Financial Management Assignment: Stock & Bond Valuation

advertisement

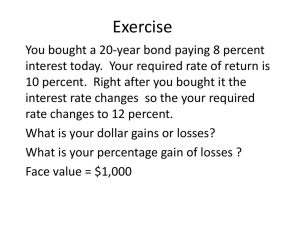

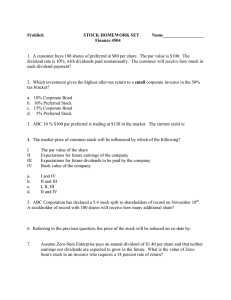

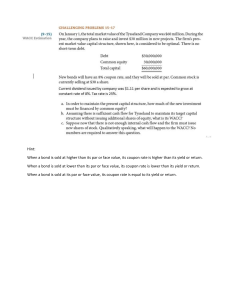

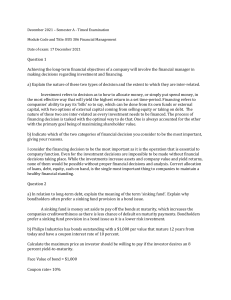

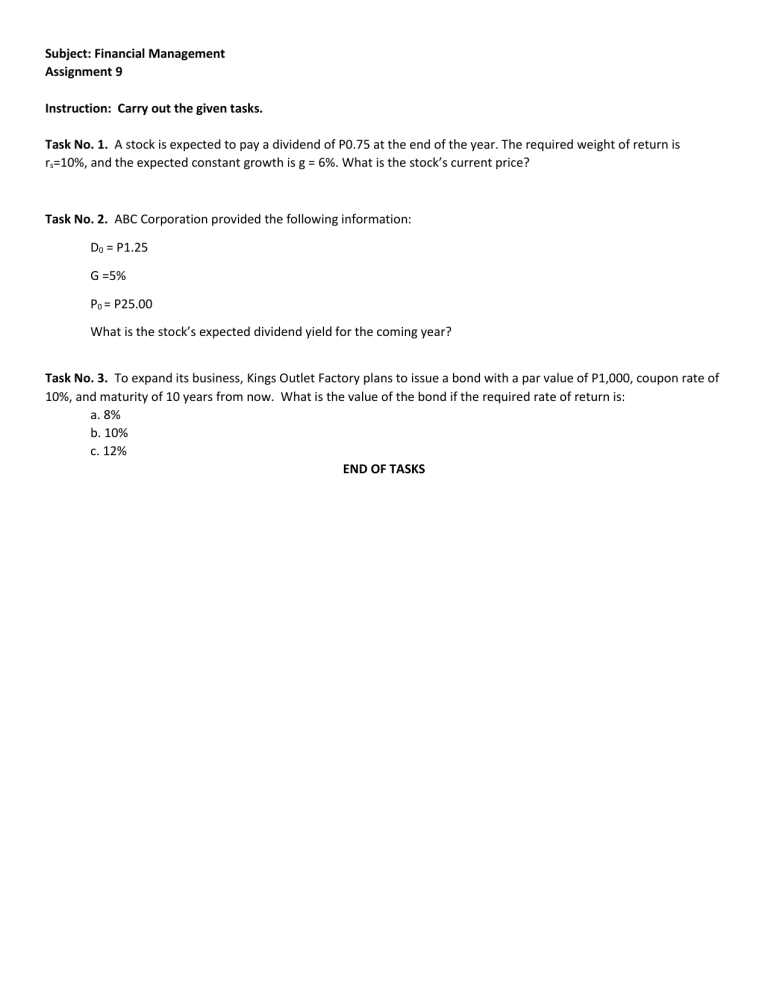

Subject: Financial Management Assignment 9 Instruction: Carry out the given tasks. Task No. 1. A stock is expected to pay a dividend of P0.75 at the end of the year. The required weight of return is rs=10%, and the expected constant growth is g = 6%. What is the stock’s current price? Task No. 2. ABC Corporation provided the following information: D0 = P1.25 G =5% P0 = P25.00 What is the stock’s expected dividend yield for the coming year? Task No. 3. To expand its business, Kings Outlet Factory plans to issue a bond with a par value of P1,000, coupon rate of 10%, and maturity of 10 years from now. What is the value of the bond if the required rate of return is: a. 8% b. 10% c. 12% END OF TASKS