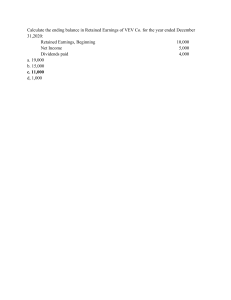

BEAM047 - Problem Set for Lecture 3 Solutions 1. Hitachi Corporation currently pays a dividend of $0.5 per quarter, and it will continue to pay this dividend forever. What is the ex-dividend price per share if its equity cost of capital is 15% per year? Answer: (perpeuty dusturunda ise bize APR lazimdi) Since dividends are paid quarterly, we can value them as a perpetuity using a quarterly discount rate The PV of a perpetuity is P = C r Yeni bildiyin kimi normalda burda bond coupon deyil dividend oldugu ucun, P0=Div1/r olmaliydi ama meselen serti formasini ezberle bele dusende bu dustur; P=C/r tetbiq et sadece What is the appropriate quarterly discount rate? Given 15% is the true EAR we need to calculate the quarterly APR so by rearanging the formula EAR = N 1 + APNR − 1 we get: 1 (1.15) 4 − 1 = 3.556% (1 + APR) = (1 + EAR)^(1/N) seklinde arrange ede bilerik to solve for APR. where; N=4, EAR=15% ve buradan tapdigimiz APR perpetuity dusturundaki r olacag then, P=$0.5/0.03556=$14.06. 2. Bakkaloglu S.A. currently plows back 30 percent of its earnings and earns a return of 25 percent on this investment. The dividend yield on the stock is 5 percent. a) Assuming that Bakkaloglu can continue to plow back this proportion of earnings and earn a return of 25 percent on the investment, how rapidly will earnings and back elediyi investment'in return'u dividends grow? What is the expected return on Bakkaloglu’s stock? plow ele ROE demeydi. Lutsi ROE=25% Answer: We know that g, the growth rate of dividends and earnings, is given by: g = plowback ratio x ROE = 0.30 x 0.25 = 0.075 = 7.5% We also know that: r = (DIV1 /P0 ) + g = dividend yield + growth rate i Therefore: r = 0.05 + 0.075 = 0.125 = 12.5% b) Suppose that management suddenly announces that future investment opportunities have dried up. Now Bakkaloglu intends to pay out all its earnings. How will the stock price change? PVGO/Po Answer: Dividend yield = 5%. Therefore: DIV1 /P0 = 0.05 DIV1 = 0.05 P0 A plowback ratio of 0.3 implies a payout ratio of 0.7, and hence: DIV1 /EP S1 = 0.7 PAYOUT RATIO DIV1 = 0.7 EP S1 Equating these two expressions for DIV1 gives a relationship between price and earnings per share: 0.05P0 =0.7 EP S1 P0 /EP S1 = 14 Also, we know that: P V GO EP S1 = r ∗ (1 − ) P0 P0 With (P0 /EP S1 ) = 14 and r = 0.125, the ratio of the present value of growth opportunities to price is 42.86 percent. Thus, if suddenly there are no future investment opportunities, the stock price will decrease by 42.86 percent. Alternative Solution: Recall that P0 =DIV1 /(r − g)=EP S1 (1-plowback ratio)/(r-g); and that with no growth P0N G =EP S1 /r hence the percentage change in price is=( P0N G -P0 )/ P0 = (P0N G / P0 )-1=(r-g)/(r*(1plowback ratio))-1=0.4286 c) Suppose that management simply announces that the expected return on new investment will in the future be the same as the cost of capital. Now what is Bakkaloglu’s stock price? Answer: In Part (b), all future investment opportunities are assumed to have a net present cunki deyr axi "Suppose that management suddenly announces that future investment opportunities have dried up." ii value of zero. If all future investment opportunities have a rate of return equal to the capitalization rate, this is equivalent to the statement that the net present value of these investment opportunities is zero. Hence, the impact on share price is the same as in Part (b). 3. Table Year Book equity (beginning of year) Earnings per share, EPS Return on equity, ROE Payout ratio Dividends per share Growth rate of dividends 1 10.00 2.50 0.25 0.20 .50 - 2 12.00 3.00 0.25 0.20 .60 .20 3 14.40 2.30 0.16 0.50 1.15 .92 4 15.55 2.49 0.16 0.50 1.24 .08 1-ci ilde; ROE=EPS/Equity per share (in other wordsbook equity) !from lecture 2-ci ilde; g=ROE * plowback (in other words, 1-payout) a) Complete the table. Answer: See the Table please. b) Assume that the opportunity cost of capital is 12%. Calculate the value of the company’s stock (assume that after year 4 the company grows at a constant rate, i.e. the growth rate stays constant at year 4 level). year 4 ucun constant growth dividend discount model (perpetuity with growth) slide21 Answer: ona gore year 4 ucun ki sertde deyir " ie the growth rate stays contstant at year 4" yeni 4cu ilden baslayaraq sabit qalir eslinde baxmayaraqki after year 4 yazb P = $0.50 $0.60 $1.15 1 $1.24 + + + ∗ = $23.81 2 3 3 (1.12) (1.12) (1.12) (1.12) (0.12 − 0.08) c) What part of that value reflects the discounted value of P3 , the price forecasted for year 3? Answer: P V (P3 ) = 1 $1.24 ∗ = $22.07 3 (1.12) (0.12 − 0.08) iii d) What part of P3 reflects the present value of growth opportunities (PVGO) after year 3? Answer: Without PVGO, P3 would be equal to earnings for year 4 capitalized at 12 percent: P V (P3N G ) = $2.49 = $20.75 (0.12) Therefore: PVGO = $31.00 - $20.75 = $10.25 e) Suppose that competition will catch up with the company by year 4, so that it can earn only its cost of capital on any investments made in year 4 or subsequently. What is the stock worth now under this assumption? (Make additional assumptions if necessary). Answer: The PVGO of $10.25 is lost at year 3. Therefore, the current stock price of $23.81 will decrease by: $10.25 = $7.30 (1.12)3 The new stock price will be: $23.81 - $7.30 = $16.51 4. Answer the following questions: a) Explain the difference between the average return and the realized return. Are both numbers useful? If so, explain why. Answer: Both numbers are useful. The realized return tells you what you actually made if you hold the stock over this period. The average return over the period can be used as an estimate of the monthly expected return. If you use this estimate, then this is what you expect to make on the stock in the next month. b) What is the correlation coeffcient between two stocks that gives the maximum reduction in risk for a two-stock portfolio (assume long position in both of the stocks)? Answer: If we hold long positions in both stocks: the correlation coefficient that gives the maximum reduction in risk for a two-stock portfolio is -1. If one stock is sold short and another stock is a long position in the portfolio then a correlation of +1 is actually best to minimise portfolio risk. iv