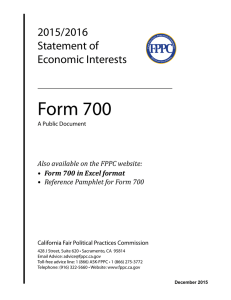

2014-California-Fair-Political-Practices-Commission

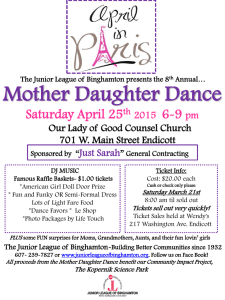

advertisement

California Fair Political Practices Commission Overview Northern California Assessors' Association : Lynda Cassady, Division Chief Technical Assistance Division Note: The slides presented today do not have the force of law. 1 Presented August 2014 Objectives Gain a basic understanding on the following topics: • Role of the FPPC • What to report on your Form 700 • Agency reports • Revolving door rules • Mass mailing restrictions • Campaign rules • Enforcement efforts 2 FPPC Regulates CAMPAIGN REPORTING INDEPENDENT EXPENDITURE ADS SEI/FORM 700 CONFLICT OF INTEREST (Including G.C. 1090) HONORARIA REVOLVING DOOR 3 AGENCY GIFTS TICKETS & TRAVEL STATE LOBBYING AGENCY‘S MASS MAILINGS FPPC does not Regulate BROWN ACT USE OF GOVT FUNDS CONDUCT OF ELECTIONS QUALIFYING FOR THE BALLOT 44 Political Reform Act of 1974 Initiative measure passed by voters Created FPPC – five-member commission Purpose is to prevent corruption of public officials in the governmental decision making process Disclosure reports promote transparency and accountability so public has access to government processes FPPC has a staff of around 65 You can view Commission meetings on our website as well as research advice letters and enforcement actions 5 Statements of Economic Interests Form 700 6 Who Files Form 700? Any officer, employee, member, or consultant of your agency whose position is designated in your agency’s conflict of interest code. These positions are deemed to make or participate in making government decisions. • Conflict of interest code may limit disclosure • Note: Most local officials are required to complete an ethics training course. The FPPC website has a link for a free online course. (AB 1234) 7 Before Getting Started- Know Your Disclosure Categories Designated Position Assigned Disclosure Category Assessor 1 Appraiser 1 I.T. Manager 2 Category 1: Interests in real property, and all investments, business positions in business entities, and income, including receipt of gifts, loans, and travel payments. Category 2: Investments, business positions in business entities, and income, including receipt of gifts, loans, and travel payments, from sources of the type that provides services, goods, products in the telecommunications and information technology fields. 8 Why No Full Disclosure For All Staff? An I.T. Manager would have to report stock in vendors other than I.T. if he/she were assigned to a broad disclosure category. Tailor disclosure category assignment to match job duties 9 Form 700 Resources 10 Schedule A-1 & A-2 Investments Stocks, Limited Partnerships, Trusts Common Reportable Interests: • Stocks • Partnership interests • Business entities (including independent contracting or consulting businesses) • Interests held in a trust, including businesses, investments, and real property 11 Schedule B – Interests in Real Property Non-reportable Interests: Any personal residence not claimed as a business deduction for tax purposes or rented out Reportable Interests in your county: • Rental property • Leasehold interests • Vacant land; timber land; agricultural land 12 Schedule C – Income 13 Non-reportable: • Governmental Salary Reportable: Spouse salary (50%) from non-governmental source (report employer’s name) • Interest income Income from sale of home or car • Stock dividends Personal loans (non-family members) Schedule D – Gifts Non-reportable Gifts: • Gifts from family members • Gifts returned unused within 30 days • Gifts exchanged on birthday, holidays, or similar occasions Reportable gifts: • Gifts from other sources such as meals, tickets to sporting or entertainment events 14 What is a “Gift”? Anything of value – meals, cup 15 of coffee, tickets Any payment providing a personal benefit for which you do not provide payment or services of equal or greater value. $440 gift limit from a single source in a calendar year Check disclosure categories Many exceptions Tickets to Fundraising Events Not reportable or limited: - Two admission tickets to 501(c)(3) fundraisers (must be received from the organization) - Two tickets to campaign fundraisers (must be received from committee) Reportable and subject to gift limits: - Tickets to 501(c)(3) and political events provided by third party source - Tickets benefiting other types of non-profits, such as 501(c)(4) or 501(c)(6)s - Value: Pro-rata share of food and entertainment or non-deductible portion of the ticket or admission. 16 Example The Assessor is invited to attend a police vs. firefighters football game to benefit the local Boys and Girls Club which is a 501(c)(3) organization. The Boys and Girls Club provides two tickets to the Assessor valued at $75 each. These tickets are not reported as a gift. (Reg. 18946.4) 17 Gift Exceptions Informational material to assist in performing official duties (i.e., admission to informational conferences) Note: This exception does not include meals, travel or lodging Home hospitality when host is present Pre-existing personal friendships – not subject to limits or reportable if unrelated to position 18 Schedule E – Travel Payments Reportable travel payments: •Travel paid by third party unless reported on Form 801 •Travel paid in connection with a speech Travel may be subject to gift limits – check with FPPC in advance. 