NEW-Job-PPT

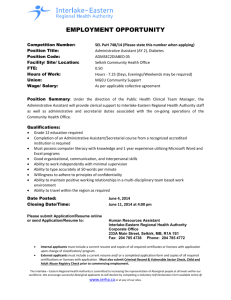

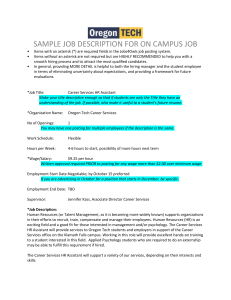

advertisement

Job Presentation • • • • • • • A booming economy Low unemployment Skill shortages Benefits of the working holiday visa Minimum wages Internships Sponsorships To access the Members Area: USER NAME = Email address PASSWORD = Membership number • The purpose of the resume • Use the resume builder on our website (www.worknholiday.com) • The photo • Let us correct/improve your resume • Let us be your referee (character reference) • Why do I need a cover letter? • How and when do I use it? • Find a template in the members area • Job search websites • Local newspaper (E.g. Seek, My Career, Career one) • Using key words • Notice boards • Job listing • Post a free ad online • Spontaneous & speculative applications • Find leads and employer contact lists on the internet • Word of mouth • Read the job description very carefully • Adapt your resume; tailor your application • Identify the selection criteria • Follow-up – When? – What do I say? – Keep track of what you’ve done • • • • • • Be prepared Career minded not travel minded Job Assistance Manual Interview simulation The interview may lead to a trial Unpaid trials are illegal Harvest Jobs o Harvest Guide: 1800 062 332 o www.harvesttrail.gov.au o www.aussiefarmjobs.com Working hostels o o o www.jobfortraveller.com.au www.hostelz.com www.reisebine.de (German) • Volunteer program 4-6 hours/day for free board and accommodation • 1 year membership for $65 Pump up your CV 2nd year visa Save your precious money Bulleting board/ forum Permanent plan B See the real Australia Get new skills Improve your English Practical courses you may need: • RSA • RCG • Barista • Shop Assistant • Stock Control • Shelving • Assembly & Process Work • Pickers & Packers • Warehousing, Storage & Distribution • White Card • Steel capped boots • High visibility vest • Au Pair • Nanny (Live-in or Live-out) • Child Care Assistant • • • • • Administrative Assistant Receptionist Office support staff Call centre staff PA & Secretarial Staff Generally, you are an Australian resident for tax purposes if any of the following applies: • you have been in Australia continuously for six months or more, and for most of the time you have been: • in the same job, and • living in the same place • you have been in Australia for more than half of the financial year, unless • your usual home is overseas, and • you do not intend to live in Australia.” • Foreign residents • Resident for tax purposes Taxable income Tax on this income Taxable income Tax on this income 0 - $37,000 32.5c for each dollar of earnings 0 - $18,200 Nil $37.001- $80,000 $10,730 plus 30c for each $1 over $37000 $18,201 - $37,000 19c for each $1 over $18,200 $80,001 - $180,000 $23,630 plus 37c for each $1 over $80,000 $37,001 - $80,000 $3,572 plus 32.5c for each $1 over $37,000 $180,001 and over $60,630 plus 45c for each $1 over $180,000 $80,001 - $180,000 $17,547 plus 37c for each $1 over $80,000 $180,001 and over $54,547 plus 45c for each $1 over $180,000 CPA - Certified Practising Accountant http://www.cpaaustralia.com.au/apps/finder/cpa/showfind.aspx • Personalise/ adapt your applications • Prepare your interviews thoroughly • Follow-up on every application you’ve sent • Build a rapport with prospective employers • Be patient/ persistent/ positive Good Luck & All the best!