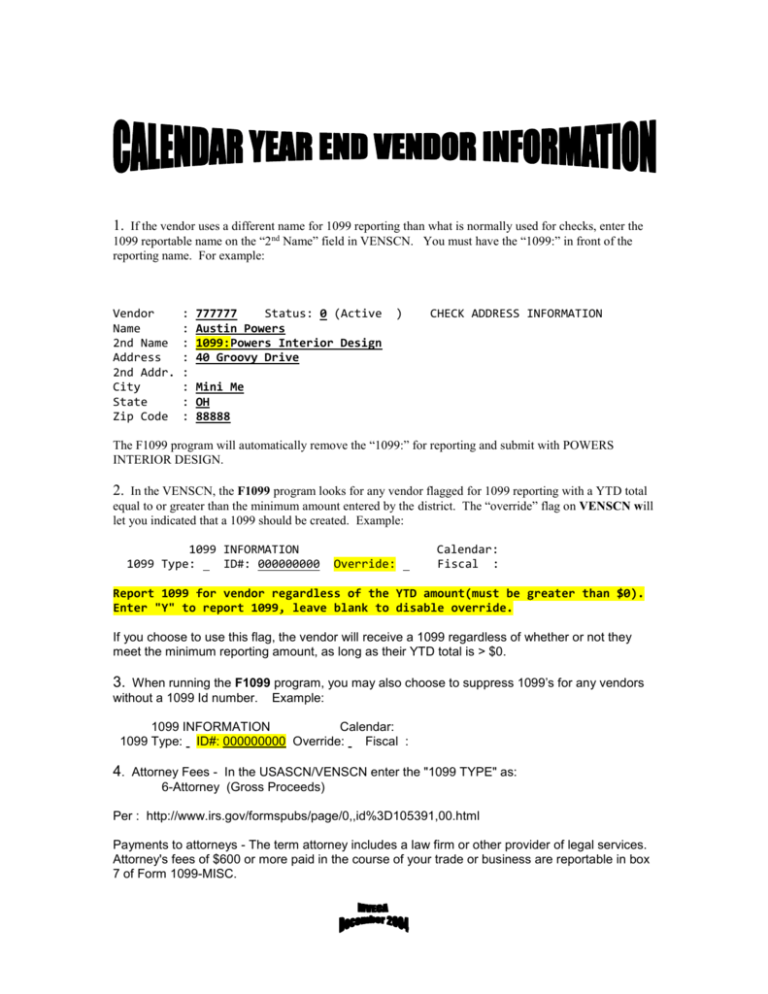

Vendor Information

advertisement

1. If the vendor uses a different name for 1099 reporting than what is normally used for checks, enter the 1099 reportable name on the “2nd Name” field in VENSCN. You must have the “1099:” in front of the reporting name. For example: Vendor Name 2nd Name Address 2nd Addr. City State Zip Code : : : : : : : : 777777 Status: 0 (Active Austin Powers 1099:Powers Interior Design 40 Groovy Drive ) CHECK ADDRESS INFORMATION Mini Me OH 88888 The F1099 program will automatically remove the “1099:” for reporting and submit with POWERS INTERIOR DESIGN. 2. In the VENSCN, the F1099 program looks for any vendor flagged for 1099 reporting with a YTD total equal to or greater than the minimum amount entered by the district. The “override” flag on VENSCN will let you indicated that a 1099 should be created. Example: 1099 INFORMATION 1099 Type: ID#: 000000000 Override: Calendar: Fiscal : Report 1099 for vendor regardless of the YTD amount(must be greater than $0). Enter "Y" to report 1099, leave blank to disable override. If you choose to use this flag, the vendor will receive a 1099 regardless of whether or not they meet the minimum reporting amount, as long as their YTD total is > $0. 3. When running the F1099 program, you may also choose to suppress 1099’s for any vendors without a 1099 Id number. Example: 1099 INFORMATION Calendar: 1099 Type: ID#: 000000000 Override: Fiscal : 4. Attorney Fees - In the USASCN/VENSCN enter the "1099 TYPE" as: 6-Attorney (Gross Proceeds) Per : http://www.irs.gov/formspubs/page/0,,id%3D105391,00.html Payments to attorneys - The term attorney includes a law firm or other provider of legal services. Attorney's fees of $600 or more paid in the course of your trade or business are reportable in box 7 of Form 1099-MISC.