Joint & By-Product Costing: Accounting Methods & Allocation

advertisement

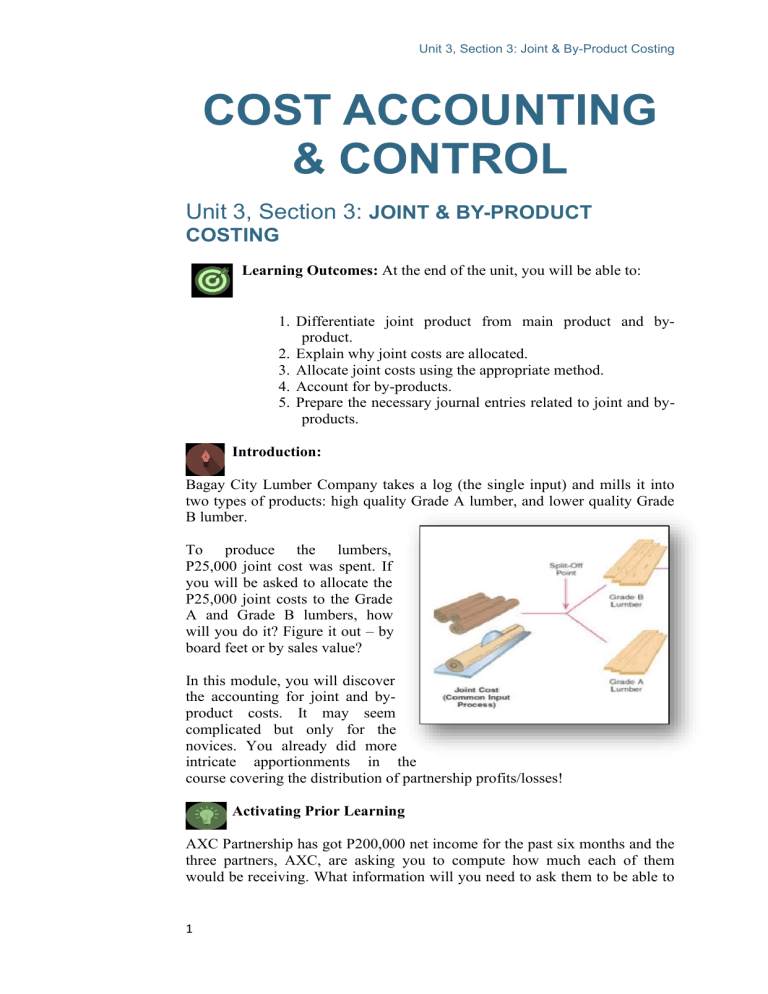

Unit 3, Section 3: Joint & By-Product Costing COST ACCOUNTING & CONTROL Unit 3, Section 3: JOINT & BY-PRODUCT COSTING Learning Outcomes: At the end of the unit, you will be able to: 1. Differentiate joint product from main product and byproduct. 2. Explain why joint costs are allocated. 3. Allocate joint costs using the appropriate method. 4. Account for by-products. 5. Prepare the necessary journal entries related to joint and byproducts. Introduction: Bagay City Lumber Company takes a log (the single input) and mills it into two types of products: high quality Grade A lumber, and lower quality Grade B lumber. To produce the lumbers, P25,000 joint cost was spent. If you will be asked to allocate the P25,000 joint costs to the Grade A and Grade B lumbers, how will you do it? Figure it out – by board feet or by sales value? In this module, you will discover the accounting for joint and byproduct costs. It may seem complicated but only for the novices. You already did more intricate apportionments in the course covering the distribution of partnership profits/losses! Activating Prior Learning AXC Partnership has got P200,000 net income for the past six months and the three partners, AXC, are asking you to compute how much each of them would be receiving. What information will you need to ask them to be able to 1 Unit 3, Section 3: Joint & By-Product Costing complete the allocation? Are you going to allocate as you wish or do you need to follow a certain guideline? Topic 1: Allocation of Joint Costs Learning Objectives: At the end of this lesson, you will be able to: a. Define Joint costing. b. Explain why joint costs are allocated. c. Cite several joint cost situations. Presentation of Content What is Joint Costing? Processing costs incurred prior to the split-off point are the joint costs. The stage of processing at which the two products are separated is called the split-off point. 2 Unit 3, Section 3: Joint & By-Product Costing Managers often are interested in another issue. Should a product be sold at the split-off point or processed further? In our example, rather than selling the grade B lumber at the split-off point, should Bagay City Lumber Company process it further? This requires additional processing costs, but the sales value for grade B lumber processed with additives is higher than that for grade B lumber at the split-off point. Other joint situations: Industry Agriculture & Food Processing 1 Palay 2 3 4 5 Chicken Lumber Hogs Cocoa beans Separable Products Rice, binlid, rice hull Breast, wings, drumstick, thighs, liver, gizzard, feather and poultry meal. Lumber of different grades and shapes Butterfly cut, adobo cut, spare ribs, ham Cocoa butter, cocoa powder, tanning cream Extractive 1 Salt Hydrogen, chlorine, caustic soda 2 Petroleum 3 Copper ore Crude oil, natural gas, premium gasoline, regular gasoline Copper, silver, lead, zinc Why Allocate Joint Costs? Joint costs are allocated for several reasons. I will list two: • • Compensation Package. Cost allocations are frequently used to determine departmental or division costs for evaluating managerial performance. Companies may compensate employees on the basis of departmental or division earnings for the year. Valuation of Inventory. Industrial companies must allocate joint costs to determine the inventory value of the goods that result from the joint process. Topic 2: Joint Cost Allocation Methods Learning Objectives: At the end of this lesson, you will be able to: a. Explain the two common joint cost allocation methods b. Allocate joint costs using the net realizable value method. c. Allocate joint costs using the physical quantities method. 3 Unit 3, Section 3: Joint & By-Product Costing Presentation of Content What are the two most common Joint Cost Allocation Methods? The two main methods of allocating joint costs are: (1) the net realizable value method and (2) the physical quantities method. 