Joint Costs PowerPoint

advertisement

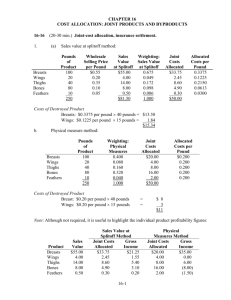

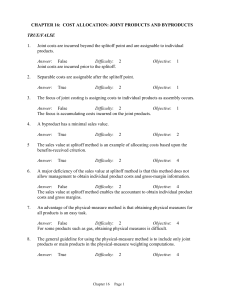

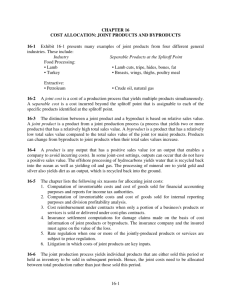

Cost Allocation: Joint Products and By-products ACCT7320 Dr. Bailey 15 - 1 Nature of Cost Allocations Pervasive in accounting – Across time (depreciation) – Between departments (e.g., service depts) – To products, customers, branch offices, etc. Often arbitrary – May mislead in decision making 15 - 2 Criteria to Guide Cost-Allocation Decisions Cause-and-effect: Using this criterion, managers identify the variable or variables that cause resources to be consumed. Benefits-received: Using this criterion, managers identify the beneficiaries of the outputs of the cost object. 15 - 3 Criteria to Guide Cost-Allocation Decisions Fairness or equity: This criterion is often cited on government contracts when cost allocations are the basis for establishing a price satisfactory to the government and its suppliers. Ability to bear: This criterion advocates allocating costs in proportion to the cost object’s ability to bear them. 15 - 4 Role of Dominant Criteria The cause-and-effect and the benefitsreceived criteria guide most decisions related to cost allocations. Fairness and ability to bear are less frequently used. Why? 15 - 5 Role of Dominant Criteria Fairness is an especially difficult criterion to obtain agreement on. The ability to bear criterion raises issues related to cross-subsidization across users of resources in an organization. 15 - 6 Joint Costs This “joint cost” problem arises when companies inescapably produce two or more products simultaneously out of the same process. How do they allocate costs to jointly-produced products. How are the resulting allocations useful? 15 - 7 Joint-Cost Basics Joint costs are the costs of a single production process that yields multiple products simultaneously. Industries abound in which a single production process simultaneously yields two or more products. 15 - 8 Joint-Cost Basics Tomatoes Tomato juice Tomato sauce Tomato paste 15 - 9 Joint-Cost Basics Coal Gas Benzol Tar 15 - 10 Joint-Cost Basics 1 2 The outputs of a joint production process fall into two general categories: Joint products—those that the company is in business to produce (higher total value) By-products—those that also emerge (lesser value) 15 - 11 Splitoff Point The splitoff point is the juncture in the production process where one or more products in a joint-cost setting become separately identifiable. Separable costs are all costs (manufacturing, marketing, distribution, etc.) incurred beyond the splitoff point that are assignable to one or more individual products. 15 - 12 Joint Products and By-products Joint products have relatively high sales value at the splitoff point. – Main product is the result of a joint production process that yields only one product with a relatively high sales value. By-products are incidental products resulting from the processing of another product. 15 - 13 Joint Products and By-products A by-product has a relatively low sales value compared with a joint or main product. – Revenue from byproducts generally reduces the costs of the joint products. We aren’t studying the details. Some outputs of the joint production process have zero sales value. – “Waste” can be ignored in accounting 15 - 14 Joint Products and By-products Main or By-products Joint Products High Low Sales Value 15 - 15 Joint Products and By-products To reiterate: sales value determines the classification Products can change from by-products to joint products when their relative sales values increases, and vive-versa – Kerosene once main product of petroleum 15 - 16 Why Allocate Joint Product Costs? 1 The purposes for allocating joint costs to products include: Inventory costing – Important for financial accounting purposes, reports to income tax authorities, and internal reporting purposes. 2 Cost reimbursement contracts – Cost allocation is required for cost reimbursement purposes under contracts when only a portion of a business’ products or services is sold or delivered to a single customer (government agency). 15 - 17 Why Allocate Joint Product Costs? 