1 Paul Middleditch

advertisement

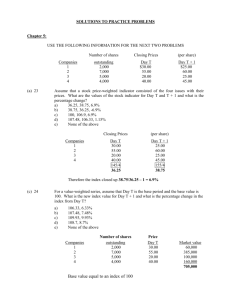

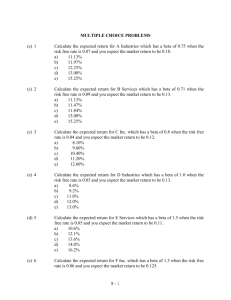

MUTIS Finance Conference 2014 Paul Middleditch Lecturer in Macroeconomics @DrMiddleditch In preparation, use your mobile phone visit www.rwpoll.com Session ID: manc (lower/upper case) Don’t enter details, just click Continue Feel Free to Feedback to me on TP or on twitter during this talk. 1 Linkedin Rankings for Investment University of Manchester Ranks seventh on Linkedin in the UK for employment in the area of investment banking. 151,800 students & alumni on Linkedin (440 personally connected) https://www.linkedin.com/edu/rankings/gb/undergraduateinvestment-banking 2 What contributes towards the success of our graduates? The existence of MUTIS is no doubt significant Manchester Business School Award winning careers office The Economics Department………..? 3 What is your impression of the current value of the FTSE 250? 33% 1. Strongly undervalued 2. Undervalued. 20% 3. About right. 20% 17% 4. Overvalued. 10% 5. Strongly overvalued. 1. 2. 3. 4. 5. Macroeconomics IIIA ECON30611– 3rd Year UG Macroeconomics IIIA – approx 300 students Twitter: @PaulM_Mac3A14 Learn the importance of expectations in the realistic modelling of the economy. Concepts of Rational Expectation and Adaptive Expectations Derive the New Keynesian Philips Curve (NKPC) from first principles: Macroeconomics IIIA What about when we disaggregate? The concept that both market fundamentals ‘and’ expectations drive prices can be dis-aggregated. The NKPC can be manipulated to describe the disaggregate or the sectoral level, such as the finance sector: Richard Evans – The Telegraph 25th Oct Stock Market Value: The market PE ratio currently around 15 Cyclically adjusted PE (CAPE) currently 14 (11 in 2009) Dividend Yield currently 4% (Highest for 13 years) All measures signal ‘BUY’ but only reflect past information. Legacies, Clouds and Uncertainties – IMF World Outloook (Global Growth – 3.3% 2014) What is your impression of the current value of the FTSE 250? 30% 1. Strongly undervalued 2. Undervalued. 20% 20% 17% 3. About right. 13% 4. Overvalued. 5. Strongly overvalued. 1. 2. 3. 4. 5. What is your impression of the current value of the FTSE 250? 33% Strongly undervalued Undervalued. 20% 10% 20% 20% About right. 17% 17% Overvalued. Strongly overvalued. 30% 20% 13% First Slide Second Slide Conclusion.... Traditional measures of stock market and investment vehicles value tend to be backward looking. Current prices already contain information about the future so measures of value should also. Including policy announcements and economic outlook could provide better indicators for the future value of stocks, forex, bonds and financial vehicles generally. Finally, you can also view the course taught in Economics at Manchester over the web to see this in practice: @PaulM_Mac3A14 11