1. Net Realizable Value Method. This value method allocates joint costs to products based on their net realizable values at the split-off point. Net realizable value (NRV) is the estimated sales value of each product at the split-off point. NRV can be the a. market value or sales price - if the joint products can be sold at the split-off point. b. estimate the net realizable value - if the products require further processing before they are marketable. You can determine this by taking the sales value after further processing and deducting the additional processing costs. Joint costs are then allocated to the products in proportion to their net realizable values at the split-off point. Thus, this method is also referred to as the workback method. 2. Physical Quantities Method. In this technique, joint costs are assigned to products based on a physical measure such as volume, weight, or any other common measure of physical quality. This mode of allocation is frequently used when output product prices are highly unstable or when substantial processing occurs between the split-off point and the first point of marketability or when product prices are not set by the market. Why some companies do not allocate Joint Costs. A number of companies prefer non-allocation of joint costs to products. They reason out that their production or extraction processes are too complex and there is much difficulty gathering adequate data for proper allocations. In the absence of joint cost allocation, a company may just subtract the joint costs directly from total revenues. If substantial inventories exist, then firms that do not allocate joint costs often carry their product inventories at NRV. 4 Unit 3, Section 3: Joint & By-Product Costing Application: Multiple Choices. Choose the best alternative to answer the question. 1) What type of cost is the result of an event that results in more than one product or service simultaneously? A) separable cost B) joint cost C) byproduct cost D) main cost 2) All costs incurred beyond the splitoff point that are assignable to one or more individual products are called: A) joint costs B) byproduct costs C) main costs D) separable costs 3) In joint costing: A) costs are assigned to individual products as assembly of the product occurs B) a single production process yields two or more products C) costs are assigned to individual products as disassembly of the product occurs D) Both B and C are correct. 4) The ________ point is the juncture in a joint production process when two or more products become separately identifiable. A) process B) joint product C) end D) splitoff 5) The focus of joint costing is on allocating costs to individual products: A) at the splitoff point B) at the end of production C) after the splitoff point D) before the splitoff point 6) When a single manufacturing process yields two products, one of which has a relatively high sales value compared to the other, the two products are respectively known as: A) main products and byproducts B) main products and joint products C) joint products and byproducts D) joint products and scrap 7) When a joint production process yields two or more products with high total sales values, these products are called: A) scrap B) byproducts C) main products D) joint products 8) Byproducts and main products are differentiated by the: A) number of units per processing period B) amount of total sales value C) weight or volume of outputs per period D) None of these answers is correct. 9) Products with a relatively low sales value are known as: A) byproducts B) scrap C) joint products D) main products 5 Unit 3, Section 3: Joint & By-Product Costing 10) All of the following changes may indicate a change in product classification of a manufacturing process which has a splitoff point EXCEPT a: A) main product becomes technologically obsolete B) main product becomes a joint product C) byproduct increases in sales value due to a new application D) byproduct loses its market due to a new invention Short Answer: Compute for the required. 