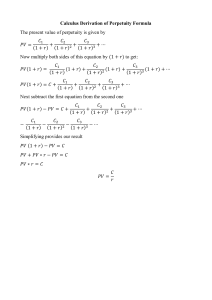

Unit 4 - Homework Your written assignment is to answer the following questions which appear in Earhardt & Brigham, Corporate Finance, 4e. It is to be submitted as a word document to the week four eCollege Dropbox. Answers to the following questions (not problems) including the ten true/false questions listed below. Ch. 7, page 296, question 7-3. No-growth common stock is similar to a perpetuity in that they both pay a set dividend and the value will not increase or decrease, the formula for figuring the par value is essentially the same for both. Preferred stock is similar to a perpetuity in that they both have fixed payments and a par value, but a company’s inability to make the preferred stock payments does not force the business into bankruptcy. Ch. 8, page 329, question 8-1. a. b. c. Option, call option and put options are contracts that give the holder the right to buy or sell an asset at some predetermined price within a specified period of time. Exercise price and strike price is the price stated in the option contract at which the security can be bought or sold. Black-Scholes Option Pricing Model – estimates the value of a call option. Answer the following true or false questions based on the textbook: [1] A proxy is a document giving one party the authority to act for another party, including the power to vote shares of common stock. (True) [2] The preemptive right gives current stockholders the right to purchase, on a pro rata basis, any new shares issued by the firm. (True) [3] The total return on a share of stock refers to the dividend yield less any commissions paid when the stock is purchased and sold. (True) [4] Preferred stock is a hybrid--a sort of cross between a common stock and a bond--in the sense that it pays dividends that normally increase annually like a stock but its payments are contractually guaranteed like interest on a bond. (False) [5] From an investor's perspective, a firm's preferred stock is generally considered to be less risky than its common stock but more risky than its bonds. (True) [6] An option is a contract that gives its holder the right to buy or sell an asset at a predetermined price within a specified period of time. (True) [7] Because of the time value of money, the longer before an option expires, the less valuable the option will be, other things held constant. (True ) [8] The constant growth model is often appropriate for evaluating start-up companies that do not have a stable history of growth but are expected to reach stable growth within the next few years. (False) [9] An option that gives the holder the right to sell a stock at a specified price at some future time is a put option. (True ) [10] Companies can issue different classes of common stock. Some class or classes of common stock are entitled to more votes per share than other classes. (True )