certain other organizations. Corporations must show: Corporation Inc PC Corp Medical and Legal Corporations are NOT exempt. An LLC or Ltd is NOT a corporation, is reportable and must provide a TIN. What is the “Eyeball Test”? The IRS allows us to use the “Eyeball Test” and assume exempt status for corporations, government agencies, hospitals, insurance companies, churches, universities and schools and banks. “Eyeball” means that the invoice or other legal document, including the WWW, shows the above. We cannot take this info verbally but documents allowed are: Company letterhead sent or faxed from payee. Pre-printed invoice from payee with company name. Official web site of payee company showing company name, and address. How do we document W9 Info? Documentation must be kept on all W9 information and is scanned into Docuware including copies of W9s, copies of websites and letterheads. We already maintain invoices in Docuware and just need to note on Vendor Notes (10N or 20N in FRS) where we saw the designation (INC/INV 1/14/05 RA). Any time we receive verification of exempt status or a tax id # we need to note on Vendor Notes where we got it from. (E.g EIN & PARTNERSHIP/W9 1/10/05 RA or SSN & SOLE PROP/W9 1/7/05 RA) so we can find the verification if questioned. How do we code vendors for 1099 status? The 1099 field in FRS is coded C, I or F: C - Exempt vendors (Corporations, government agencies, hospitals, universities or colleges, insurance, churches, banks and 501c nonprofit organizations.) I - Non-exempt vendors (Individuals, sole proprietors, LLC or LTD, partnerships or if we do not have in writing that a vendor is exempt) F - Foreign vendors. If the foreign vendor is performing a service in the US they will fall under 1042 reporting and FSO-Operations needs to know about them before payment. What is the Tax ID Type? The Tax ID type is “T” for Employer Id #s or “S” for Social Security Numbers. This is important as there are some TINs that are both SSNs and EINs. Ask, Ask, Ask if the TIN is a SSN or an EIN. This not only assures that it is coded correctly but helps identify Sole Proprietors that have given you a company name. If the vendor is an individual or Sole Proprietor we must also have the name of the person the SSN or EIN is for as this is what the IRS will look for. FRS Vendor Screen What are the 1099 Voucher Codes? L – Rent or lease M – Medical, dental, veterinary, ambulance, psychiatric and physical therapy services. N – Non employee compensation – Any fee for service P – Other payments that are not fees for services. R – Royalties Z – Payments for settlements when the check is made out to both the attorney and the claimant. 1099 Form L - Rentals or Leases Real estate rental Equipment rental Charter of bus or airplane If the driver's or pilot's fee is included in the charter fee, include the whole payment under the code of L. – If the driver's or pilot's fee is listed separately on the invoice, code the fee as an N and the rental as an L. L - Rentals or Leases (cont) Film rental Furniture or office equipment rental Spring fling rentals Rent-to-Own Bed & Breakfast Hotel room rentals (If the hotel bill includes room rental, code entire bill as "L") M - Medical All medical or health care services even if the vendor is incorporated. Dental services Veterinary services Ambulance services Psychiatric services Physical therapy N - Non-employee Compensation ANY tangible purchase that includes a service (code whole invoice as N) Advertising Airline tickets Artistic creations purchased from the artist Banquets Catering Commissions Consultants fee N - Non-Employee Comp (cont) Entertainers Honorarium or lecturer's fee Laundry & cleaning services Legal fees – All legal fees are reportable even if the vendor is a corporation. If who receives the payment cannot be determined, code as Z Maintenance agreements Medical tests analyzed by the vendor Medical Insurance Medical research N - Non-Employee Comp (cont) Membership/Dues Programming Per-diem exceeding the per diem as established for University employees on travel status. Photographer services Professional Service Fees (Accountants, Architects, etc.) Publishing fees Registration/Conference fees N - Non-Employee Comp (cont) Software support and software license maintenance fees (Software is not reportable) Sports officials Subject Pay Tickets Transportation service Trash collection and sewer service. Travel agencies P- Other Income Final payroll payments of deceased employees to beneficiary. Prizes or awards that are not for services such as the prizes given at Spring Fling. R - Royalties All royalty or copyright payments License Fees for reprints Intellectual property fees Permission Fees for use of copyright material. Z - Legal Settlements Legal settlements when the attorney's legal fee cannot be determined. (e.g. The attorney's and the claimant's name on one check) Legal fees for services provided the University of Arizona are “N” What payments are not 1099 reportable? Tangible items – Code T Expense reimbursement, with original receipts – Code X Scholarships or fellowships – Code S Payments to Foreign vendors for services performed in the US or royalties – 1042 reportable (including 3rd party payments). Payments to Foreign vendors for services (not royalties) performed outside of the US – Not reportable unless they show as a US Resident for Tax purposes on the Substantial Presence Test (ask FSO-Operations) Employee Perks (including 3rd party payments) – W2 reportable. Employee Perks – (Just an FYI if you run across these payments) Something of value given to employees over and above regular wages and benefits. Employee reimbursement of auto leases, repair/maintenance, insurance, licensing and registration. Employee Housing (Apartment rentals, house payments, etc.) including that for short term employees. Refund of Insurance Child Care Commuting between home and work. Moving Expenses including third party payments for rental car and lodging in Tucson. Gifts or awards of money or goods. How does the IRS check TINs? The IRS runs all vendors through a program that matches the TIN with the name(s). If they don’t match we get a B Notice and will be penalized if we report them without getting new info. They are looking for the name the TIN was issued for and they look at both address lines. If we receive a B Notice we cannot verify the information verbally but must have a signed W9 and must immediately start withholding 28% on any payment or freezing the vendor. A 2nd B Notice requires verification of name and TIN from the Social Security Administration or Internal Revenue Service. How should Vendor Numbers be set up? The 1099 tape has two lines for names but we have only one. To show two lines on the 1099 tape the first Address line in FRS must have DBA or DIV in front of the name so it will be picked up as the 2nd Address Line. The legal name, the name that the TIN was obtained under, must be on one of the two lines in order to avoid B Notices. Individual or Sole Proprietor The individual’s name should be on 1st line (SUSAN *SMITH) and the DBA, if any, on 2nd line (DBA SUE’S STICHES). The SSN or EIN must belong to the name on the 1st line. Partnership If the partnership is using a SSN, the name of the person whose SSN it is must be in the name line (SUSAN *SMITH) and the name of the Partnership on the first Address Line with DBA in front (DBA SUE AND SALLY’S STICHES) If the partnership has an EIN put the name of the partnership on the Name Line. Companies The legal name can be either on the name line (SSS LLC) with a DBA on the first Address Line (DBA S & S STICHES). Or the DBA name can be on the Name line (S & S STICHES) and the legal name on the first Address Line with DIV (for “division of”) in front (DIV SSS LLC). Organization and Conferences The name of the organization that the TIN is for must be on the Name line or on the first Address Line with DIV or DBA in front. (e.g. SEWING SOCIETY) The name of the conference means nothing to the IRS. (e.g. 2005 CONFERENCE ON SEWING) Get a correct address as often the address given is not the address we need to mail the 1099 to. Best of all get written corroboration that the organization is exempt so we don’t have to report! Organizations at a University Most organizations need to supply their own TIN, not that of the university. We require all our organizations to get their own TIN before we pay them as they are not legally part of the University even though the members may be students, faculty or staff at the university. If an organization does not have an FRS account # they are probably not part of the U of A. If they do have an FRS account # they should be paid with an IDB. Additional resources From the IRS Website (http://www.irs.gov) you can download a W9 form and instructions and a 1099 form and instructions.