1) BSACC-AIS Company processes sugar cane into three products. During August, the joint costs of processing were P240,000. Production and sales value information for the month were as follows: Product Units Produced Sales Value @ Splitoff Separable costs Sugar Sugar Syrup Fructose Syrup 6,000 4,000 2,000 P80,000 70,000 50,000 P24,000 64,000 32,000 Required: Determine the amount of joint cost allocated to each product if the sales value at splitoff method is used. 2) CBEA Chemicals processes pine rosin into three products: turpentine, paint thinner, and spot remover. During May, the joint costs of processing were P240,000. Production and sales value information for the month is as follows: Product Units Produced Sales Value at Splitoff Point Turpentine 6,000 liters P60,000 Paint thinner 6,000 liters 50,000 Spot remover 3,000 liters 25,000 Required: Determine the amount of joint cost allocated to each product if the physical-measure method is used. 3) White Tigers Corporation processes tomatoes into catsup, tomato juice, and canned tomatoes. During July of 2020, the joint costs of processing the tomatoes were P420,000. There was no beginning or ending inventories for the summer. Production and sales value information for the summer is as follows: Product Catsup P28/case Juice 25/case Canned 10/case 6 Cases 100,000 SV @ Splitoff P6/case Separable Costs P3.00/case 150,000 8/case 5.00/case 200,000 5/case 2.50/case Price Unit 3, Section 3: Joint & By-Product Costing Required: Determine the amount allocated to each product if the estimated net realizable value method is used, and compute the cost per case for each product. Check figures: For MC: BDDDA, ADBAB 1. 2. 3. Fructose syrup P60,000 Spot remover P48,000 Juice P930,012; Catsup cost per case P4.50 Topic 3: Accounting for By-products Learning Objectives: At the end of this lesson, you will be able to: a. Define by-product and differentiate it from a main and joint product. b. Explain and execute the production method of accounting for by products. c. Explain and execute the sales method of accounting for by products. d. Prepare journal entries related to accounting for byproducts. Presentation of Content What are By-products? By-products are goods from a joint production process that have low total sales values compared with the total sales value of the main product or of joint products. The presence of by-products in a joint production process can influence the allocation of joint costs. In this module, you will discover two accounting methods for by-products: (1) production method, (2) sales method. ➢ Production method. Recognizes by-products in the financial statements at the time production is completed. ➢ Sales method. Delays the recognition of by-products until the time of sale. Now, which method should you use in your company? ✓ Production method. Theoretically correct because of its consistency with the matching principle. ✓ However, the sales method is simpler and is often used in practice, mostly justified on the justification that the amounts of byproducts are immaterial. 7 Unit 3, Section 3: Joint & By-Product Costing ✓ You, beware!!! The sales method permits managers to “smoothen” reported income. They may pile up by-products and sell them when revenues from the main product or joint products are short the target. Application: You may consider solving this sample case to become well versed with the two methods of accounting for by-products. The Lagum Woods Corporation processes timber into fine-grade lumber and wood chips that are used as mulch in gardens and lawns. Information about these products follows: • Fine-Grade lumber (the main product)—sells for P6 per board foot (b.f.) • Wood chips (the byproduct)—sells for P1 per cubic foot (c.f.) Data for July 2020 are as follows: Fine-Grade lumber (b.f.) Wood chips (c.f.) Beginning Production Inventory 0 50,000 0 4,000 Sales 40,000 1,200 Ending Inventory 10,000 2,800 Joint manufacturing costs for these products in July 2020 are P250,000 comprising P150,000 for direct materials and P100,000 for conversion costs. Both products are sold at the splitoff point without further processing. Illustrating of the two techniques 1) Production Method: By-products are recognized at time production is complete. This method recognizes the byproduct in the financial statements—the 4,000 cubic feet of wood chips—in the month it is produced, July 2020. The NRV from the byproduct produced is offset against the costs of the main product. You, study cautiously the following journal entries: 1. Work in Process ……………………………………………..150,000 Accounts Payable …………………….