3 Insurance settlements » Require cost allocation when damage/loss claims made by manufacturer: What was the “cost”? 4 Rate regulation » If one or more of the jointly produced products or services are subject to price regulation (nat. gas). 5. Litigation » Joint cost allocation is important in litigation involving one or more joint products. 15 - 18 How to Allocate Joint Costs? The two basic approaches to allocating joint costs are: – Use market-based data such as relative product revenues. » “Sales value at splitoff” » “Estimated net realizable value” – Use physical measures such as weight or volume. 15 - 19 Allocating Joint Costs Lubbock Company incurred $200,000 of joint costs to produce the following: Product A: 10,000 units, 20,000 pounds Product B: 10,500 units, 48,000 pounds Product C: 11,500 units, 12,000 pounds 15 - 20 Sales Value at Splitoff Method Allocates joint costs to joint products on the basis of the relative total sales value at the splitoff point. – All outputs must have sales values at this point to use the method. 15 - 21 Sales Value at Splitoff Method Assume the following sales values per unit: A: $10.00, B: $30.00, and C: $20.00 What is the total sales value at splitoff point? Product A: 10,000 × $10.00 = $100,000 15.5% Product B: 10,500 × $30.00 = 315,000 48.8% Product C: 11,500 × $20.00 = 230,000 35.7% Total $645,000 100% 15 - 22 Sales Value at Splitoff Method How much joint costs are allocated to each product? A: 15.5%× $200,000 = $ 31,008 B: 48.8% × $200,000 = 97,674 C: 35.7% × $200,000 = 71,318 Total $200,000 15 - 23 Sales Value at Splitoff Method What are the joint production costs per unit? Product A: $31,008 ÷ 10,000 = $3.10 Product B: $97,674 ÷ 10,500 = $9.30 Product C: $71,318 ÷ 11,500 = $6.20 15 - 24 Sales Value at Splitoff Method Assume all of the units produced of B and C were sold (no further processing). 2,500 units of A (25%) remain in inventory. What is the gross margin percentage of each product? 15 - 25 Sales Value at Splitoff Method Product A Revenues: 7,500 units × $10.00 Cost of goods sold: – Joint product costs $31,008 – Less ending inventory 7,752* $75,000 23,256 » *$31,008 × 25% Gross margin $51,744 15 - 26 Sales Value at Splitoff Method Prod. A: $75,000 – $ 23,256 = $51,744; $51,744 ÷ $75,000 = 69% Prod. B: ($315,000 – $97,674) ÷ $315,000 = 69% Prod. C: ($230,000 – $71,318) ÷ $230,000 = 69% The sales value at splitoff method produces an identical gross margin percentage for each product. 15 - 27 Estimated Net Realizable Value (NRV) Method Often products are processed further beyond the splitoff point to make them marketable or increase their value. 15 - 28 Estimated Net Realizable Value (NRV) Method The estimated NRV method allocates joint costs to joint products on the basis of the relative estimated NRV. NRV = (expected final sales value in the ordinary course of business) – (expected separable costs of the total production of these products) 15 - 29 Absolute Irrelevance of Joint Costs for Decision Making Joint costs incurred up to the splitoff point are past (sunk) costs irrelevant to the decision to sell a joint (or main) product at the splitoff point or to process it further. 15 - 30 Irrelevance of Joint Costs for Decision Making Assume that products A, B, and C can be sold at the splitoff point (at price1) or processed further into A1, B1, and C1 and sold at price2. Units price1 price2 Add’l costs 10,000 A: $10 A1: $12 $35,000 10,500 B: $30 B1: $33 $46,500 11,500 C: $20 C1: $21 $51,500 15 - 31 Irrelevance of Joint Costs for Decision Making Should A, B, or C be sold at the splitoff point or processed further? Product A: Incremental revenue $20,000 – Incremental cost $35,000 = ($15,000) Product B: Incremental revenue $31,500 – Incremental cost $46,500 = ($15,000) Product C: Incremental revenue $11,500 – Incremental cost $51,500 = ($40,000) 15 - 32 Irrelevance of Joint Costs for Decision Making Products A, B, and C should be sold at the splitoff point. No techniques for allocating joint-product costs can guide decisions about whether a product should be sold at the splitoff point or processed beyond splitoff. 15 - 33 The End 15 - 34