Program Exclusions

advertisement

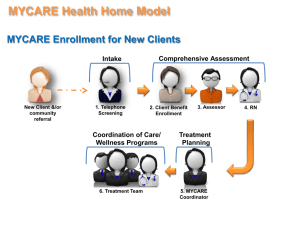

MyCare Ohio Skilled Nursing Facility Orientation Demonstration/Pilot Area 2 Health Plan Options 3 Implementation Timeline 4 114,000 members in 29 counties are eligible for the MyCare Ohio program. This includes: • Individuals 18 years and older • Members residing in the MyCare Ohio service area • Individuals entitled to benefits under Medicare Part A enrolled under Medicare Parts B and D, and receive full Medicaid benefits. • Adults with disabilities and persons 65 years and older • Persons with serious mental illness 5 Program Exclusions Those who are not eligible for MyCare Ohio enrollment: • Individuals under age 18 years • Individuals with an ICF/IDD level of care served either in an ICF/ID facility or on a waiver • Individuals who are eligible for Medicaid through a delayed spend-down • Individuals with third party insurance 6 Opt IN Enrollees Full duals with Buckeye Medicare and Medicaid benefits through Buckeye – Medicare – option to change plans monthly – If member selects another MyCare MCP will be enrolled as a full dual with the new plan – If member selects a plan outside the MyCare network, member retains Medicaid benefits with Buckeye. One claim submitted to Buckeye. – Will be adjudicated for both Medicare and Medicaid with one submission. – Will generate two payments 7 Opt IN ID Card (Medicare & Medicaid) 8 Opt OUT Enrollees Medicaid as Secondary Coverage with Buckeye Medicaid benefits only through Buckeye – Option to change Managed Care Plans during initial 90 days of enrollment – Locked in for remainder of benefit year until annual open enrollment – Medicare benefits through other non MyCare payor including Fee for Service Secondary claims to be submitted to Buckeye. – Will be adjudicated as secondary payor 9 Opt OUT ID Card (Medicaid Only) 10 Service Packages Services included: Medical benefits Behavioral health benefits Home & Community Based Services Long Term Care Pharmacy Dental Vision 11 e Services MyCare Ohio Waiver includes: Ohio Home Care Waiver Transitions II Carve-Out Waiver Passport Waiver Choices Waiver Assisted Living Waiver Enrollees who are eligible for waiver will have access to all of the services included in the MyCare Ohio Waiver. 12 Determining Eligibility Waiver Eligibility will be determined by government agencies Department on Aging CareStar or other vendor Level of care assessment evaluates the member’s: Ability to perform the activities of daily living Mental acuity Level of impairment Level of need Member’s level of care determination will determine which services the member is eligible to receive. Skilled, Intermediate, Intermediate/Mental Retardation-Developmental Disabilities / Protective or None Member has choice to receive services 13 Transitions of Care – Nursing Facility • NF services: – Provider will be retained at current rate for the life of Demonstration (42 months). 14 Transitions of Care - Exceptions During the transition period, change from the existing services or provider can occur in any of the following circumstances: 1. 2. 3. 4. Consumer requests a change Significant change in consumer’s status Provider gives appropriate notice of intent to discontinue services to a consumer Provider performance issues are identified that affect an individual’s health & welfare Plan-initiated change in service provider can only occur after an in-home assessment and development of a plan for the transition to a new provider 15 The Integrated Care Team Works Together with the Member to Find the Best Health Solutions for Members Care Manager (Accountable Point of Contact) Accountable point of contact for the Integrated Care Team Registered Nurses, Social Workers and Counselor’s. Program Coordinator Mixture of licensed/certification professionals. Focused on the physical, psychological and social welfare of the member. Community Health Worker Provides team support, and reaches out to members with health and preventive care information Waiver Service Coordinator Focuses on Buckeye members that receive services through a home and community-based services waiver. Partnership with the Area Agency on Aging (AAA) for member age 60+. 16 Provider Value 17 Value That Centene Brings to Providers Timely and accurate claims payment (clean claims) processed within 7-8 days of receipt 75% of claims are paid within 7-10 days of receipt 99% of claims are paid within 30 days Local dedicated resources: Care coordinators serve as an extension of physician offices Education of providers and support staff through orientations Provider participation on health plan committees and boards Minimal referral requirements for physician services Electronic and web-based claims submission Web based tools for administrative functions 18 Provider Portal @ www.bchpohio.com Through our main website, providers can access: Provider Newsletters Provider and Billing Manuals Provider Directory Announcements Quick Reference Guides Benefit Summaries for Consumers Online Forms Logon to www.bchpohio.com and become a registered provider 19 On our secure portal, providers can: Verify eligibility and benefits View provider eligibility list Submit and check status of claims Review payment history Secure Contact Us Registration is free and easy. These services can also be handled by Buckeye Provider Services @ 866-296-8731 20 Submitting Claims to Buckeye 21 What Requires Prior Authorization? ALL SNF and LTC services require prior authorization New Services: Existing Services: Services will be based on the member’s care plan. Services that are currently in place for member will remain for 365 days. Care Coordinator will be in contact with both the member and provider. HCBS Care Coordinator will enter prior authorizations for each service into the system. Once services are approved, prior authorization will be entered into the system by Care Coordinator. Providers will receive a notice from Buckeye explaining transition process, and members identified as currently in facility or LTC. Care Coordinator will contact service providers with a prior authorization number, confirming service can now take place. If you have questions if a service is authorized for the member, contact the HCBS care coordination team at 866-549-8289. All out of network non-emergent services and providers require prior authorization. 