Robert Haddad Ashley Hughes AmirAli Motamedi Masoudieh

advertisement

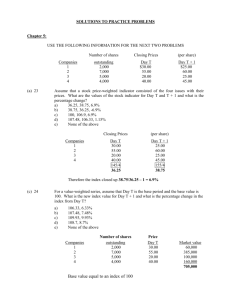

Robert Haddad Ashley Hughes AmirAli Motamedi Masoudieh Size and Composition Business and Economic Analysis Financial Analysis Valuation Analysis Recommendation Composed of companies involved in the production and supply of energy 166 Energy Sector Stocks with >$1B Mkt Cap (non‐ADR) 39 “Energy Sector” Companies in S&P 500 10.69% of the S&P 500 $1.079 Trillion in Market Cap in S&P 500 Composed of companies involved in the production and supply of energy 166 Energy Sector Stocks with >$1B Mkt Cap (non‐ADR) 39 “Energy Sector” Companies in S&P 500 10.69% of the S&P 500 $1.079 Trillion in Market Cap in S&P 500 Telecommunication Services, 3.00% Utilities, 3.76% Materials, 3.44% Consumer Discretionary, 10.12% Consumer Staples, 11.53% Information Technology, 18.69% Energy Sector S&P: 10.69% SIM: 9.07% 1.61% Underweight Energy, 10.69% Industrials, 10.38% Financials, 16.31% Health Care, 12.09% % SIM Under/Overweight S&P 500 As of 6/30/10 Utilities Telecommunication Services Materials Information Technology Industrials Health Care Financials Energy Consumer Staples Consumer Discretionary -5.0% -4.0% -3.0% -2.0% -1.0% 0.0% 1.0% Currently Underweight in Energy by 1.61% 2.0% 3.0% SIM Stocks / Our Stocks Oil & Gas Drilling Noble Corp. Oil & Gas Equipment & Services National Oilwell Varco Inc., Cameron Int’l, FMC Technologies Integrated Oil & Gas Chevron Oil & Gas Exploration & Production Oil & Gas Refining & Marketing Oil & Gas Storage & Transportation Coal & Consumable Fuels Largest Companies Company Exxon Mobil Top Performers Stock Price Rank Market Cap (billions) 59.72 1 305.3 Company Pioneer Natural Resources 1 Yr Price Change 105.66% Chevron 73.52 14 147.7 Smith International 58.17% ConocoPhillips 53.79 29 80.1 FMC Technologies 54.11% Schlumberger 59.35 34 70.8 Sunoco 37.08% Occidental Petroleum 82.14 37 66.7 EOG Resources 37.01% Oil Natural Gas Fossil Fuels Coal Electric Power Solar Wind Renewable Hydropower Nuclear Geothermal Bioenergy Fusion Hydrogen Current & Forecasted Oil Production Capacity Current & Forecasted World Oil Demand Current &Forecasted GDP Predominantly From Industrial & Agricultural Output Current & Forecasted Level of World Population and Number of Cars Current Estimates of World Oil Reserves The level of Political, Economical and Social Stability in Oil Producing Countries OPEC Decisions The Current and Projected Level of Investment Requirments Infrastructural Components of The Energy Sector CIA‐Factbook Argentina Egypt Malaysia Qatar Oman Indonesia Azerbaijan Thailand Kazakhstan Libya Kyrgyzstan United Kingdom Nigeria Angola Brazil Venezuela Algeria Kuwait United Arab Emirates Norway Iraq European Union Mexico Canada India Iran China United States Saudi Arabia Russia 10,000,000 9,000,000 8,000,000 7,000,000 6,000,000 5,000,000 4,000,000 3,000,000 2,000,000 1,000,000 0 CIA‐Factbook Malaysia South Africa Argentina Turkey Thailand Egypt Belgium Venezuela Taiwan Singapore Australia Netherlands Iran Spain Indonesia Italy United Kingdom Mexico France Korea, South Canada Saudi Arabia Brazil Germany India Russia Japan China European Union United States 20,000,000 18,000,000 16,000,000 14,000,000 12,000,000 10,000,000 8,000,000 6,000,000 4,000,000 2,000,000 0 Yemen United Kingdom Ecuador Indonesia Egypt Vietnam Oman European Union India Norway Sudan Azerbaijan Brazil Mexico Angola Algeria China United States Qatar Kazakhstan Nigeria Libya Russia United Arab Emirates Venezuela Kuwait Iraq Iran Canada Saudi Arabia 300,000,000,000 250,000,000,000 200,000,000,000 150,000,000,000 100,000,000,000 50,000,000,000 0 OPEC Bulleting‐WWW.OPEC.ORG 2009 World Oil Outlook World Oil Outlook‐2009 World Oil Outlook‐2009 World Oil Outlook‐2009 Threat of Entry(Low): Capital Intensive/ Regulations & Controls/OPEC power/Government oversights Threats of Rivalry(Medium): Relatively low among OPEC members/ medium among publically traded or private companies Threats of Substitutes(Low‐Medium): In large scale currently no substitute in current energy portfolio but more diversification in energy in coming future Threats of Suppliers(Low): viewing suppliers as oil/petroleum equipment providers it is low to medium Threats of Buyers(Low): buyers hold not much power, it is traded in free market EPS Revenue 50.0% 200.0% 150.0% 25.0% 100.0% 50.0% 0.0% 0.0% ‐50.0% ‐25.0% ‐100.0% ‐150.0% ‐50.0% ‐200.0% Mean Median 11.5% 8.9% Note : Above mean calculated without outlier (950% on far left) Mean Median 2.6% 3.2% Revenue EPS 90.0% 450.0% 80.0% 70.0% 350.0% 60.0% 50.0% 250.0% 40.0% 30.0% 150.0% 20.0% 10.0% 50.0% 0.0% ‐10.0% ‐50.0% ‐20.0% Mean Median 12.2% 48.4% Mean Median 12.7% 15.9% 80.0% 70.0% 60.0% 50.0% 40.0% 30.0% 20.0% 10.0% 0.0% ‐10.0% Cons Discr. Cons Stap. Energy Financials Healthcare Industrials Info Tech Telecom Materials Utilities Relative to S&P 500 Energy Sector Valuation Overvalued by >10% Inline with S&P Undervalued by >10% Absolute Basis High Low Median Current % overvalued / (undervalued) P/Trailing E 24.7 6.1 13.6 15.2 11.8% P/Forward E 23.9 7.8 13.3 11.2 ‐15.8% P/B 4 1.4 2.8 1.9 ‐32.1% P/S 1.4 0.5 1 0.9 ‐10.0% 10.1 5 7.6 7.4 ‐2.6% P/CF Relative to SP500 High Low Median Current % overvalued / (undervalued) P/Trailing E 1.1 0.5 0.74 1 35.1% P/Forward E 1.2 0.57 0.78 0.82 5.1% P/B 1.4 0.7 0.9 0.9 0.0% P/S 1 0.6 0.7 0.8 14.3% 0.9 0.6 0.7 0.8 14.3% P/CF Industry Valuations Oil & Gas – Equipment/Services Overvalued by >10% Inline with S&P Undervalued by >10% Absolute Basis High Low Median Current % overvalued / (undervalued) P/Trailing E 107 6.5 28 22.5 ‐19.6% P/Forward E 32.9 7.8 21.3 18.7 ‐12.2% P/B 8.6 1.6 4.6 2.6 ‐43.5% P/S 3.5 1 2 2.1 5.0% P/CF 23 5.5 13.3 12.7 ‐4.5% Relative to SP500 High Low Median Current % overvalued / (undervalued) P/Trailing E 3.9 0.58 1.5 1.5 0.0% P/Forward E 1.7 0.61 1.3 1.4 7.7% P/B 2.8 0.9 1.4 1.3 ‐7.1% P/S 2.8 1 1.5 1.8 20.0% P/CF 1.6 0.8 1.2 1.4 16.7% Industry Valuations Drilling Relative to SP500 High Low Median Current % overvalued / (undervalued) P/Trailing E 3.7 0.28 1.3 0.68 ‐47.7% P/Forward E 2.1 0.28 0.9 0.9 0.0% P/B 1.7 0.4 0.7 0.6 ‐14.3% P/S 5.7 1.4 2.7 1.4 ‐48.1% P/CF 1.8 0.4 1.1 0.6 ‐45.5% Median Current % overvalued / (undervalued) Exploration/Production Relative to SP500 High Low P/Trailing E 1.4 0.31 0.69 1.2 73.9% P/Forward E 1.9 0.5 0.75 1.1 46.7% P/B 1.3 0.5 0.7 0.8 14.3% P/S 3.5 0.9 1.8 2.7 50.0% P/CF 0.8 0.3 0.5 0.7 40.0% Overvalued by >10% Inline with S&P Undervalued by >10% Industry Valuations Integrated Relative to SP500 High Low Median Current P/Trailing E 1.1 0.5 0.68 0.86 P/Forward E 1.2 0.46 0.73 0.7 P/B 1.4 0.7 1 0.9 P/S 0.8 0.5 0.6 0.7 P/CF 0.9 0.5 0.7 0.8 % overvalued / (undervalued) 26.5% ‐4.1% ‐10.0% 16.7% 14.3% Refining/Marketing Relative to SP500 High Low Median Current % overvalued / (undervalued) P/Trailing E 7.6 0.23 0.53 - - P/Forward E 4.8 0.3 0.55 0.87 58.2% P/B 1.3 0.2 0.5 0.4 ‐20.0% P/S 0.5 0.1 0.2 0.1 ‐50.0% P/CF 1.3 0.2 0.5 1.2 140.0% Overvalued by >10% Inline with S&P Undervalued by >10% Industry Valuations Oil Storage Relative to SP500 High Low Median Current P/Trailing E 22 0.21 1.1 0.97 P/Forward E 1.3 0.69 1.1 1 P/B 1.1 0.6 0.9 0.9 P/S 2.2 0.4 0.9 1.6 P/CF 1.3 0.5 0.7 0.7 % overvalued / (undervalued) ‐11.8% ‐9.1% 0.0% 77.8% 0.0% Coal Relative to SP500 P/Trailing E P/Forward E P/B P/S P/CF High Low Median Current 23.3 2.1 2.1 0.45 0.39 0.7 1.3 0.99 1.5 1.3 0.88 1.5 4 0.3 1 1.4 2.1 0.5 0.8 1.1 % overvalued / (undervalued) 0.0% ‐11.1% 0.0% 40.0% 37.5% Overvalued by >10% Inline with S&P Undervalued by >10% Currently underweight by 161 basis points Recommend increasing weight by 211 basis points to bring SIM overweight relative to S&P500 by 50 basis points Demand for energy will increase with economic recovery, further growth in emerging market, expected reduction of energy sector systematic risk, still relatively cheap