19 Travel Travel payments from your own 20 agency and other governmental agencies not reportable Travel from 501(c)(3)s may be reportable but not limited Travel in connection with speeches reportable but not limited Third party travel for official agency business may trigger Form 801 Other travel payments may be reportable and subject to limits Travel for Speeches For formal substantive presentations or participation on panels on public policy issues, the following are not subject to gift limits, but must be reported: Transportation (airfare, mileage, cabs, etc.) Lodging (day before, day of speech, day after) Travel that is not reportable: Transportation paid by a local, state, or federal government Meals in connection with speech and nominal items Important: Receiving payments for speeches is prohibited honoraria 21 Travel Example Assessor serves on the board of directors for the International Association of Assessing Officers (IAAO). The association pays for the travel expenses (airfare, meals and lodging) so that he may participate at board meetings. These payments are reportable as income, but not subject to gift limits. 22 Reporting Review Questions Do you report the following: Spouse’s salary as a public school teacher? Rental condo in San Diego? Travel to a seminar in Washington, D.C. paid for by the 23 Treasury Department? Vanguard security fund similar to mutual fund? Personal residence? Name of source who purchased home/car? Stock in Starbucks? Your co-worker who bought lunch on your birthday? Dinner provided by a sales representative? Airline tickets to New York City provided by your college roommate for a personal visit? Agency Reports When are they triggered? 24 Agency Reports Gifts to an Agency (Form 801) Generally, travel payments Ceremonial Role Events and Ticket/Admission Distributions (Form 802) Entertainment events & ceremonial roles Behested Payments (Form 803) “Featured” elected officials: $5,000 or more funding to charities 2525 25 Agency Payment Reports Your Department is offered the use of a software program on a trial basis. (Official agency use – no personal benefit.) Form 801 is not triggered as there is no personal benefit for department personnel. Agency is procuring a new software program. Potential vendors offer to send an employee to NYC to observe how it is used in another agency. Form 801/Form 700 reporting is required as there is a personal benefit for department personnel. 26 Sample Form 801 27 Ceremonial & Ticket Report Agencies must report tickets the agency either distributes or uses for its staff Agencies must adopt a ticket policy that provides the public purposes Common reportable tickets include: A fair board distributing tickets to the county fair An official receiving tickets for a ceremonial role at an event Tickets to an event as a morale or recognition reward 28 Reporting on Form 802 An Appraiser is awarded the County’s Employee of the Year Award, which includes two tickets to a San Francisco 49ers game. Since there is a benefit to the official, a Form 802 is required. 29 Sample Form 802 30 Behested Payment Report An elected official must complete Form 803 if the official solicits funds of $5,000 or more for a charitable or governmental purpose. Assessor signs a letter asking for donations to a local charity and a donor donates $5,000 or more. 31 Behested Payment Exceptions • Listing in roster format if elected officer’s name is not otherwise singled out (signature, photo, personal reference) • If elected officers make up a majority of the roster, Form 803 may be triggered • Seek FPPC advice – send sample communication 32 Sample Form 803 33 Because You're Elected… Other Applicable Rules 34 Mass Mailings with Public Funds • More than 200 pieces sent through mail • No “featuring” (photos, signatures, multipronouns of elected officials) • Permissible: letterhead, rosters, meeting announcements, emails, websites 35 Revolving Door ProvisionsLeaving Government Work Most FPPC advice in writing One year ban - appearing before former agency for compensation to influence Ban on influencing prospective employers 36 Campaign Rules • Return contributions within 60 days if you do not have a person’s address, occupation, and employer. • Don’t accept cash/money orders of $100+ • Watch for signs of campaign money laundering – employees being reimbursed by employers. • Report subvendors, not just your political consultant’s fees. • File campaign finance reports on time. 37 Campaign Issues • You may have a campaign report due even if you run unopposed on a ballot. • Most candidates must file the following FPPC forms: • Form 501 – before you raise $$ • Form 410 – to receive an FPPC ID # • Form 497 – identifies donors of $1,000 or more to your committee • Form 460 – public disclosure report of all money in/out of your campaign 38 Enforcement History Warning Letters Related to Assessors Campaign mailing did not include the Assessor’s committee as the sender of the mailing Campaign reports not filed on time Appraiser failed to file Form 700 when leaving office 39 When in Doubt… If you have questions, research or ask! www.fppc.ca.gov •Toll Free Advice Line: 866-275-3772 (AM hours) •Email advice: advice@fppc.ca.gov 40