22 Claim Services Timely Filing Guidelines 365 Days from the date of service 180 Days if retro eligibility is an issue 180 Days to submit a corrected claim, request a reconsideration of payment, or to file a claim dispute *Please refer to our provider or billing manual online for more detailed information* Paper Claims Providers may submit to the following addresses: Buckeye Community Health Plan Attn: Claims P.O. Box 3060 Farmington, MO 63640 (866)-329-4701 Corrected Claims, and Requests for Payment Reconsideration – Providers may submit to the following addresses: Buckeye Community Health Plan MyCare Ohio Claim Reconsideration P.O. Box 4000 Farmington, MO 63640 23 Claim Submission and Reimbursement • Authorization is required for all services including bed hold days • Buckeye will accept standard Medicare and Medicaid billing codes RUGS etc. No payor specific codes required Program Exclusions • Buckeye will reimburse based upon current Medicare & Medicaid fee schedules including bed hold days • Bed hold days policy will be consistent with current regulatory policies and rates (Buckeye has current rates including occupancy variances) • Inpatient hospice – Buckeye will reimburse hospice provider who will in turn reimburse SNF for room & board. 24 Bad Debt Policy • Bad Debt – applies to member liability for skilled level of care days 21-100 of single stay • Buckeye will not require SNF to file annual bad debt report Program Exclusions • Buckeye will aggregate bad debt detail from adjudicated claims by facility • Buckeye will review and determine liability using the following methodology Services 5/1/14 through 9/30/14 – 76% of bad debt Services 10/1/4 through 12/31/14 – 65% of bad debt • Reimbursement will be paid as a lump sum payment in the 2nd quarter of each year. 25 Claim Services CLAIM SUBMISSION OPTIONS Electronic Claims Submission – EDI • • • More efficient, fewer errors Faster reimbursement 5-7 days from submission Requires EDI vendor or clearinghouse agreement Buckeye Provider Portal • • • • Requires registration and username/password Very efficient; fewer errors No cost to provider Faster reimbursement 5-7 days from submission Paper Claim Submission • • • Less efficient Requires original claim forms Average reimbursement 10-14 days from submission of clean claim 26 EDI Partner Payor ID# Phone #’s Emdeon 68069 (800) 845-6592 Gateway 68069 (800) 987-6720 SSI 68069 (800) 880-3032 Smart Data Solutions 68069 (651) 690-3140 Availity 68069 (800) 282-4548 Via the Provider Portal we can also: Receive an ANSI X12N 837 professional, institution or encounter transaction. Portal allows batch\individual claim submissions Generate an ANSI X12N 835 electronic remittance advice known as an Explanation of Payment (EOP). Please contact: Buckeye Community Health Plan c/o Centene EDI Department 1-800-225-2573, extension 25525 or by e-mail at: EDIBA@centene.com 27 Paper Claim format All services must be billed to Buckeye using a CMS 1500 form. Forms cannot be filled out by hand. Must be completed using computer software or a typewriter. All claims must be submitted within Program Exclusions 180 days from the date of service. Claims must be submitted to the following address: Buckeye Community Health Plan ATTN: Claims 3060 Farmington, MO 63640 28 Billing – Dos and Don’ts Billing – Dos Billing – Don’ts Submit your claim within 90 days of the date of service Submit handwritten claims Submit on a proper original form – CMS 1500 Don’t circle data on claim forms Use red ink on claim forms Don’t add extraneous information to Mail to the correct PO Box number any claim form field Submit all claims in a 9” x 12” or Program Exclusions Don’t use highlighter on any claim for larger envelope field Type all fields completely and Don’t submit photocopied claim forms correctly (no black and white claim forms) Use typed black or blue info only at 9 Don’t submit carbon copied claim point font or larger forms Include all other insurance Don’t submit claim forms via fax information (policy holder, carrier name, ID number and address) when applicable 29 EFT and ERA Buckeye partners with PaySpan Health delivering electronic payments (EFTs) and remittance advices (ERAs). FREE to Buckeye Providers Electronic deposits for your claim payments Electronic remittance advice presented online. HIPAA Compliant Provider Benefits with PaySpan Health Reduce accounting expenses – Electronic remittance advices can be imported directly into practice management or patient accounting systems Improve cash flow – Electronic payments for faster payments Maintain control over bank accounts – You keep TOTAL control over the destination of claim payment funds. Multiple practices and accounts are supported. Match payments to advice quickly – You can associate electronic payments with electronic remittance advices quickly and easily. Manage multiple Payers – Reuse enrollment information to connect with multiple Payers. Assign different Payers to different bank accounts, as desired. For more information visit www.payspanhealth.com or contact them directly at (877) 331-7154 to obtain a registration code and PIN number. 30 Thank you!