…………………….…150,000 To record direct materials purchased and used in production during July. 2. Work in Process ………………………….…………………..100,000 Various accounts ………………………………………………100,000 To record conversion costs in the production process during July. 8 Unit 3, Section 3: Joint & By-Product Costing 3. Byproduct Inventory—Wood Chips (4,000 c.f. * P1 per c.f.) ….4,000 Finished Goods—Fine-Grade Lumber (P250,000 - P4,000) …246,000 Work in Process(P150,000+P100,000) ……………………..…250,000 To record cost of goods completed during July. 4a. Cost of Goods Sold [(40,000 b.f./50,000 b.f.) * P246,000] ….196,800 Finished Goods—Fine-Grade Lumber ………………………196,800 To record the cost of the main product sold during July. 4b. Cash or Accounts Receivable (40,000 b.f. * P6 per b.f.) … 240,000 Revenues—Fine-Grade Lumber ……………………………….240,000 To record the sales of the main product during July. 5. Cash or Accounts Receivable (1,200 c.f. * P1 per c.f.) …..……1,200 Byproduct Inventory—Wood Chips ……….…………………… 1,200 To record the sales of the by-product during July. The production method reports the byproduct inventory of wood chips in the balance sheet at its P1 per cubic foot selling price [(4,000 cubic feet - 1,200 cubic feet) P1 per cubic foot P2,800]. 2) Sales Method: This method makes no journal entries for byproducts until they are sold. Revenues of the by-product are reported as a revenue item in the income statement at the time of sale. Again, you be cautious to learn the technique of journalizing: 1. and 2. Same as for the production method. Work in Process ……………………………………………150,000 Accounts Payable ……………………………………………150,000 Work in Process ……………………………………...…… 100,000 Various accounts …………………………………………….100,000 3. Finished Goods—Fine-Grade Lumber …………...…………250,000 Work in Process ……………………………………………… 250,000 To record cost of main product completed during July. 4a. Cost of Goods Sold[(40,000 b.f./50,000 b.f.)*P250,000] ….200,000 Finished Goods—Fine-Grade Lumber ………………………...200,000 To record the cost of the main product sold during July. 4b. Same as for the production method. Cash or Accounts Receivable (40,000 b.f. * P6 per b.f.) …..240,000 Revenues—Fine-Grade Lumber ………………………..…… 240,000 5. Cash or Accounts Receivable ………………………………....1,200 Revenues—Wood Chips ………………………………………..……..1,200 To record the sales of the byproduct during July. 9 Unit 3, Section 3: Joint & By-Product Costing Of course, if I were you, as an excellent student, I will prepare the income statement. You check with this! You got it? Treat yourself some…ice cream? Production Method P240,000 43,200 Total Revenue Gross margin Inventory: Main product: Fine-grade P 49,200 lumber Byproduct: Wood chips 2,800 Sales Method P241,200 41,200 P 50,000 0 Summary of the Unit: ➢ ➢ ➢ ➢ ➢ ➢ joint costs joint products by-products main products Physical Quantities Method. Production method ➢ Sales method ➢ split-off point ➢ Net Realizable Method Value Assessment: A 30 items, 30 pts. Graded Multiple Choice Quiz will be conducted at the end of this unit. Reflection on Learning: Now that you were done with the unit, take time to internalize what you have absorbed so far by answering these questions: 1. What learning interest you the most in this unit? Why do you think so? 2. Did you happen to notice any firm in your area whereby you can apply joint costing? Do you think they are willing to utilize this concept? Why or why not? 3. What topic in the unit you feel most incompetent and desire to know more? References: 1. Lanen, Anderson & Maher (2017) Fundamentals of Cost Accounting. New York, NY: McGraw-Hill Education. 2. Flores, M. (2016) Integrated Cost Accounting Principles and Applications. Quezon City, PH. REX Book Store Inc. 3. Brewer, P., Garrison, R., & Noree, E. (2016) Introduction to Managerial Accounting. Penn Plaza, New York, NY: McGraw-Hill Education. 4. Horngren, T., Datar, S., & Rajan, M. (2012) Cost Accounting. A Managerial Emphasis. Upper Saddle River, New Jersey. Pearson Prentice Hall. 10